Banking sector derivative pair strategy: Options outlook for Bank nifty ahead of expiry this week

On august 28, Bank Nifty futures exhibited a movement of 397.75 points, concluding higher by 277.15 points or 0.63 percent, and closing at the 44500 level.

After a week of consolidation, the Bank Nifty seems to be on a rebound, culminating in a precise closure at the 50-day Exponential Moving Average (EMA), accompanied by the formation of a higher-high, higher-low pattern.

The Bank Nifty futures moved 397.75 points on August 28 and closed 277.15 points or 0.63 percent higher at the 44,500 level.

On the daily chart, the Bank Nifty formed a morning star pattern and closed marginally above the 50-DEMA at 44,494, a rise of 262 points. “The option activity at the 44,500 Strike will provide cues about Bank Nifty’s future direction, as both call and put writers are vying to dominate. A close above yesterday’s high of 44,610 could lead to a resurgence of bulls in the Bank Nifty,” Samco Securities said.

Kunal Shah, Senior Technical and Derivative Analyst at LKP Securities, stated that the index remained sideways throughout the day before closing with a Doji formation. While the trend remains weak, the failure to drop below 19,245 on a closing basis might trigger a short-term market pullback. The RSI has shown a bullish crossover. “Support is positioned at 19,245, and a decisive breach below this level could attract significant selling pressure. On the higher end, resistance is observed at 19,450,” Shah said.

Derivative Outlook

According to LKP Securities, the Bank Nifty index demonstrates a strong bullish sentiment at the lower end of the range, with sustained buying interest. “As long as the index maintains its position above the key level of 44,000, which aligns with substantial put open interest, the prevailing stance remains on the buy side,” it said.

An immediate challenge for further upside movement is seen at 44,500. Successfully surpassing this level could prompt short-covering and propel the index towards 45,000. This level holds significance due to the highest open interest built up on the call side.

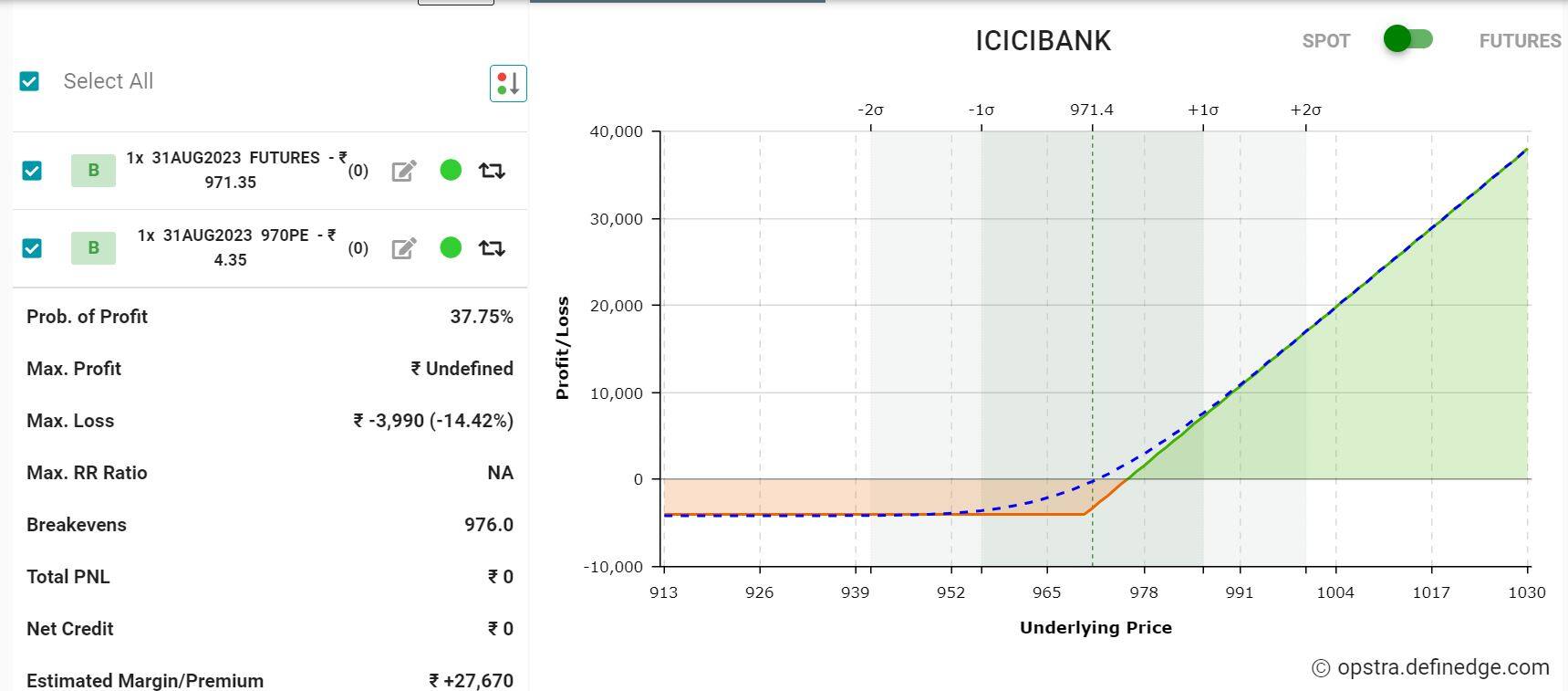

As the weekly and monthly expiry approaches on Thursday, Shah recommends a paired strategy on ICICI Bank and the Bank Nifty index, given the bullish outlook on both.

