Trade setup for Thursday: 15 things to know before opening bell

The market recorded a strong rebound from its 50-day EMA (exponential moving average) placed at around 19,550 and formed a bullish candlestick pattern with a long lower shadow which resembles a Bullish Engulfing pattern formation at the downtrend on the daily timeframe on September 27, indicating sign of reversal. Hence, the Nifty50 may face a hurdle at 19,800-20,000 levels in coming sessions, with support at 19,600-19,500.

The BSE Sensex climbed 173 points to 66,119, while the Nifty50 was up 52 points at 19,716, after consolidation in the previous two sessions, ahead of the monthly F&O expiry on September 28.

“Technically, Wednesday’s market action is indicating the formation of a Bullish engulfing pattern. Normally such patterns after a reasonable decline or near the supports signal chances of upside bounce in the underlying post confirmation,” Nagaraj Shetti, technical research analyst at HDFC Securities said.

After the rangebound movement in the last few sessions, the market showed a false downside breakout of the range in the early part of Wednesday before witnessing a sharp intraday upside bounce. Hence, there is a higher possibility of upside breakout of the narrow range at 19,750 levels, according to Shetti.

He said a follow-through upmove could confirm a short-term higher bottom reversal pattern. “Immediate support is placed around 19,600-19,550 levels and a decisive move above the hurdle of 19,750 levels could pull the Nifty towards 19,950-20,000 levels.”

The broader markets also traded higher though the breadth was not strong enough. The Nifty Midcap 100 index jumped 0.75 percent and Smallcap 100 index gained nearly 1 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,600, followed by 19,558 and 19,490. On the higher side, 19,735 can be an immediate resistance, followed by 19,776 and 19,844.

On September 27, the Bank Nifty, too, recouped more than 400 points loss from the day’s low and closed with minor losses of 36 points at 44,588 ahead of the monthly futures & options expiry, forming a bullish candlestick pattern with a long lower shadow and minor upper shadow on the daily scale, indicating buying at lower levels.

The Bank Nifty bulls displayed resilience by defending the key support level at 44,200, which coincided with the rising trendline support. However, the index is currently trading below its 20-day moving average (20DMA) positioned at 45,000. “A decisive break above this level could trigger significant short-covering,” Kunal Shah, senior technical & derivative analyst at LKP Securities said.

Currently, the Bank Nifty is trading within a broad range of 44,200 to 45,000. A clear break on either side of this range will likely lead to trending moves, he feels.

Nevertheless, within this range, the overall sentiment remains bullish, suggesting that a “buy on dip” approach may be favourable, Kunal advised.

As per the pivot point calculator, the banking index is expected to take support at 44,294, followed by 44,180 and 43,994. On the upside, the initial resistance is at 44,665 then 44,780 and 44,965.

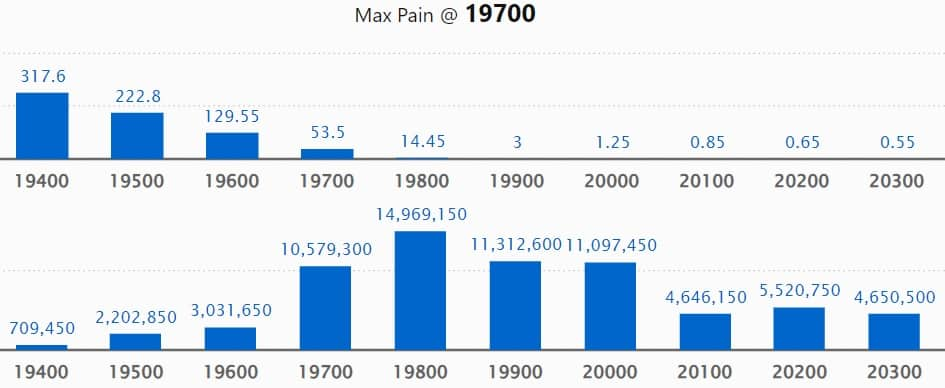

The options data suggested that the maximum weekly Call open interest (OI) was seen at 19,800 strike with 1.5 crore contracts, which can act as a key resistance for the Nifty. It was followed by 19,900 strike which had 1.13 crore contracts, while 20,000 strike had 1.1 crore contracts.

The meaningful Call writing was seen at 19,900 strike, which added 22.02 lakh contracts followed by 19,800 and 19,500 strikes, which added 17.13 lakh and 5.34 lakh contracts.

The maximum Call unwinding was at 20,100 strike, which shed 19.86 lakh contracts followed by 20,500 strike and 20,200 strike, which shed 13.71 lakh contracts, and 9.69 lakh contracts.

On the Put side, the maximum open interest remained at 19,600 strike, with 1.31 crore contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,500 strike comprising 1.24 crore contracts, and 19,700 strike with 1.06 crore contracts.

