Trade setup for Friday: Top 15 things to know before the opening bell

The market has seen a minor bear attack and fell a little more than half a percent, but broadly traded within the previous day’s range, on August 17. Going ahead, the benchmark Nifty50 is still expected to be rangebound and the breakout of the 19,250-19,500 range on either side can give clear direction, experts said.

The BSE Sensex fell 388 points to 65,151, while the Nifty50 declined 100 points to 19,365 and formed a bearish candlestick pattern on the daily charts.

A Triangle type pattern is unfolding on the Nifty as per the daily timeframe chart and the market is currently placed near the lower end of a pattern around 19,300. “The attempt of upside recoveries from the intraday lows have been reversed on Thursday. The negative chart pattern like lower tops and bottoms is active on the daily chart and the market has not shown any decisive upside bounce so far,” Nagaraj Shetti, technical research analyst at HDFC Securities said.

Hence, he thinks the short-term trend of the Nifty remains choppy with weak bias.

“There is a possibility of downside breakout of the key lower support around 19,300-19,250 levels in the short term and that could possibly drag the Nifty down to another support of 19,100-19,000 in the near term. Any rise from here could find a strong hurdle at 19,600,” Shetti said.

The broader markets fared better than benchmarks as the Nifty Midcap 100 and Smallcap 100 indices gained 0.25 percent and 0.14 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may get support at 19,333, followed by 19,301 and 19,249. In case of an upside, 19,436 can be the key resistance, then 19,468 and 19,520.

On August 17, the Bank Nifty corrected 55 points to 43,891, continuing the downtrend for the sixth consecutive session, but there was a Doji candlestick pattern formation on the daily scale, indicating the indecisiveness among bulls and bears about the future trend.

“The Bank Nifty index displayed resilience by maintaining the support level of 43,600, which aligns with its 100-day moving average (100DMA). This support zone becomes crucial for adopting a buy-on-dip strategy,” Kunal Shah, senior technical & derivative analyst at LKP Securities said.

Shah says the surpassing of key resistance level at 44,200 could trigger short-covering and a potential move towards 45,000.

“The momentum indicator, RSI (relative strength index), entering the oversold region suggests a potential rebound. This possibility becomes more significant if the mentioned support level holds,” Shah said.

The pivot point calculator indicates that the Bank Nifty is likely to take support at 43,778, followed by 43,701 and 43,576. On the upside, the initial resistance is at 44,028 then by 44,105 and 44,230.

