F&O Manual | Indices trade flat, Nifty faces resistance at 19,550

Among individual stocks, GMR Infra, CoForge and Mphasis saw a bullish setup, while NMDC, Hindalco and Lauraslabs saw a short buildup.

The Indian indices, which opened higher on August 24 amid neutral global cues but positive domestic sentiment after India’s successfully landed Chandrayaan 3 on the Moon’s south pole, were trading a tad lower at mid-day.

At 12 pm, the Sensex was up 94.02 points or 0.14 percent at 65,527.32, and the Nifty was up 25.50 points or 0.13 percent at 19,469.50. About 1,810 shares advanced, 1,238 declined, and 107 were unchanged.

All sectoral indices were trading in the green, with S&P BSE realty up by 1.2 percent.

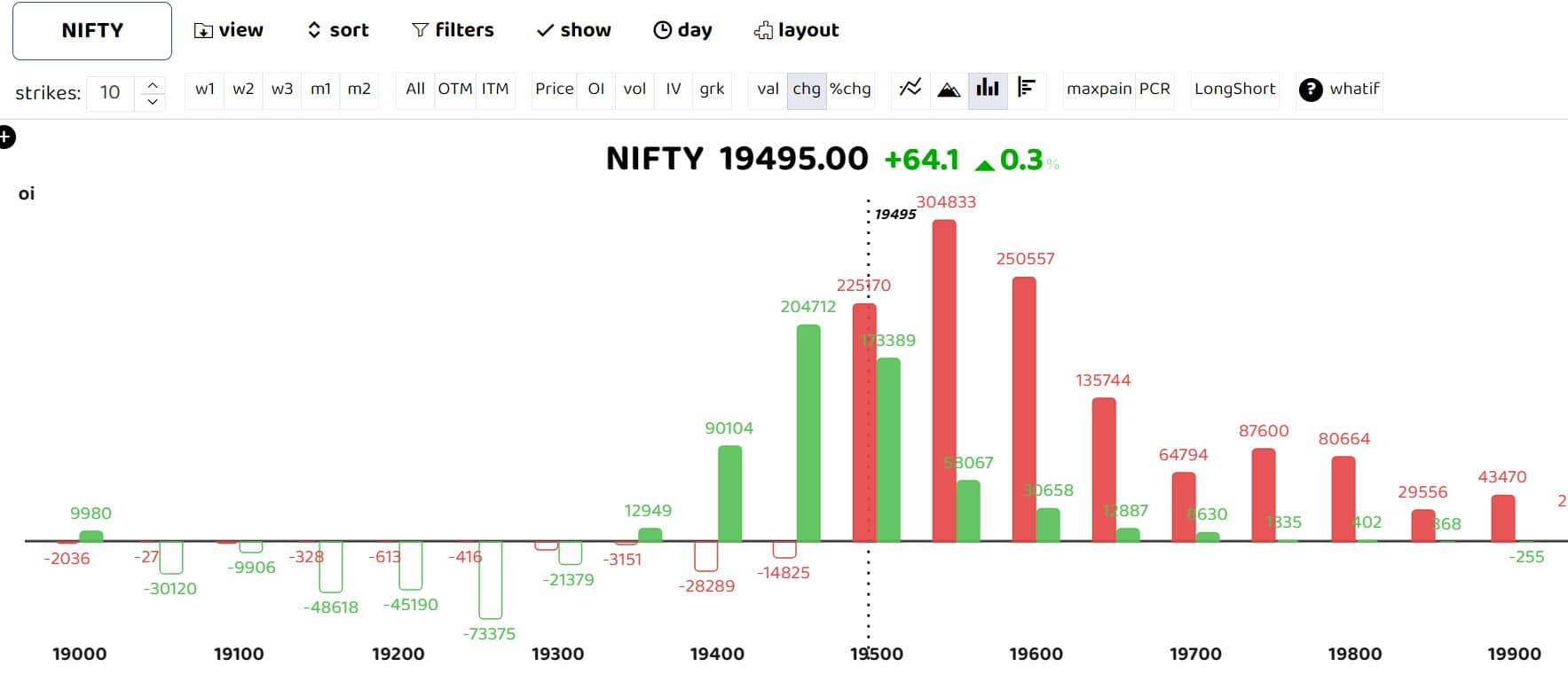

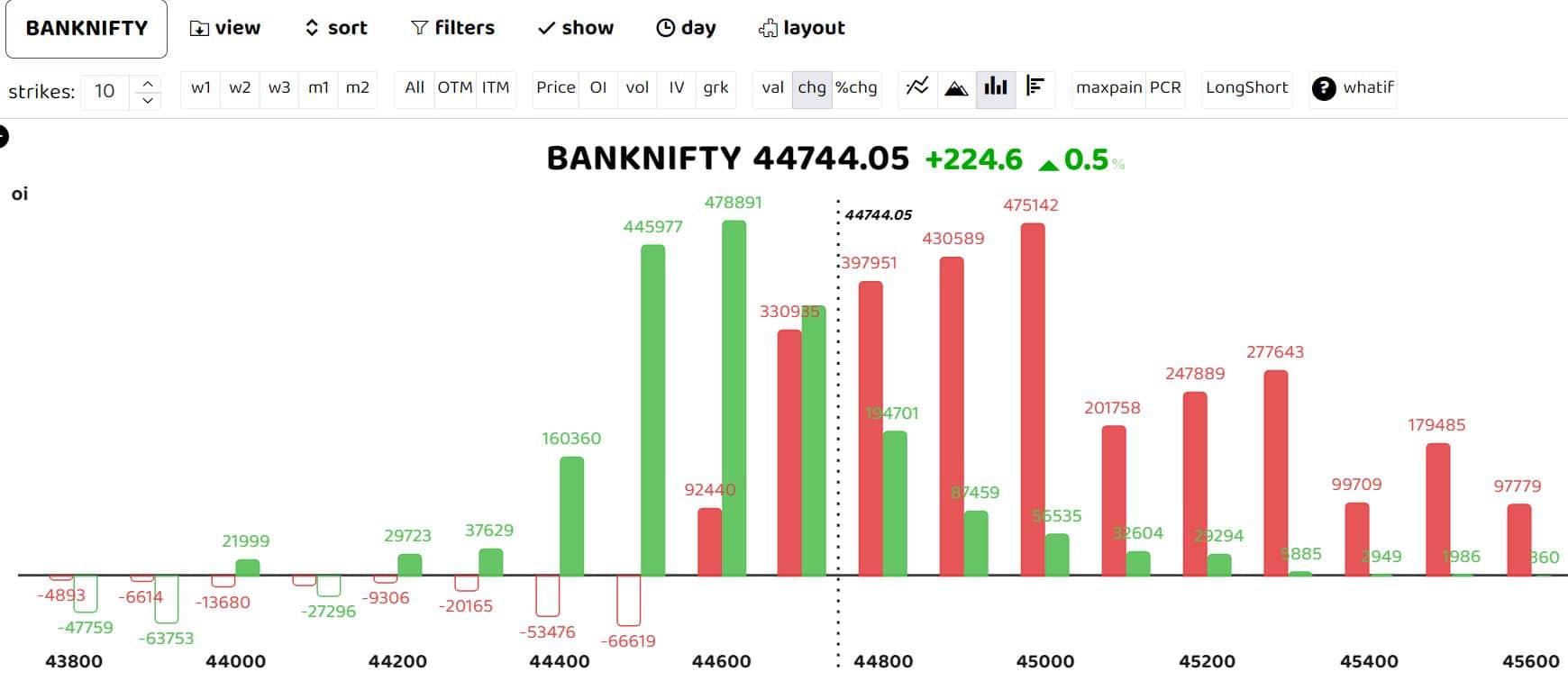

Bars reflect changes in open interest (OI) during the day. The red bars show call option OI and the green put option OI.

Nifty futures open interest (OI) data reveals significant call writing at the 19550 strike followed by the 19,600. These levels are expected to act as key resistance areas.

On technical front, the Nifty is gradually inching toward the crucial resistance zone of 19,480-19,500, analysts said. If there is no significant global aberration, there’s a high possibility of the index surpassing the higher boundaries, potentially setting the stage for positive momentum towards 19,650-19,680.

While on the flip side, the support base is now elevated to 19,400-19,370 followed by 19,300.

Bank Nifty

The 50-day exponential moving average and the maximum put OI for Bank Nifty is at 44,500 and hence, the options activity at 44,500 strike will set the trend for the next leg of the rally.

According to analysts, a decisive break above 44,500, corresponding to the 50EMA level, will demonstrate conviction and can take the index to 45,400-45,600 in the upcoming sessions.

According to Prabhudhas Lilladher, “Bank Nifty, which has already turned up the daily trend after 19 days, has indicated a positive bullish candle on the daily chart to strengthen the bias, with most of the frontline banking stocks like Axis Bank, ICICI Bank, Kotak Bank and SBI looking attractive and improving their bias.”

Follow our live blog for all market action

Among individual stocks, GMR Infra, CoForge and Mphasis saw a bullish setup, while NMDC, Hindalco and Lauras Labs saw a short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.