September F&O outlook: Spotlight on stocks after August rollover and derivative strategies

Long rollovers were seen in TVS Motor, Bharatforg, Idfc First Bank, Dixon, Tatacomm, PVR Inox, Mphasis, Lupin, Hindcopper, Tatapower, Suntv, Poly Cab, Shri Ram Fin, while short rollovers were observed in Cumminsind, Indigo, SBIN, AB Capital, Britannia, Muthootfin, Naukri, Hindpetro, Apollo Hospital, and CanBank.

After taking a break in the August series from a sustained rally, the Nifty seems to have entered September with the possibility of trading in a wider range in a volatile market.

A breather in August after four-series rally

The Nifty index had kick-started the August series on a flattish note but remained in a range of 550 points with capped upside throughout the series. It took a halt after rallying in the previous four months. Although it couldn’t sustain the levels above 19,650, it found support around the 19,200 zone.

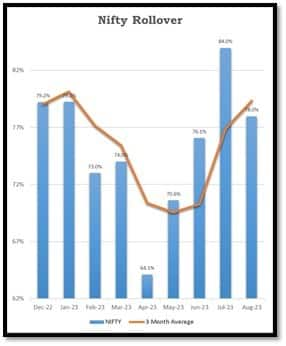

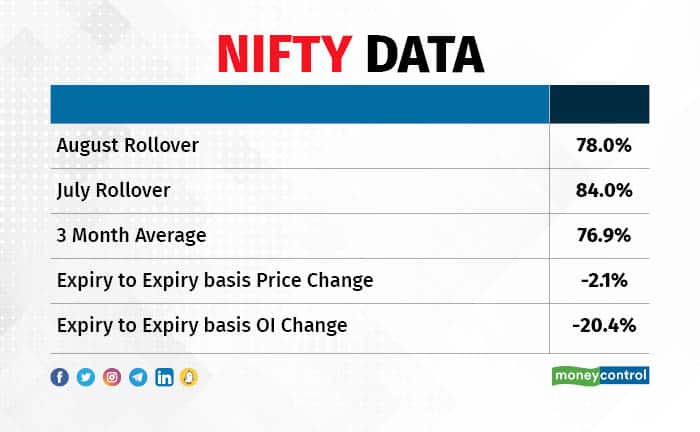

The August series saw a 20.4 percent decline in open interest along with a 2.1 percent drop in prices on an expiry-to-expiry basis. As per Chandan Taparia, Head of Derivative and Technicals at Motilal Oswal Financial Services, this suggests a liquidation of long positions after a strong run in the previous couple of series. The Nifty’s rollover rate stood at 78 percent, consistent with its quarterly average of 77 percent.

As the September series begins, option data is scattered across various far strikes in the monthly series. “On the weekly front, the Maximum Call Open Interest (OI) is observed at the 19,400 and 19,500 strikes, while the Maximum Put OI is at the 19,200 and 19,000 strikes. Call writing is prominent at the 19,400 and 19,300 strikes, while Put writing is notable at the 19,200 and 19,100 strikes. This option data suggests a broader trading range between 19,000 and 19,700 zone,” Taparia said.

The Nifty closed near the 19,250 zone, and the At The Money Straddle (September Monthly 19,250 Call and 19,250 Put) is trading at a net premium of approximately 485 points, indicating a broader range of 18,765 to 19,735 levels. Taking into consideration the overall derivatives activity, Taparia anticipates a range-bound movement in Nifty as it enters the September series.

Sectoral behaviour

Selective buying interest was observed in the IT, PSE, realty, metal, and auto sectors, while some selling pressure was evident in the FMCG, energy, and banking sectors.

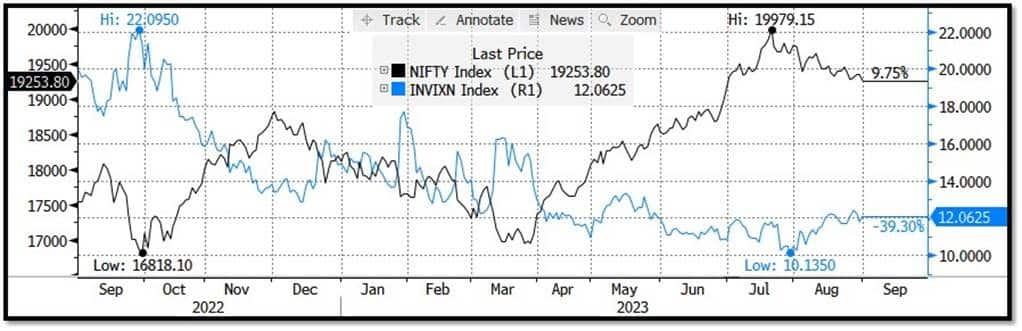

India VIX

Volatility index India VIX increased by 14.75 percent from 10.51 to 12.06 levels in the August series, resulting in higher volatility at 12.75, creating market swings and discomfort for bullish traders.