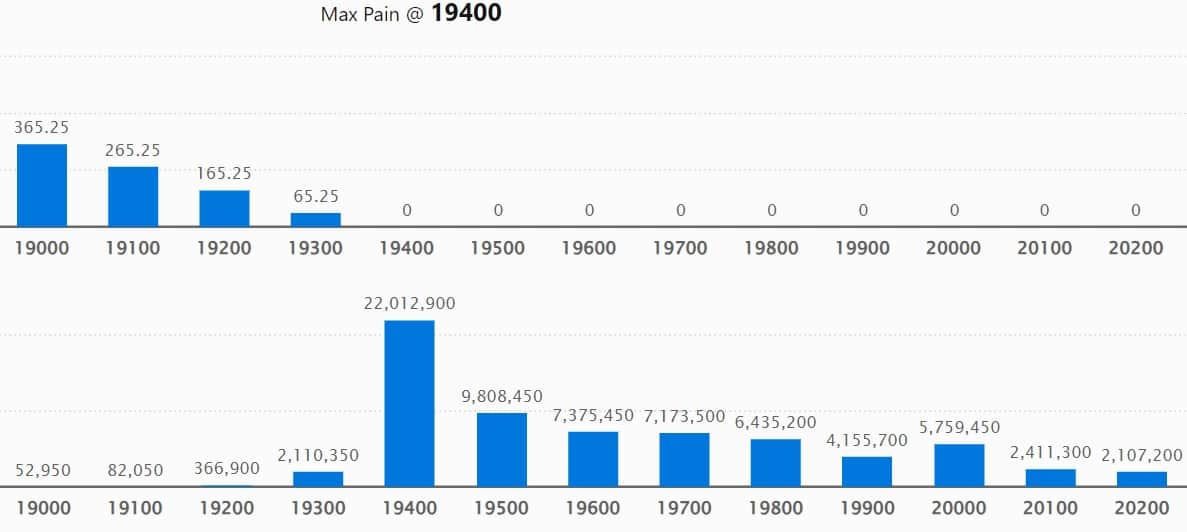

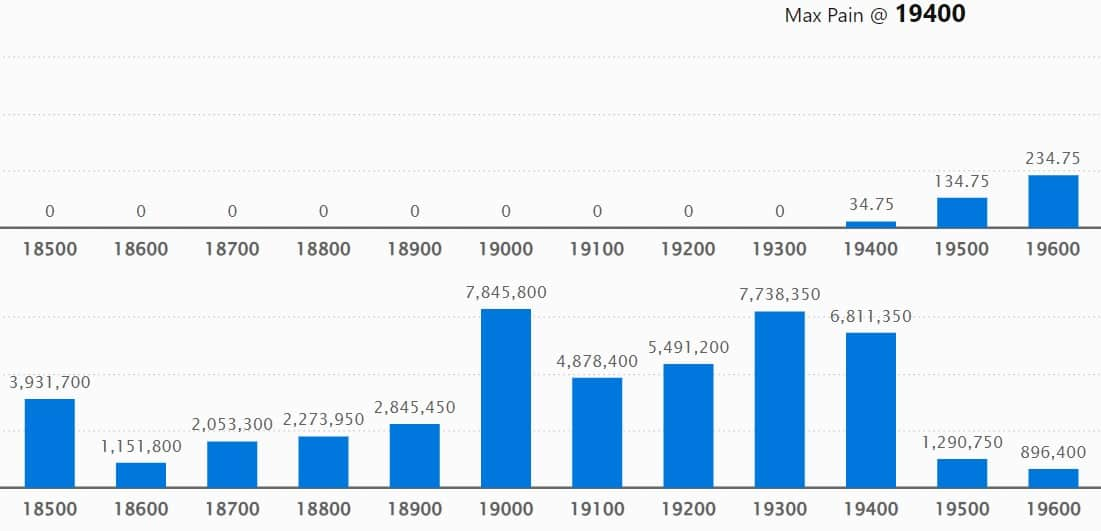

As per the options data, we have seen the maximum weekly Call open interest (OI) at 19,400 strike with 2.2 crore contracts, which can act as a key resistance for the Nifty. It was followed by 19,500 strike, which had 98.08 lakh contracts, while 19,600 strike had 73.75 lakh contracts.

The maximum Call writing remained at 19,400 strike, which added 1.48 crore contracts, followed by 20,400 and 19,900 strikes, which added 22.96 lakh and 12.03 lakh contracts, respectively.

The maximum Call unwinding was at 19,600 strike, which shed 54.70 lakh contracts, followed by 19,700 and 20,500 strikes, which shed 18.22 lakh and 11.22 lakh contracts.

The maximum Put open interest was at 19,000 strike, with 78.45 lakh contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,300 strike, comprising 77.38 lakh contracts, and 19,400 strike with 68.11 lakh contracts.

The maximum Put writing was seen only at 19,000 strike, which added 1.61 lakh contracts.

Meaningful Put unwinding was at 19,300 strike, which shed 64.49 lakh contracts, followed by 19,400 and 19,200 strikes, which shed 60.96 lakh and 29.51 lakh contracts.

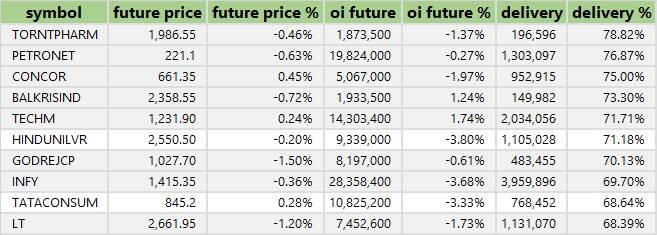

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Torrent Pharmaceuticals, Petronet LNG, Container Corporation of India, Balkrishna Industries, and Tech Mahindra were among the stocks that saw the highest delivery.

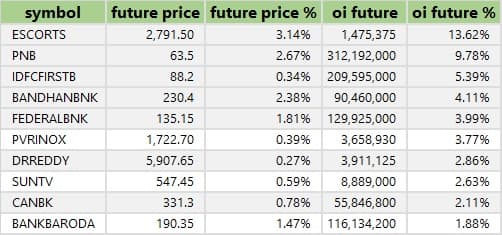

Escorts Kubota, Punjab National Bank, IDFC First Bank, Bandhan Bank, and Federal Bank were among the 26 stocks to see a long build-up. An increase in open interest (OI) and price indicate a build-up of long positions.

Based on the OI percentage, 59 stocks, including Oracle Financial, InterGlobe Aviation, HCL Technologies, Hindustan Copper, and Hindustan Unilever saw long unwinding. A decline in OI and price indicate long unwinding.

