More than 70 smallcaps gain 10-31% even as market fall continues

On the sectoral front, Nifty Bank and Realty indices shed 1.5 percent each, Nifty FMCG index fell 1 percent, while Nifty Media index rose 7 percent, PSU Bank index added 3 percent and Information Technology index up 1.2 percent.

Indian equity market lost further ground as benchmark indices witnessed selling in the third consecutive week ended August 11 post hawkish RBI commentary with no rate cut signal by this year-end and imposing Incremental Cash Reserve Ratio (ICRR) and rising inflation forecast hurt the market sentiment.

In this week, BSE Sensex lost 0.60 percent or 398.6 points to close at 65,322.65, and Nifty50 shed 0.45 percent or 88.7 points to end at 19,428.30.

Broader indices performed mixed with Mid-cap Index added nearly 1 percent, BSE Small-cap index up 0.6 percent while BSE Large-cap Index declined 0.5 percent.

“The Indian market experienced bearishness during the week that focused on economic data as inflation concerns dented domestic sentiments. The week began with moderate gains, led by strong performances in the pharma and IT sectors. However, uncertainties surrounding economic data releases and the RBI’s policy announcement hindered substantial moves. Inflation worries resurfaced as the RBI raised their CPI forecast by 30 bps to 5.4%, increasing the potential for a prolonged rate-cut trajectory. Additionally, the RBI’s move to manage liquidity through the incremental CRR impacted banking sector sentiment, albeit with a limited effect as expected,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Global markets faced volatility due to weak signals such as declining Chinese exports and the rating downgrade of US small and mid-sized banks. Despite lower-than-expected US CPI and better-than-anticipated UK GDP figures, global market sentiment remained subdued. Amid rising inflation concerns, investors are closely monitoring the domestic CPI data for July, which is projected to show a significant increase due to rising food prices,” he added.

On the sectoral front, Nifty Bank and Realty indices shed 1.5 percent each, Nifty FMCG index fell 1 percent, while Nifty Media index rose 7 percent, PSU Bank index added 3 percent and Information Technology index up 1.2 percent.

