Riders of the Storm: These 337 names delivered over 500% returns since Covid

With Nifty Bank and Nifty continuing to trade in a narrow range, more punters are seeking their daily fix in Midcap Nifty contracts.

The January to March period of 2020 was perhaps the last ‘normal’ quarter for businesses before the Covid pandemic set the world order to ‘new normal’. Since then, not only has Dalal Street weathered multiple storms deftly, it also fostered a host of multi-baggers delivering huge returns.

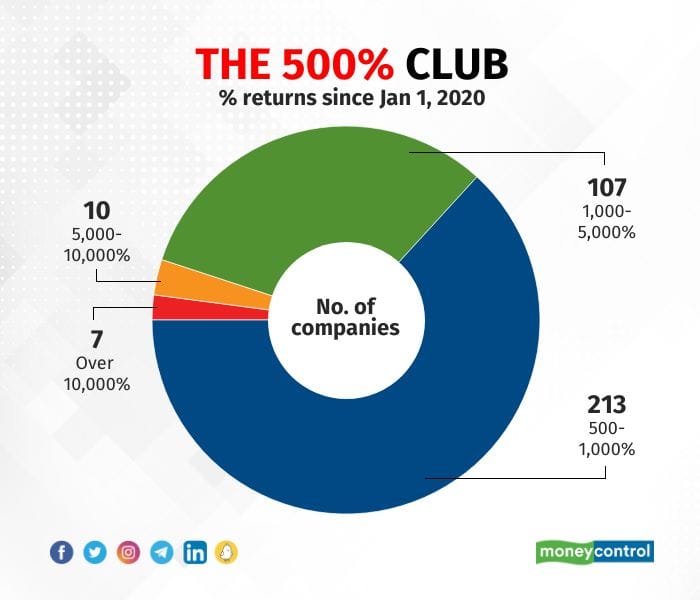

As per an analysis by Moneycontrol, some 337 stocks have soared over 500 percent since January 1, 2020. Out of these, 213 stocks registered 500 to 1,000 percent growth, and 107 counters saw the spike in the range of 1,000 to 5,000 percent.

For 10 stocks, gains ranged from 5,000 to 10,000 percent, and six had 10,000 to 20,000 percent surge.

One stock – Raj Rayon Industries Ltd – experienced a mind-boggling surge of over 26,000 percent.

Danger Ahead?

Returns in three, four and, not to mention, five digits often have a hypnotising effect on investors, who rush towards these stocks like moths to a flame.

