Bearish sentiment hits pharmaceutical stocks on profit booking, heavy call writing in Cipla

Experts maintain a bullish outlook on the pharmaceutical sector on a series-to-series basis, recommending a Bull Call strategy for Aurobindo Pharma

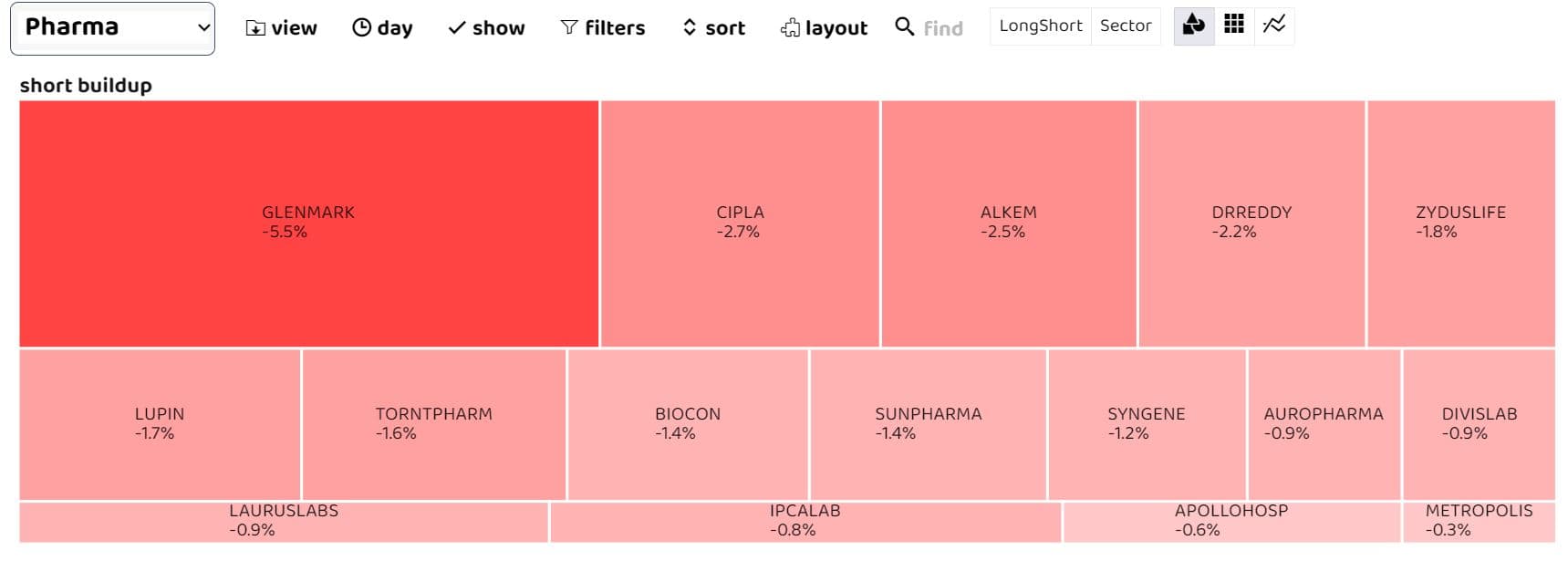

The pharmaceutical sector is exhibiting strong bearish positions on September 22.

Among individual stocks in the sector, short positions can be observed in Glenmark, Cipla, Alkem and Dr Reddy’s for the day.

The pharmaceutical sector has been experiencing profit-booking pressure, said Sacchitanand Uttekar, Vice President of Research and Data Analysis at Tradebulls Securities, explaining the factors driving this bearish sentiment. He pointed out Cipla, which recently broke below a crucial support level of approximately Rs 1,230, signalling potential weakness in the stock.