The meaningful Put writing was at 19,600 strike, which added 43.66 lakh contracts, followed by 19,700 strike and 19,500 strike, which added 38.88 lakh and 38.41 lakh contracts.

Put unwinding was at 19,800 strike, which shed 6.17 lakh contracts followed by 19,900 strike and 20,000 strike, which shed 4.34 lakh and 2.47 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Max Financial Services, UltraTech Cement, InterGlobe Aviation, Bharti Airtel, and Mahindra & Mahindra have seen the highest delivery among the F&O stocks.

A long build-up was seen in 55 stocks, including Escorts, Max Financial Services, REC, Balkrishna Industries, and BHEL. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, a total of 28 stocks including Ramco Cements, Titan Company, Eicher Motors, India Cements, and Trent, saw long unwinding. A decline in OI and price indicates long unwinding.

23 stocks see a short build-up

A short build-up was seen in 23 stocks, including Gujarat Gas, Colgate Palmolive, Vedanta, Hindustan Aeronautics, and ICICI Lombard General Insurance Company. An increase in OI along with a fall in price points to a build-up of short positions.

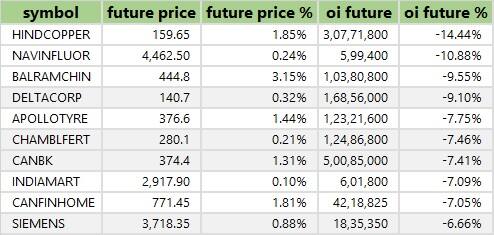

Based on the OI percentage, 82 stocks were on the short-covering list. These included Hindustan Copper, Navin Fluorine International, Balrampur Chini Mills, Delta Corp, and Apollo Tyres. A decrease in OI along with a price increase is an indication of short-covering.