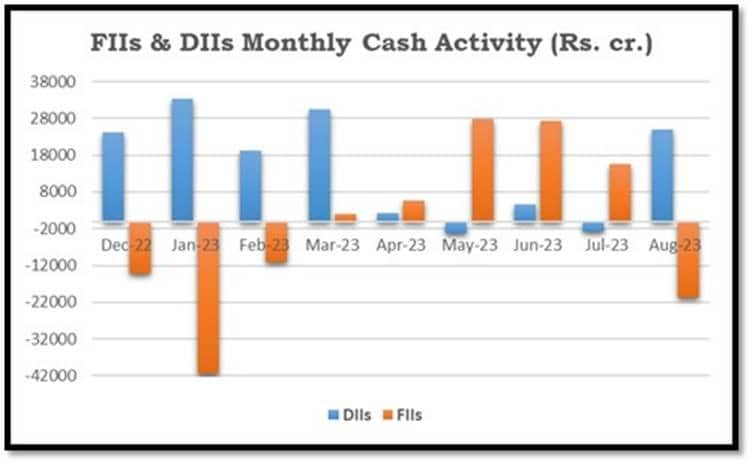

FII and DII

Foreign Institutional Investors (FIIs) broke their five-month buying streak and collectively sold equities worth Rs 20,621 crore in August. Domestic Institutional Investors (DIIs) took an offsetting position, buying to the tune of Rs 25,017 crore.

“The FIIs’ ‘Long Short Ratio’ in index futures remained relatively subdued, ranging from 39 percent to 51.4 percent in the August series, closing at its upper limit,” Taparia said.

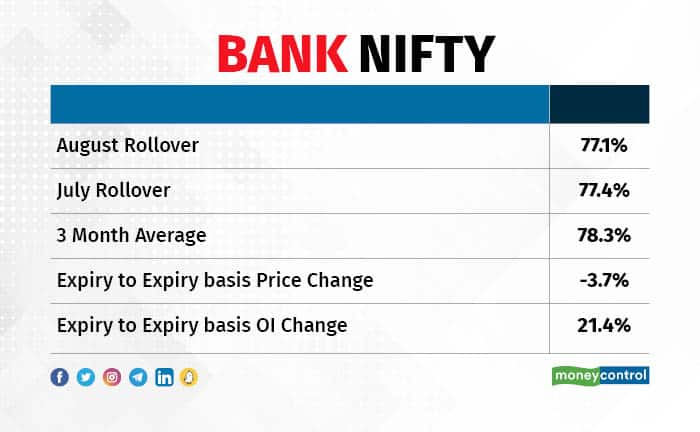

Bank Nifty rollover

Bank Nifty, saw an opening bearish candle negating its higher high-higher low formation from the last four series. Short build-up was observed as open interest fell by 21.4 percent, and prices declined by 3.7 percent on an expiry-to-expiry basis. The rollover in Bank Nifty stood at 77.1 percent, aligning with its quarterly average of 77.4 percent

Stock-wise rollover

Regarding individual stocks, long rollovers were seen in TVS Motor, Bharatforg, Idfc First Bank, Dixon, Tatacomm, PVR Inox, Mphasis, Lupin, Hindcopper, Tatapower, Suntv, Poly Cab, Shri Ram Fin, while short rollovers were observed in Cumminsind, Indigo, SBIN, AB Capital, Britannia, Muthootfin, Naukri, Hindpetro, Apollo Hospital, and CanBank.

