F&O Manual | Indices exhibit resilience, Nifty finds crucial support at 19,670

Among individual stocks Glenmark, Cipla and Alkem saw a bearish setup, while RBL Bank, BergePaint and Bandhan Bank saw a long build-up

The equity benchmark indices started the day with a neutral opening, amid adverse global cues. While profit-booking persisted, the indices displayed resilience as the day advanced, steadily shifting course and making a steadfast ascent in the positive territory. Sectors like pharma, information technology and metals were the major drags while banks – private and public and automobiles saw a rebound.

At 11 am, the Sensex was up 120.30 points or 0.18 percent at 66,350.54 and the Nifty was up 25.00 points or 0.13 percent at 19,767.30. About 1,459 shares advanced, 1,443 shares declined and 113 were unchanged.

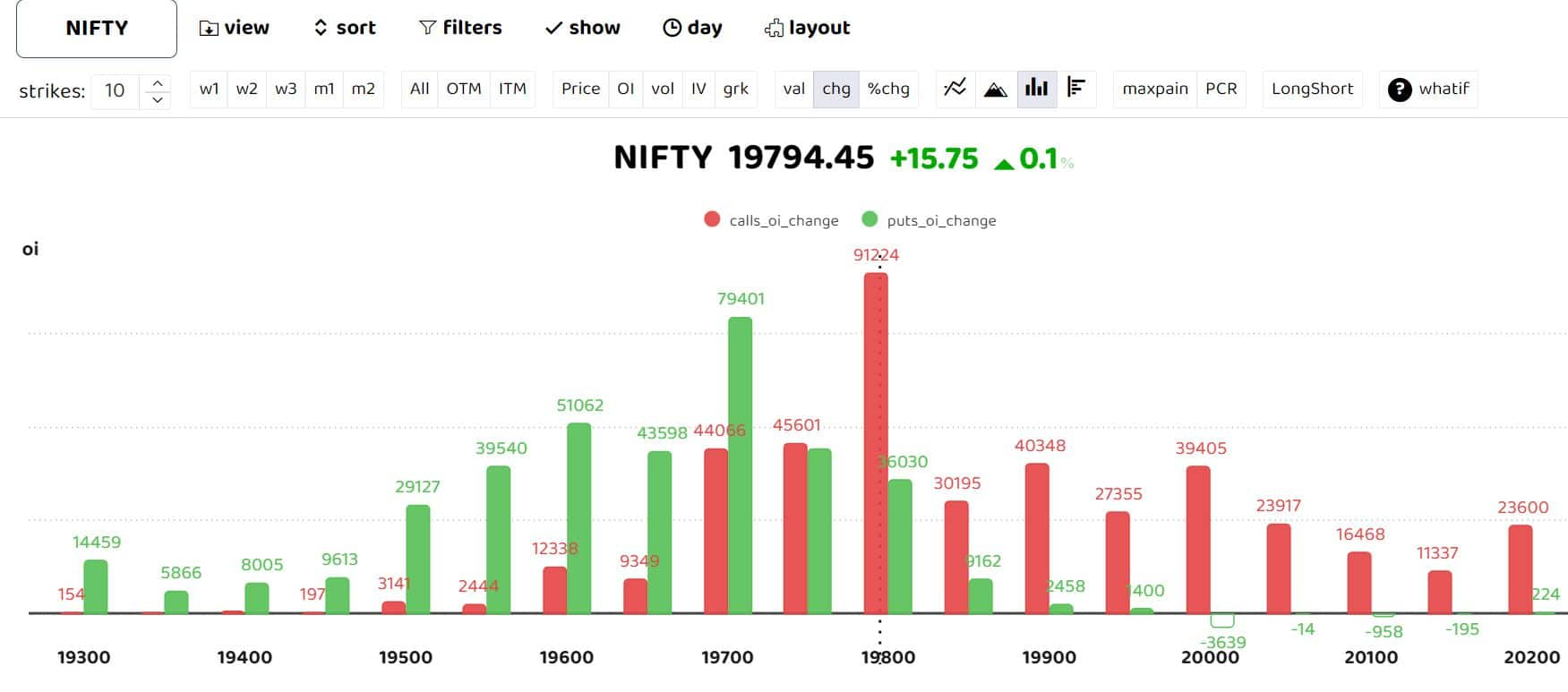

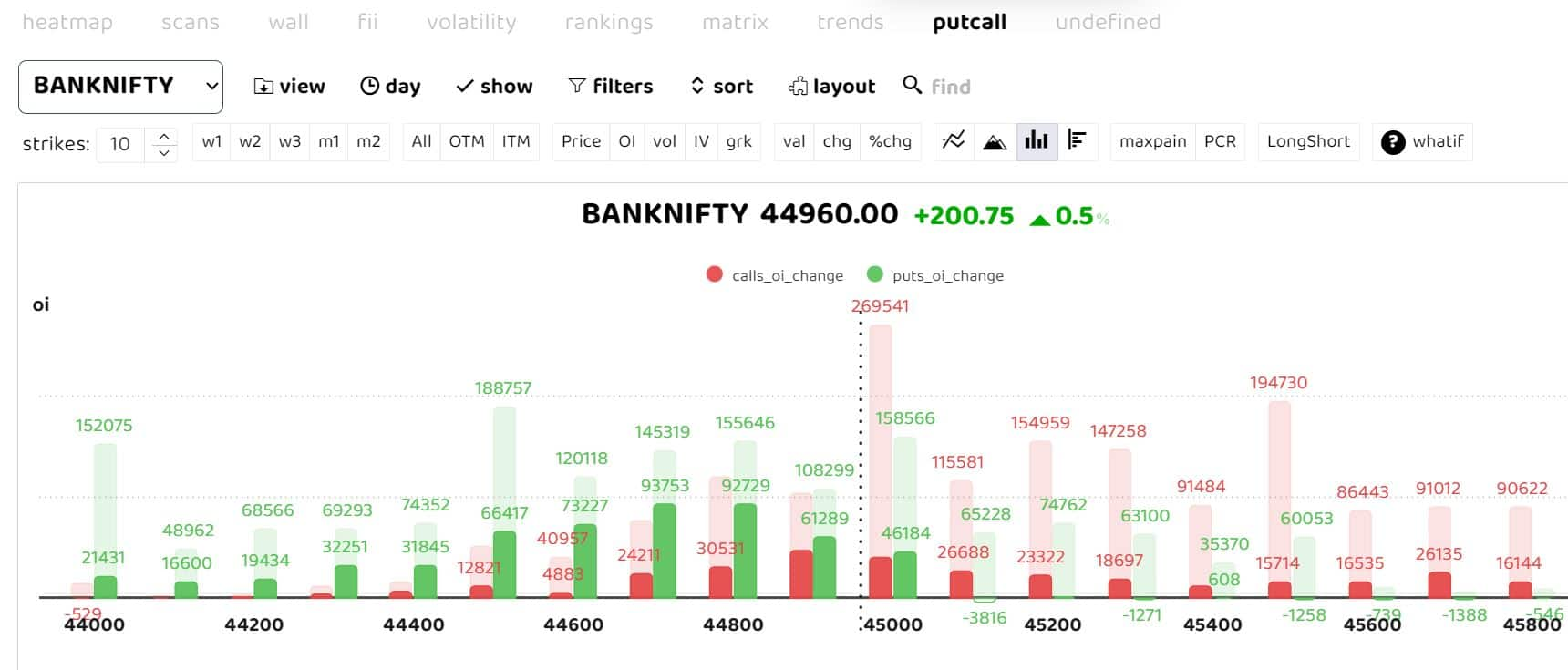

Bars reflect changes in open interest (OI) during the day. The red bars show call option OI and the green put option OI.

The options data indicates that calls have been written at nearly three times the puts at the 19,800 strike.

According to the brokerage firm Prabhudhas Lilladher, Nifty extended its losses further, breaching the 19,800 zone, while maintaining a cautious approach due to an overall weakening trend. “The index has found near-term support around the 19,670 levels with significant support resting at 19,550 levels where the crucial 50EMA is positioned. For the day, the support is expected at 19,600 levels, while resistance can be observed at 19,850 levels,” the brokerage firm added.

Option data suggests a sideways to positive momentum. According to experts, the index is expected to find the next crucial support zone at 44,400 levels and is likely to have a daily range of 44,200-45,000 levels.

Follow our live blog for all market action

Among individual stocks Glenmark, Cipla and Alkem saw a bearish setup, while RBL Bank, BergePaint and Bandhan Bank saw a long build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.