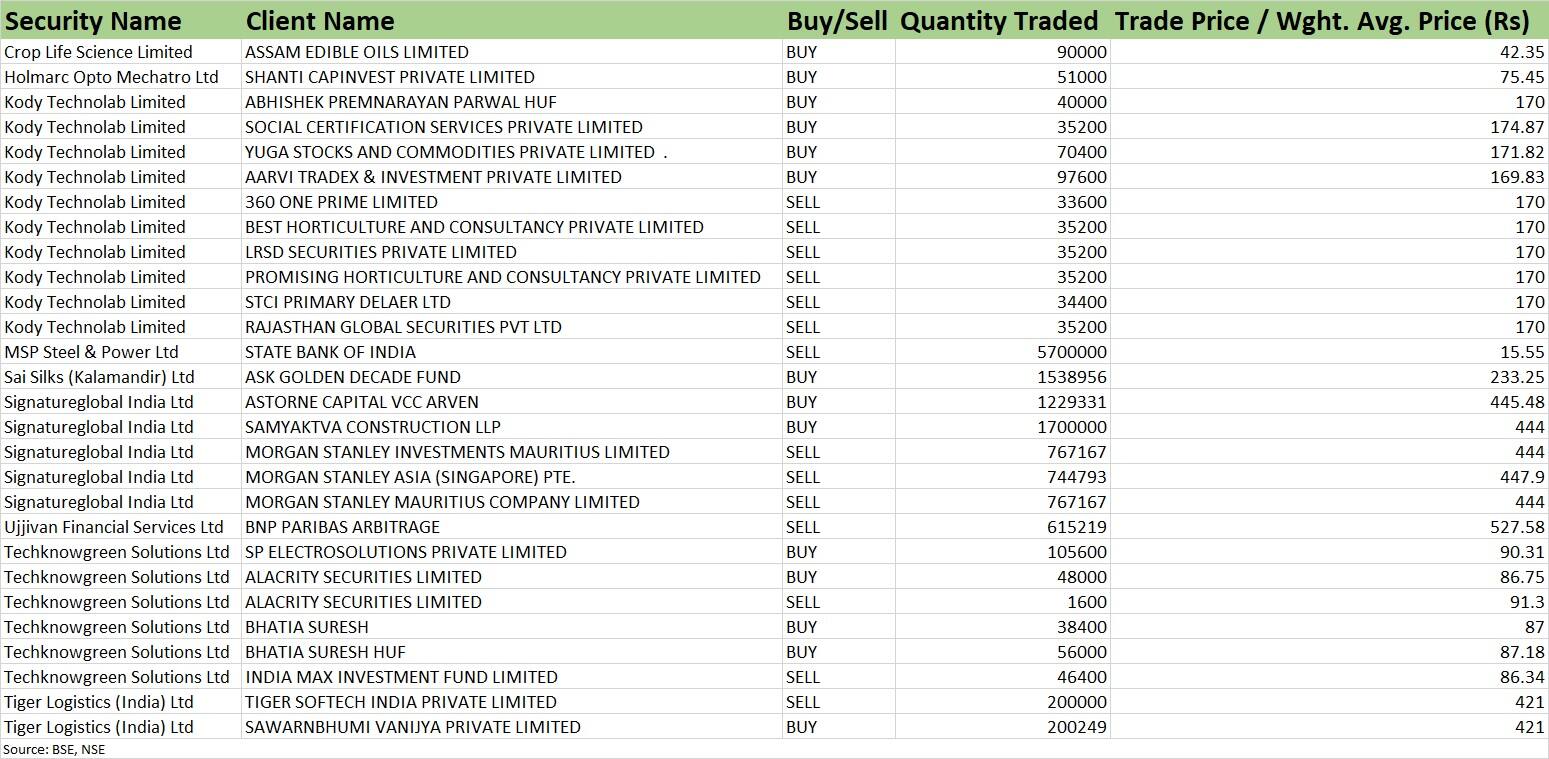

(For more bulk deals, click here)

Investors meeting on September 28

Arihant Superstructures: Senior officials of the company will interact with Valorem Advisors.

Nuvoco Vistas Corporation, Senco Gold, Monte Carlo Fashions, Apollo Micro Systems: Management of these companies will be participating in Arihant Rising Stars Summit 2023.

AU Small Finance Bank, Quess Corp: Representatives will meet analysts and institutional investors in the JP Morgan India TMT tour.

Apar Industries: Senior officials of the company will attend JP Morgan’s investors conference.

Kirloskar Oil Engines: Officials of the company will meet Motilal Oswal Financial Services.

Five-Star Business Finance: The company’s senior officials will meet Schroders, Wardferry.

Stocks in the news

Yatra Online: The corporate travel services company will list its equity shares on the BSE and NSE on September 28. The issue price has been fixed at Rs 142 per share. The date of allotment of IPO shares was set as September 25.

Aurobindo Pharma: Subsidiary Auro Vaccines has entered into a licence agreement with Hilleman Laboratories Singapore Pte Limited to develop, manufacture and commercialise a pentavalent vaccine candidate used in children’s vaccination. Auro Vaccines will make milestone payments to Hilleman upon achieving certain development and clinical study outcomes, while Hilleman will also be paid royalties upon commercialisation of the vaccine candidate.

Dixon Technologies: Subsidiary Padget Electronics has entered into an agreement with Xiaomi Technology India for the manufacturing of smartphones and other related products for Xiaomi. The said manufacturing will take place from Padget’s manufacturing facility at Noida in Uttar Pradesh.

Tata Power Company: Subsidiary Tata Power Renewable Energy (TPREL) will set up a 41 MW captive solar plant at Thoothukudi in Tamil Nadu for TP Solar’s new greenfield 4.3 GW solar cell and module manufacturing facility at Tirunelveli in Tamil Nadu.

Reliance Industries: Subsidiary Reliance Jio has net added 39.07 lakh wireless subscribers in the month of July 2023, up sharply from 22.7 lakh subscribers addition in the previous month, as per the data published by the TRAI. With this, the firm held a 38.60 percent market share of wireless subscribers as of July 2023.

Bharti Airtel: The telecom operator has net added 15.17 lakh subscribers in the month of July, increasing from 14.1 lakh subscribers addition in the previous month. The firm has a 32.74 percent market share in the wireless subscribers segment as of July 2023.

NBCC India: The state-owned construction company has announced the sale of commercial built-up space in World Trade Centre, New Delhi through e-auction. It launched the sale on September 27 and the e-auction will take place on October 23 this year. The area offered for sale is 14.75 lakh square feet and the value of the area offered is Rs 5,716.43 crore.

Fund Flow (Rs Crore)

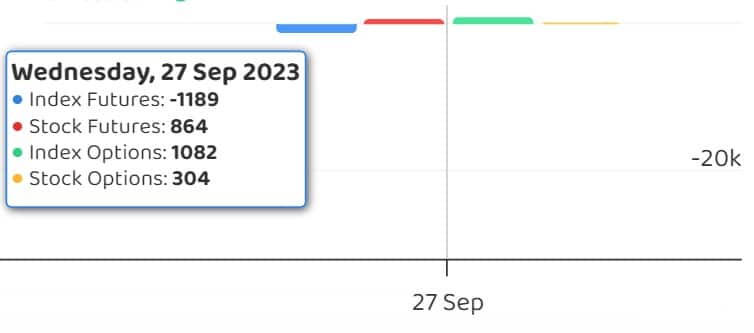

Foreign institutional investors (FII) sold shares worth Rs 354.35 crore, while domestic institutional investors (DII) bought Rs 386.28 crore worth of stocks on September 27, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has retained Delta Corp and India Cements to its F&O ban list for September 28. Balrampur Chini Mills, Canara Bank, Hindustan Copper, and Indiabulls Housing Finance removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.