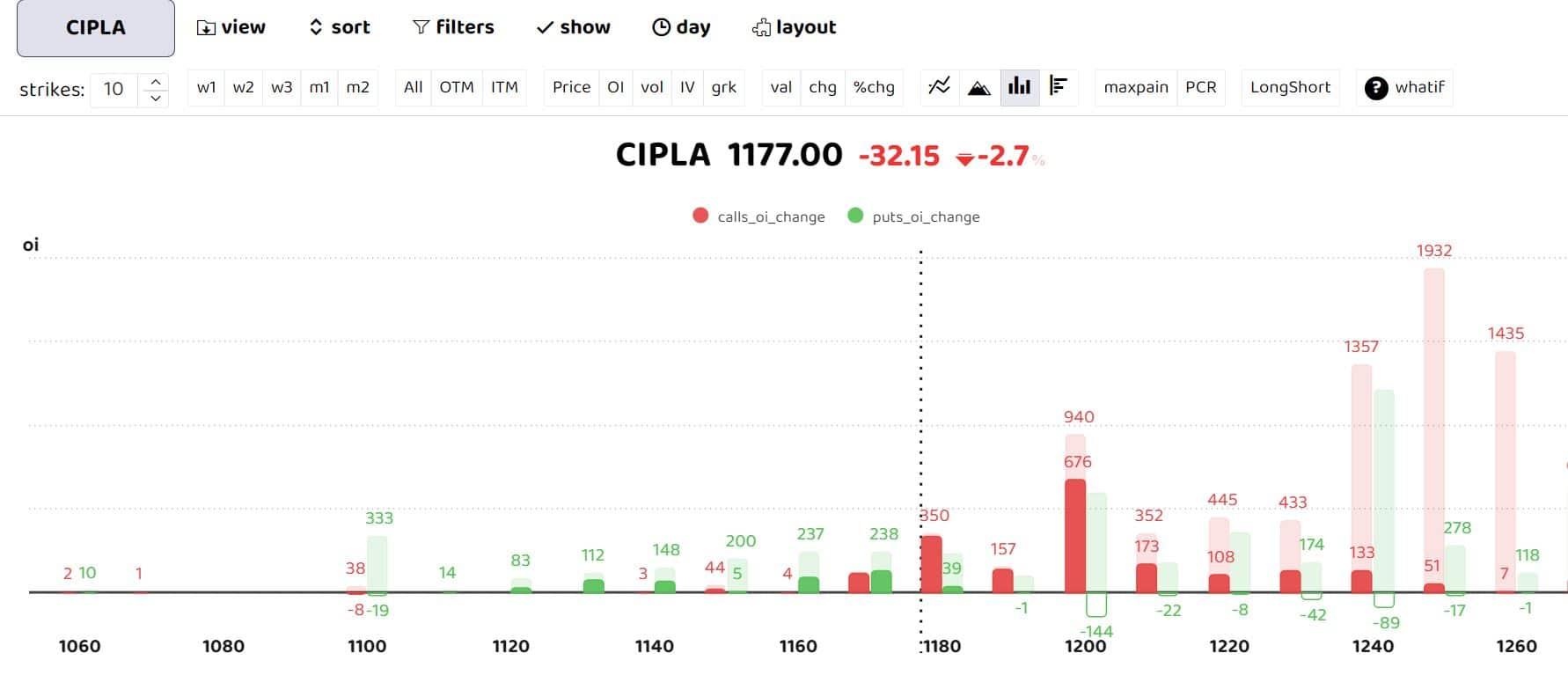

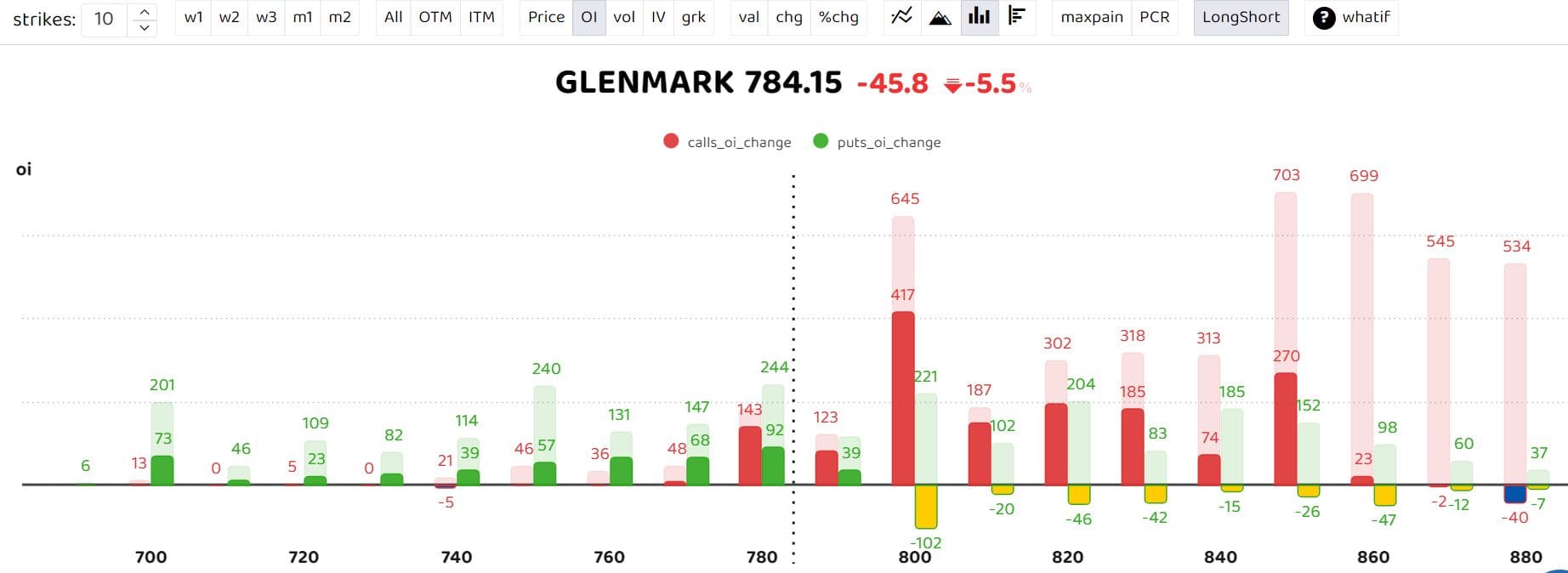

Bars reflect changes in open interest (OI) during the day. The red bars show call option OI and the green put option OI

Options data indicates call writers dominant for the day with heavy call writing at 1200 strike Cipla options, forming key resistance.

As a derivative strategy, Uttekar recommends traders initiate fresh short positions in Cipla with a suggested stop loss of around Rs 1,228 to manage risk. He anticipates an intraday swing toward Rs 1,185 on the lower side with an ultimate positional target for Cipla at around Rs 1,170.

Glenmark Pharma also led the selling spree on September 22, after the company announced that it would sell a 75 percent stake in subsidiary Glenmark Life Sciences Ltd to Nirma Ltd for Rs 5,652 crore at Rs 615 per share.

Options data highlights the Rs 800 strike price as the key resistance level for the day, as it witnesses call writers initiating positions at this particular level.

September series Pharma Sectoral Outlook

Rajesh Palviya, Senior Vice-President of Research and Head of Technical Derivatives at Axis Securities said, “Nifty Pharma Index had witnessed profit booking near the 15,700-15,750 in August expiry with a decrease in open interest indicating Long unwinding, while in the current September series also 15700 acted as a stiff resistance.”

Palviya believes that the 14700-14800 levels form an important support zone and any sustained move below the same will indicate further weakness.

“Sectoral OI has increased by 18 percent with Stocks like Granules and Auropharma seeing long built up and Cipla, Zydus Lifesciences & Lauras Labs have witnessing short built up in current series,” Palviya added. He highlights significant volume activity witnessed in Alkem, Aurobindo Pharma, Lupin and granules.

Aurobindo Pharma has a high OI concentration in call of 900 strike indicating strong resistance for this expiry while on the put side it’s at 850 and 860 strike, which is likely to act as strong support. Along with high OI concentration, there has also been writing on the put side at 850 strike further cementing the bullish view in the stock. Palviya suggests traders initiate a moderately bullish strategy called BULL CALL SPREAD.

For the September 28 expiry, Palviya recommends traders buy one lot of 870 call strike at Rs 12.50 and simultaneously sell one lot of 900 call strike at Rs 4 so that net outflow or maximum loss will be restricted to up to Rs 9,350.

“Auropharma on expiry if closes above 879 the strategy will start making a profit, however, the maximum gains will be restricted up to Rs 23,600 only because the gains of long 870 strike call will be offset by the sold 900 strike call if Auropharma closes above 900 on expiry,” added Palviya.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.