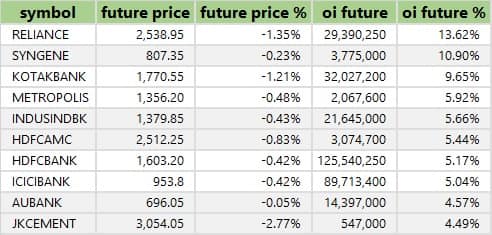

62 stocks see a short build-up

A short build-up was seen in 62 stocks, including Reliance Industries, Syngene International, Kotak Mahindra Bank, Metropolis Healthcare, and IndusInd Bank. An increase in OI along with a fall in price points to a build-up of short positions.

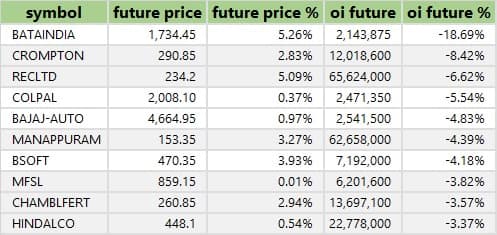

Based on the OI percentage, 41 stocks were on the short-covering list. These included Bata India, Crompton Greaves Consumer Electricals, REC, Colgate Palmolive, and Bajaj Auto. A decrease in OI along with a price increase is an indication of short-covering.

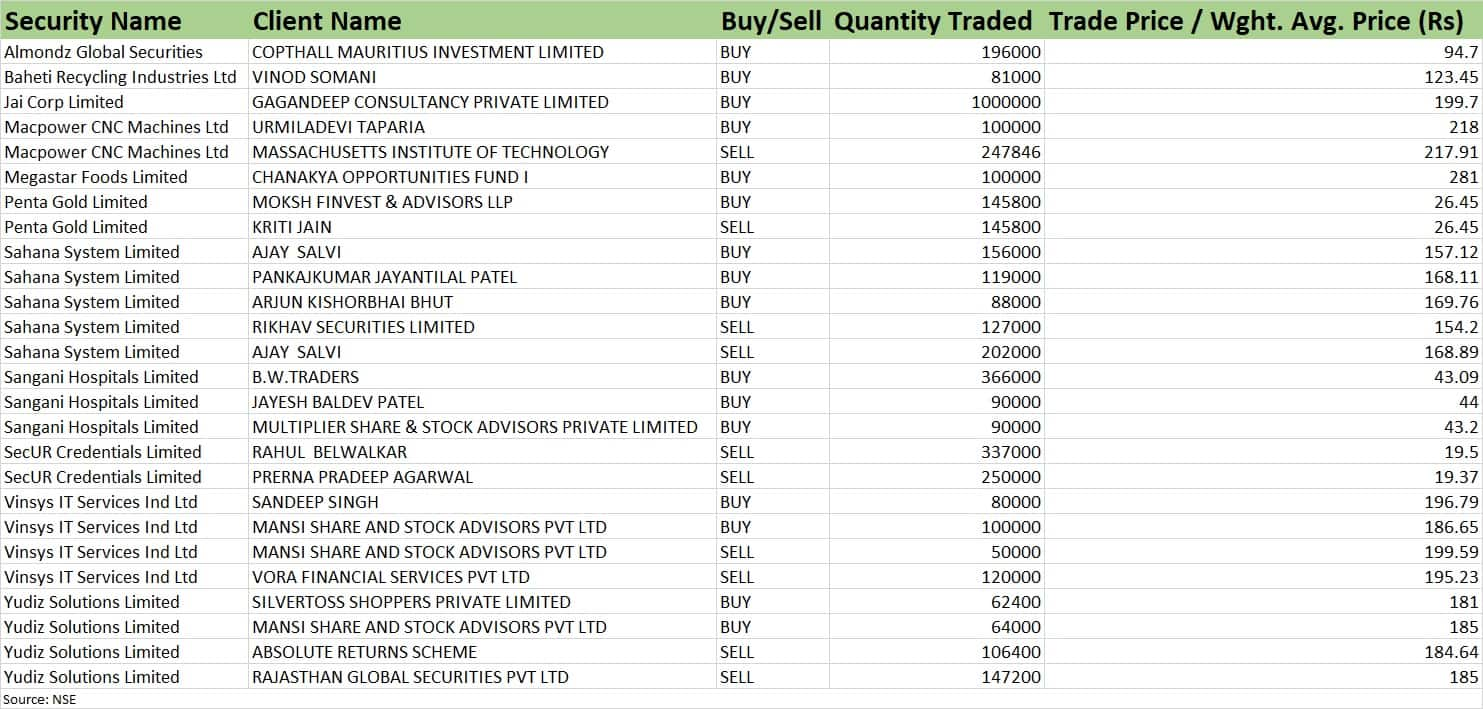

(For more bulk deals, click here)

Investors Meeting on August 18

Jindal Stainless: Company’s officials will attend Avendus Spark Investor Conference.