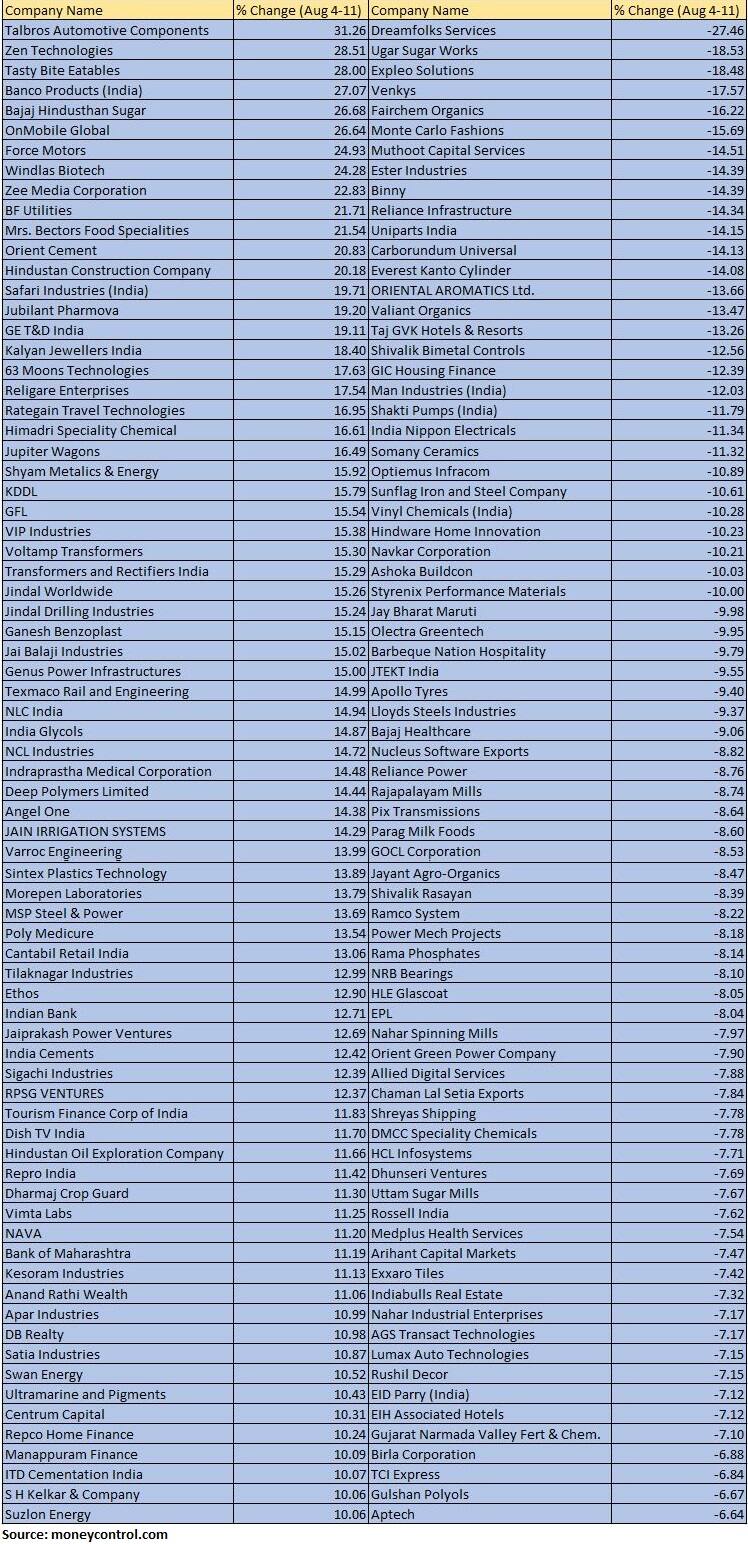

The BSE Small-cap index added 0.6 percent with Talbros Automotive Components, Zen Technologies, Tasty Bite Eatables, Banco Products (India), Bajaj Hindusthan Sugar, OnMobile Global, Force Motors, Windlas Biotech, Zee Media Corporation, BF Utilities, Mrs. Bectors Food Specialities, Orient Cement and Hindustan Construction Company gained 20-31 percent.

On the other hand, Dreamfolks Services, Ugar Sugar Works, Expleo Solutions, Venkys, Fairchem Organics, Monte Carlo Fashions, Muthoot Capital Services, Ester Industries, Binny, Reliance Infrastructure, Uniparts India, Carborundum Universal, Everest Kanto Cylinder, ORIENTAL AROMATICS, Valiant Organics, Taj GVK Hotels & Resorts, Shivalik Bimetal Controls, GIC Housing Finance, Man Industries (India), Shakti Pumps (India), India Nippon Electricals, Somany Ceramics, Optiemus Infracom, Sunflag Iron and Steel Company, Vinyl Chemicals (India), Hindware Home Innovation, Navkar Corporation, Ashoka Buildcon, Styrenix Performance Materials lost between 10-27 percent.

“The Indian equity markets started the week on a positive note, wherein the benchmark index witnessed a modest recovery from the previous week’s low. However, the market lacked conviction and remained in a slender range throughout the week, barring the last trading session, which dragged Nifty below the pivotal level of 19500. Also, the RBI’s status-Quo failed to direct any strong trend in the markets. And amidst the lackluster moves, the Nifty50 index concluded the week on a negative note, correcting 0.45 percent WoW to settle around 19430 zone,” said Osho Krishan, Sr. Analyst, Technical & Derivative Research, Angel One.

Foreign institutional investors (FIIs) sold equities worth Rs 4,702.06 crore, while domestic institutional investors (DIIs) bought equities worth Rs 2,224.3 crore in this week.

Where is Nifty50 headed?

Amol Athawale, Vice President – Technical Research, Kotak Securities:

Weak European and Asian market cues coupled with concerns that China slipping into stagflation amid slackening demand is making investors jittery and prompting them to offload in domestic equities. With FII flows turning choppy this month so far, markets are struggling to maintain the upward bias amid rise in intra-day volatile trades. Technically, during the week, the market is consistently witnessing selling pressure near the 20-day SMA (Simple Moving Average). On daily and intraday charts, the Nifty has formed a lower top formation, which indicates further weakness from the current levels.

As long as the index is trading below 19560, the weak texture is likely to continue and could retest the level of 19300-19250. On the flip side, above 19560, the chances of hitting 19670-19700 levels are bright.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty is likely to witness continuation of the selling pressure and with both the daily and hourly momentum indicators having a negative crossover, it is likely to be trending moves on the downside. On the downside, we expect the Nifty to target levels of 19100. The crucial support zone on the downside is placed at 19350 – 19290 and on the upside, resistance is placed at 19530 – 19500.

Bank Nifty has decisively broken the 44500 – 45000 range on the downside indicating weakness. The momentum indicator has a negative crossover which is a sell signal. Thus both price and momentum indicators are suggesting a further downside over the next few trading sessions. On the downside 44000 is the short-term target.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.