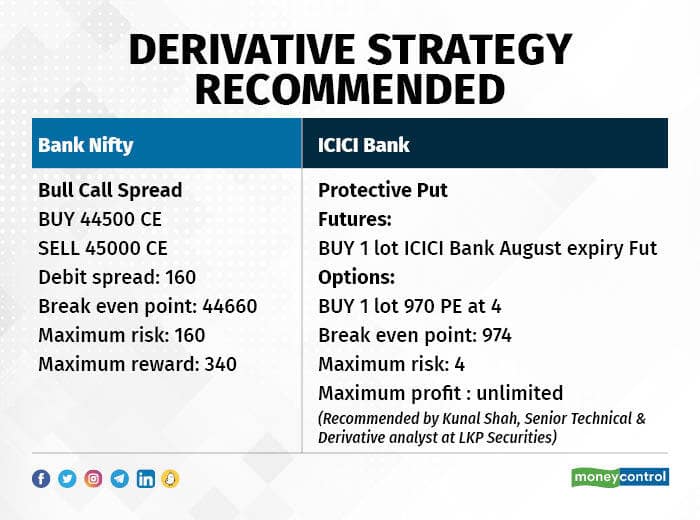

Banknifty

Bull call spread strategy:

BUY 44500 CE

SELL 45000 CE

Debit spread: 160

Break even point: 44660

Maximum risk: 160

Maximum reward: 340

Pay off chart for Bull call spread

A bull call spread is an options trading strategy designed to benefit from a stock’s limited increase in price. The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price. The bullish call spread helps to limit losses of owning stock, but it also caps the gains.

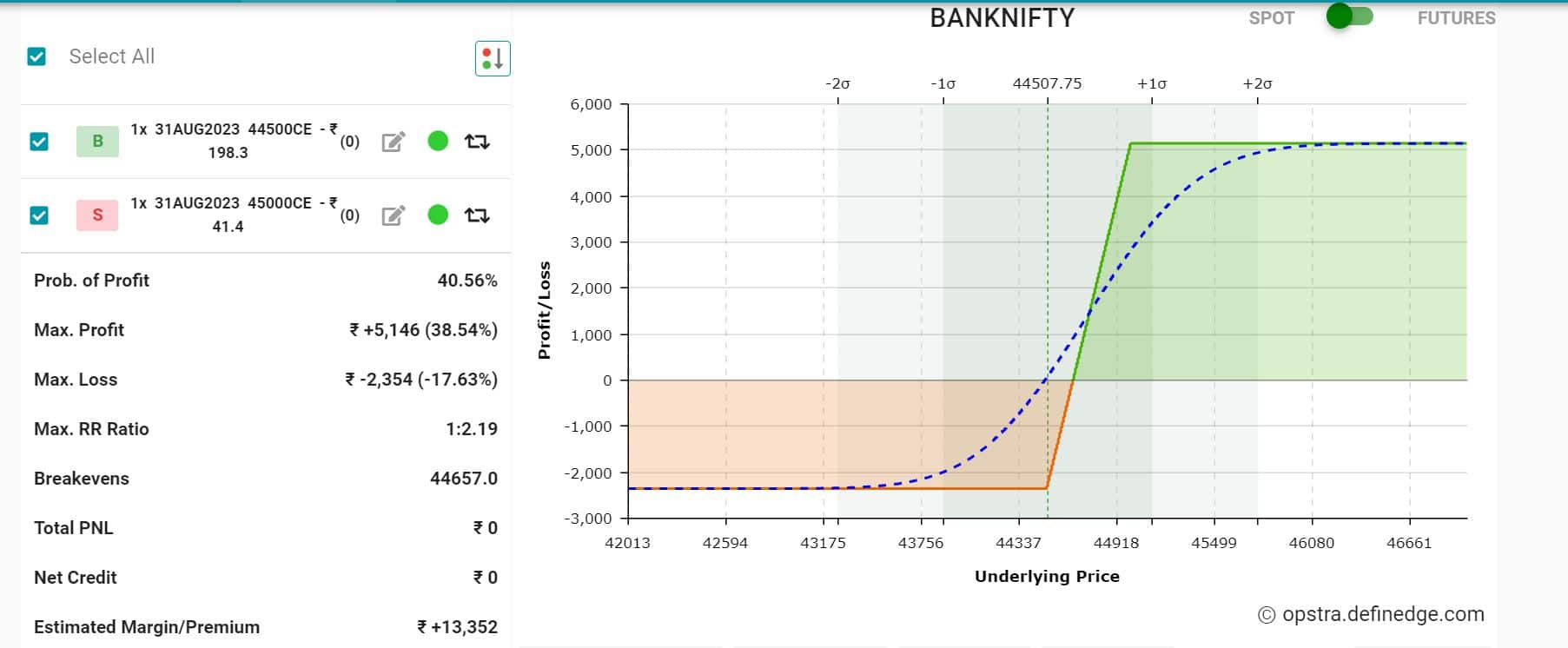

ICICI Bank Strategy

Protective Put

Futures: BUY 1 lot ICICI Bank August expiry Futures

Options: BUY 1 lot 970 PE at 4

Break even point: 974

Maximum risk: 4

Maximum profit : unlimited

Pay off chart for protective put strategy

A protective put position is created by buying (or owning) stock and buying put options on a share-for-share basis. It is a hedging strategy used to protect an existing long position in the market. In a protective put the holder of a security (equity or futures) buys a put option to protect himself against a drop in price

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.