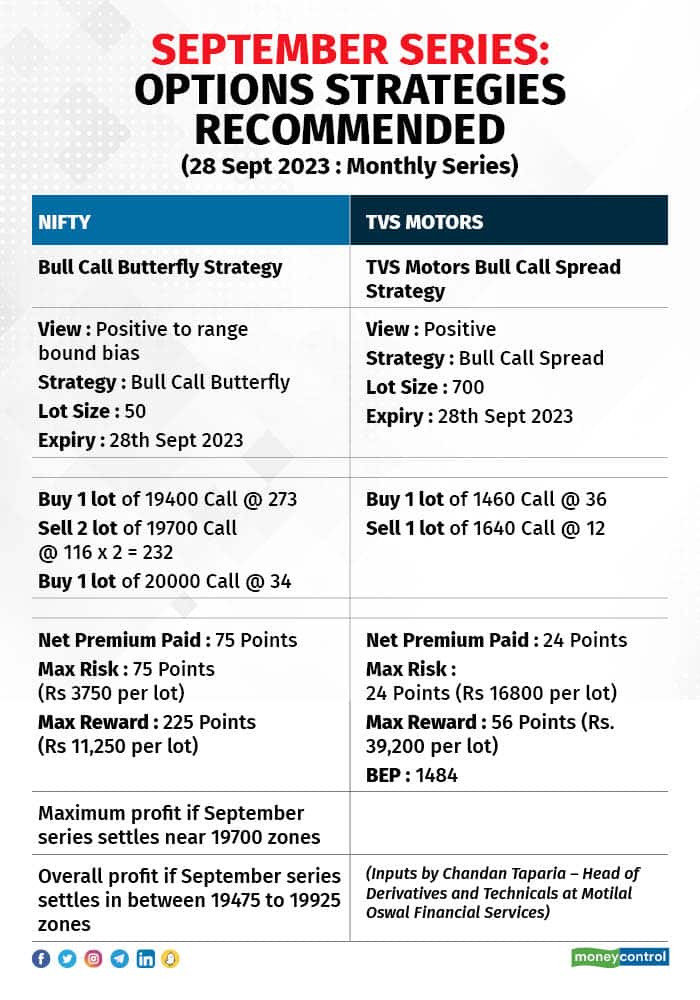

Now, let’s take a look at some specific derivatives trading strategies for the September 28, 2023, monthly series:

Nifty

Bull Call Butterfly Strategy

View: Positive to range-bound bias

Strategy: Bull Call Butterfly

Lot Size: 50

Expiry: September 28th, 2023

Buy 1 lot of 19400 Call @ 273

Sell 2 lots of 19700 Call @ 116 x 2 = 232

Buy 1 lot of 20000 Call @ 34

Net Premium Paid: 75 Points

Max Risk: 75 Points (Rs 3750 per lot)

Max Reward: 225 Points (Rs 11,250 per lot)

Maximum profit if September series settles near 19700 zones

Overall profit if September series settles between 19475 to 19925 zones

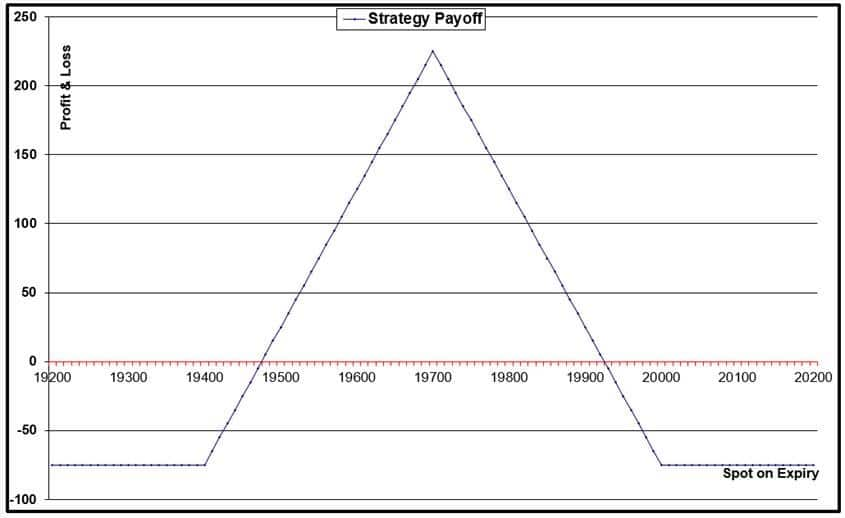

Payoff chart for bull call butterfly strategy

Payoff chart for bull call butterfly strategy

TVS Motors

Bull Call Spread Strategy

View: Positive

Strategy: Bull Call Spread

Lot Size: 700

Expiry: September 28th, 2023

Buy 1 lot of 1460 Call @ 36

Sell 1 lot of 1640 Call @ 12

Net Premium Paid: 24 Points

Max Risk: 24 Points (Rs 16800 per lot)

Max Reward: 56 Points (Rs 39,200 per lot)

BEP (Break-Even Point): 1484

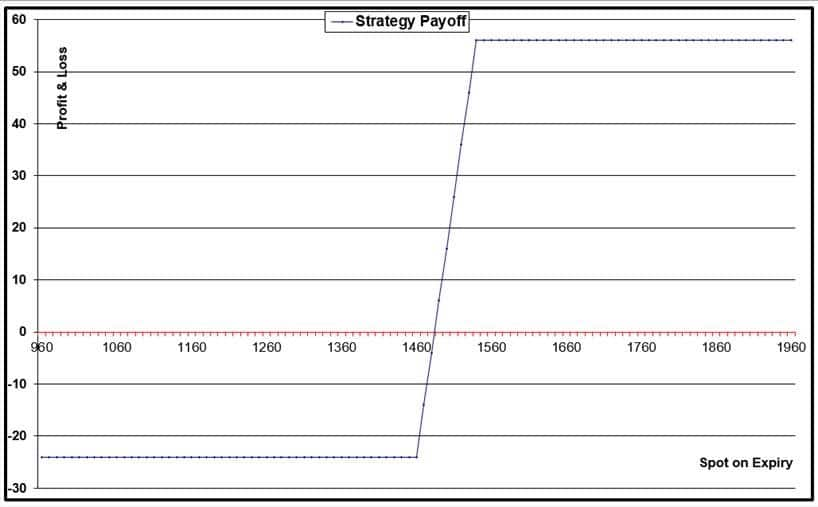

Payoff chart for bull call spread

Payoff chart for bull call spread

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions