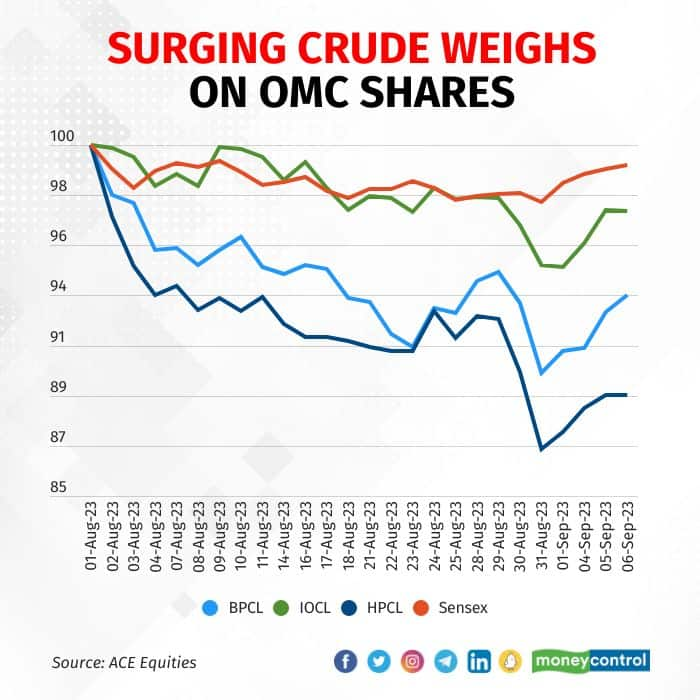

OMC shares tumble 3-10% since Aug amidst crude surge, lower Russian discount

Oil marketing firms are grappling with a tough Q2 of FY24 as Brent crude prices rise while retail fuel prices remain stable. This is likely to affect their profits due to shrinking gross marketing margins, with a 45% drop in petrol margins in Q2.

State-owned OMCs face headwinds as rising crude oil prices and reduced Russian discounts impact their shares

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

Shares of state-owned oil marketing companies (OMCs) have been on a downtrend since the start of August, with Hindustan Petroleum, Bharat Petroleum and Indian Oil declining 10 percent, 6 percent and 3 percent respectively, even as international crude prices are on the rise, and their discount with Russian crude is narrowing.

The price of Brent crude has surged over 18 percent in the September quarter so far, after declining for four straight quarters. It touched $90 per barrel on September 5, the highest in the last 10 months, after Saudi Arabia and Russia extended supply cuts till the end of the year.

OMC shares tumble 10% since Aug amidst crude oil price surge, lower Russian discount

Challenging Q2FY24

Government-owned oil marketing firms are grappling with a tough Q2 of FY24 as Brent crude prices rise while retail fuel prices remain stable. This is likely to affect their profits due to shrinking gross marketing margins, with a notable 45 percent drop in petrol margins in Q2. Diesel margins turned negative in August, according to analysts.

Read: Bajaj Finance’s acquire and cross-sell strategy to be key growth driver in FY24, says Motilal Oswal

According to JM Financials, the Q2FY24E Earnings before Interest, Tax, Depreciation and amortisation (EBITDA) of OMCs are likely to decline to Rs 34,500 crore, from Rs 48,300 crore in the first quarter of FY24. However, it is still higher, compared to the normalised quarterly EBITDA of Rs 16,000 crore. HPCL will see the sharpest decline, given its leverage to the marketing business.

“Though OMCs’ FY24 P/B valuations (0.8x for HPCL/IOCL and 1.1x for BPCL) appear attractive, we maintain our near-term cautious view on all OMCs, given that their marketing segment earnings could come under risk if: a) Brent crude price sustains above $85/bbl; and/or b) OMCs are forced to cut petrol/diesel price in the next few months,” JM Financials said in its latest note.

“We cut the target price for HPCL to Rs 275 from Rs 300, BPCL’s to Rs 400 from Rs 450, and IOCL’s to Rs 85 from Rs 90 due to the reduction in EV/EBITDA multiples for marketing business to 5x (from 5.5x) to factor in the risk to marketing segment earnings,” the JM Financial report added.

Windfall tax impact

Analysts note that a $1 rise in oil barrel prices results in a 50-point drop in per-litre gross marketing margins. To offset the impact of higher oil prices on profits, a windfall tax was implemented last year. It plans to finance a programme, aimed at lowering energy costs for households and businesses by targeting companies benefiting from external factors beyond their control.

Read: PVR INOX stock gains as SRK’s ‘Jawan’ releases, industry eyes blockbuster opening

With Brent crude oil price surging by 25-26 percent from its lows of $72 a barrel earlier this year, the government raised the windfall tax on petroleum crude from Rs 1,600 per tonne to Rs 4,250 ($51.68) per tonne, starting August 1.

Earlier, a windfall tax of Rs 1,600 per tonne had already been introduced on petroleum crude, up from zero. This reflects the government’s response to rising oil prices.

“As the government seeks to strike a delicate balance in the pre-election year, it won’t allow significant consumer impact from fuel price hikes and would keep a close eye on controlling the profit margins of OMCs, demonstrating a commitment to maintaining stability in the run-up to the elections and the oil sector’s profitability,” said Amit Pabri analysts at CR Forex.

Shrinking margins

According to Antique Stock Broking, the integrated margins of OMCs, which have consistently been in double digits over the past two quarters, have now declined to Rs 4.1/litre, compared to Rs 5/litre in FY21 and Rs 4.5/litre in FY22 at an oil price of $89/bbl.

Read: MC Interview: India aims to make rupee a hard currency over next 10 years, says Sanjeev Sanyal

This drop is primarily due to the reduced gross marketing margins for petrol and diesel, which now stand at just Rs 0.4/litre. Meanwhile, the brokerage house believes that once oil prices stabilise at $85/bbl or lower, the integrated margins will rebound to exceed Rs 6/litre, surpassing the levels seen in FY21-22, with its projections reaching Rs 7.5/litre for FY25.

Narrowing discounts on Russian crude oil prices also led to the fall. Russian Urals discount to Brent saw a sharp fall in recent months, declining to $15/bbl from $25/bbl in May, narrowing the discount for Indian refiners to $5/bbl (inclusive of shipping and insurance charges).

As a result, Russia’s share of India’s crude imports has come down to 34 percent in August from the 40 percent seen in the April-July period, according to Jefferies India.

Disclaimer: The views and investment tips by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.