V-Mart Retail: Officials of the company will interact with Nuvama Institutional Equities.

Neuland Laboratories: Company’s management will be meeting investors in the non-deal roadshow organised by B&K Securities.

Happiest Minds Technologies, Firstsource Solutions, Computer Age Management Services, Kalpataru Projects International, CESC: Senior officials of these companies will be participating in Emkay Confluence 2023.

Va Tech Wabag: Officials of the company will be meeting several analysts or investors in-person.

Indian Energy Exchange: Company’s officials will interact with Sparx Asset Management.

Bharat Forge: Senior officials of the company will meet Balyasny Asset Management.

Stocks in the news

Concord Biotech: The biotech pharma company will be listing shares on the BSE and NSE on August 18. The final issue price has been fixed at Rs 741 per share.

LTIMindtree: US-based supplemental insurance provider Aflac Incorporated has selected LTIMindtree as a digital transformation partner for application modernisation and cloud transformation. The partnership will rearchitect Aflac’s legacy applications with a cloud-first approach in collaboration with Amazon Web Services, ensuring performance efficiency, cost optimization, and operational excellence with heightened security.

Punjab National Bank: Punjab National Bank, TVS Motor Company, Shriram Finance, Trent and Zydus Lifesciences will be included in Nifty Next 50, with effect from September 29. However, ACC, FSN E-Commerce Ventures, HDFC AMC, Indus Towers, and Page Industries will be excluded from the index. The National Stock Exchange has announced replacements on account of a semi-annual review of broad market indices including Nifty Next 50, Nifty500, Nifty100, Nifty Midcap150, Nifty Smallcap250 and Nifty Midcap 50.

NTPC: The state-owned power generation company has executed the business transfer agreement (BTA) with its subsidiary NTPC Mining for hiving-off coal mining business. On July 29, NTPC received board approval for hiving off its coal mining business, consisting of six coal mines, to NTPC Mining through BTA.

Jain Irrigation Systems: The company has received board approval for short and medium-term fundraising for meeting various obligations. It will raise funds worth Rs 76.12 crore via promoter allotment. Further, to meet various obligations, Alpha Alternatives Structured Credit Opportunities Fund an SPV of Alpha Alternatives Holdings and its associates will subscribe to share warrants worth Rs 123.43 crore. Both warrants will be converted into equity shares in 18 months from the allotment.

Tata Steel: The Tata Group company will hold a meeting of its equity shareholders on September 18. They will consider the TRF merger with Tata Steel, and if thought fit, with or without modifications, approve the Scheme of Amalgamation.

Tribhovandas Bhimji Zaveri: Subhasis Sinha has resigned as Head-HR, senior management personnel of the jewellery company with effect from August 16. Sinha resigned due to personal family constraints.

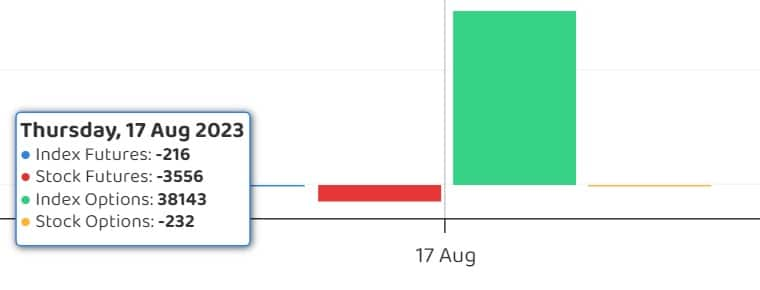

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 1,510.86 crore, while domestic institutional investors (DII) offloaded Rs 313.97 crore worth of stocks on August 17, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Punjab National Bank to its F&O ban list for August 18, while retaining Chambal Fertilisers & Chemicals, Delta Corp, Gujarat Narmada Valley Fertilizers and Chemicals (GNFC), Granules India, Hindustan Copper, Indiabulls Housing Finance, India Cements, SAIL, and Zee Entertainment Enterprises in the list. However, Balrampur Chini Mills, and Manappuram Finance removed from the list. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.