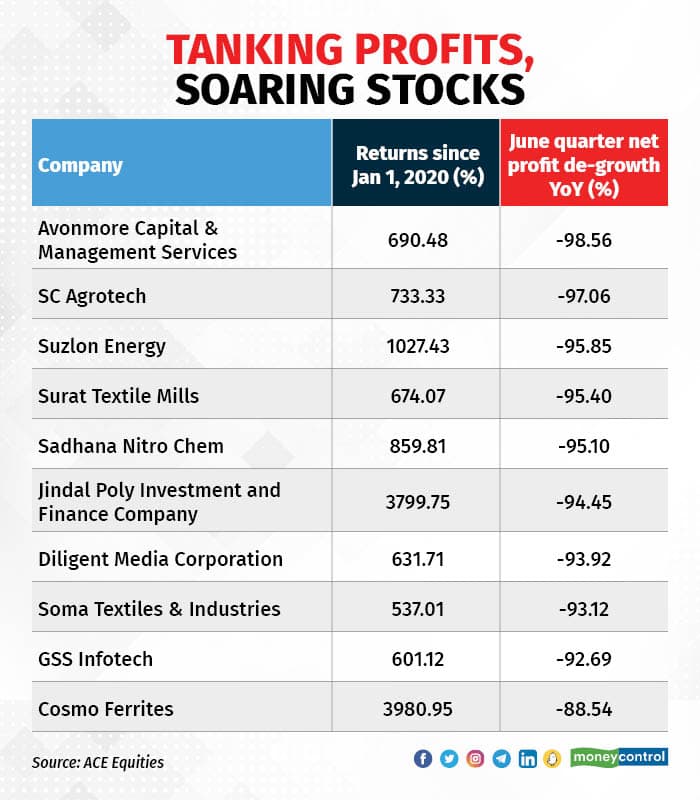

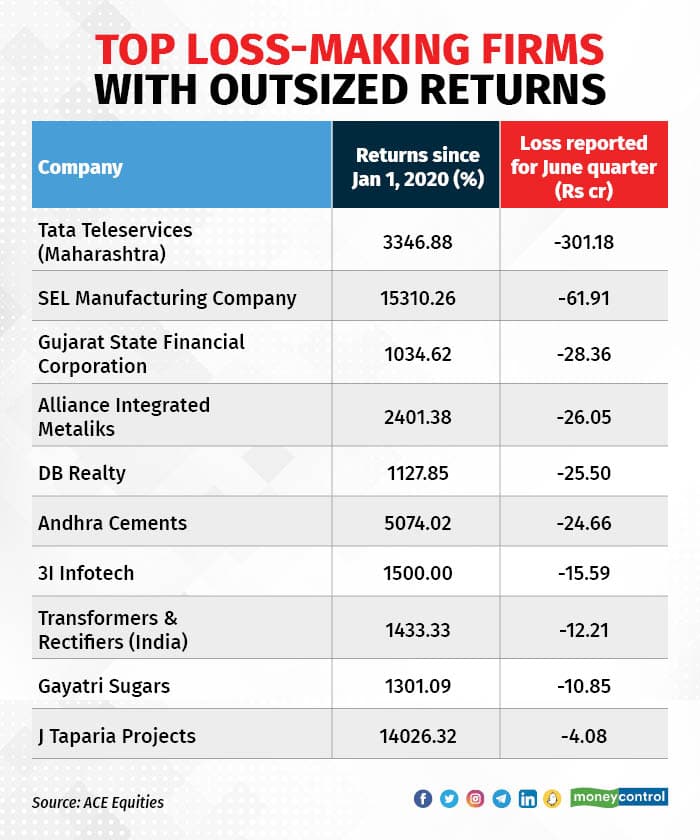

However, analysts urge caution in this case not only because of the huge run-up in these counters but also due to the fact that the financial fundamentals of many of these companies do not support the current break-out.

Take the topper of the list, Raj Rayon Industries Ltd. The manufacturer of Polyester Texturised Yarn (PTY) posted a net profit of just Rs 29 lakh in Q1 FY24, compared to a net loss of Rs 3.45 crore in the year-ago period.

In fact, of the six stocks which have delivered returns of over 10,000 percent, two are loss-making firms and two have logged quarterly profit of below Rs 30 lakh. Only two companies have managed to cross the Rs 1-crore mark in Q1 net profit.

“During all market rallies, many low-priced stocks become multi-baggers. Only some lucky investors gain from that. Most retail investors lose money by chasing multi-baggers,” said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

He added that during a prolonged market correction phase, many low-quality stocks get butchered in the bear onslaught. History is replete with examples of retail investors losing heavily by investing in such names. “Therefore, investors have to be very careful… They should do due diligence before investing in these stocks.”

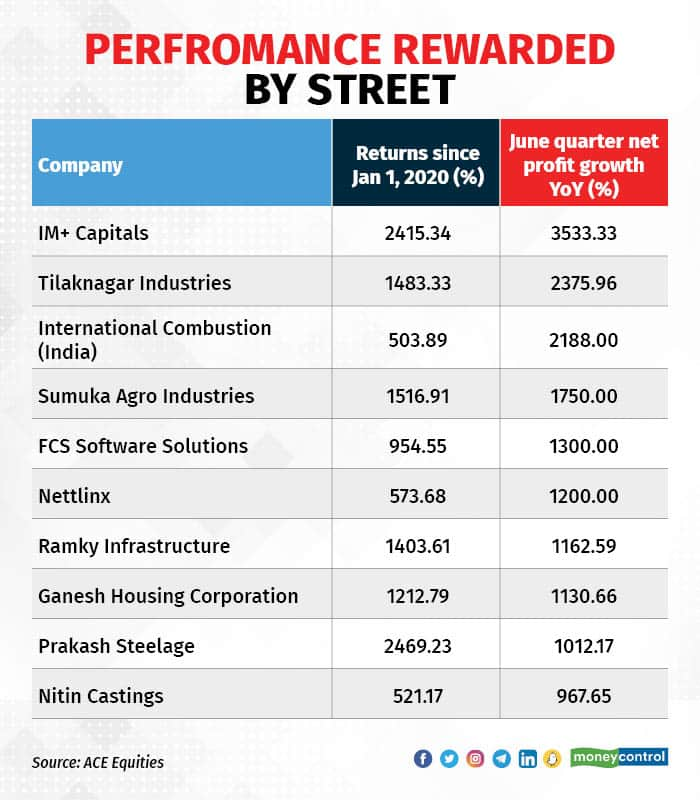

This is not to say the list only comprises dubious names. Some companies like Jindal Stainless, Tata Elxsi, Poonawalla Fincorp, LT Foods and Eveready Industries have been handsomely rewarded by the Street for consistent performance and profit growth.

Others have been the beneficiaries of the recent bullish sentiment around specific sectors, like Jupiter Wagons (railways), Olectra Greentech (e-buses) and Dixon Technologies (electronic manufacturing services).

“In the wake of the pandemic-induced panic that sent markets plummeting to historically low levels, numerous stocks had found themselves unjustly depressed well below their intrinsic worth. However, as time passed and the fog of uncertainty began to lift, a more rational assessment of these businesses took hold,” said Devarsh Vakil, Deputy Head of Retail Research, HDFC Securities.

As economies gradually reopened and consumer confidence was restored, revenues surged, and profitability followed suit.

However, he added that like in every bull market, there are some stocks that have risen beyond what their existing fundamentals warrant and there is an element of speculation.

But the whole market resurgence is not a merely a fleeting spurt driven only by speculative fervor, rather a reflection of the fundamental strength and resilience of businesses that had weathered the storm and emerged stronger, Vakil noted.

“We continue to find many such opportunities in the market and there is a long runway left for this bull market so investors should remain discerning and keep deploying capital in the equity markets,” he said.