Trade setup for Friday: 15 things to know before opening bell

The bears took control over Dalal Street on September 28, the monthly expiry day for futures & options contracts, dragging the benchmark index Nifty50 below 50-day EMA (exponential moving average placed at 19,559) which resulted in the formation of a Bearish Engulfing candlestick pattern on the daily charts.

Hence, given the bearish sentiment prevailed in the market, the bears may push the index towards 19,220, the low of the August month if it decisively breaks 19,500 on a closing basis, while on the higher side, the index may face resistance at 19,600-19,700 area, experts said.

The BSE Sensex plunged 610 points or 0.92 percent to 65,508, while the Nifty50 declined 193 points to 19,523.

“On the daily charts, we can observe that the Nifty has closed below the 19,600-19,550 zone where multiple supports were placed. This is a sign of further weakness,” Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

Hence, on the way down, he feels the index can slip further towards 19,500-19,440 which is the 78.6 percent Fibonacci retracement level of the rise from 19,224-20,222.

Daily and hourly momentum indicator has a negative crossover which is a sell signal, he said. Thus, he feels both price and momentum indicators suggest that there is a further downside possible over the next few trading sessions.

In terms of levels, 19,500-19440 is the crucial support zone while 19,625-19,650 will act as an immediate hurdle zone.

The broader markets were under selling pressure with the Nifty Midcap 100 and Smallcap 100 indices falling 1.3 percent and 0.4 percent, respectively, while the fear index, India VIX, jumped to a four-month high, up 10.68 percent at 12.82 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,489 followed by 19,424 and 19,320. On the higher side, 19,699 can be an immediate resistance followed by 19,764 and 19,869.

On September 28, the Bank Nifty corrected 287 points to 44,301 and formed a long bearish candlestick pattern on the daily timeframe. The banking index may break the 44,000 mark in coming sessions if it breaks the 44,300 level, experts said, adding the resistance on the higher side may be around the 45,000 mark.

“Bank Nifty has formed an Inverted Flag and Pole structure on the daily chart. Short Buildup was observed in Future Open Interest data for two consecutive days,” Ashwin Ramani, derivatives & technical analyst at SAMCO Securities said.

He feels a break below 44,300 can take the index to 43,800 levels while the uptrend is likely to resume upon a successful close above 44,800 levels.

As per the pivot point calculator, the banking index is expected to take support at 44,241 followed by 44,121 and 43,927. On the upside, the initial resistance is at 44,630 then 44,750 and 44,944.

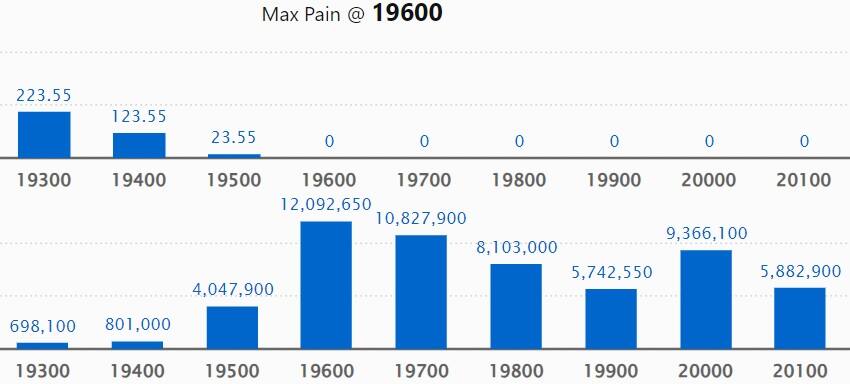

As per the options data, the maximum monthly Call open interest (OI) was seen at 19,600 strike with 1.2 crore contracts, which can act as a key resistance for the Nifty. It was followed by 19,700 strike, which had 1.08 crore contracts, while 20,000 strike had 93.66 lakh contracts.

The meaningful Call writing was seen at 19,600 strike, which added 90.61 lakh contracts followed by 19,500 and 20,200 strikes, which added 18.45 lakh and 12.47 lakh contracts.

The maximum Call unwinding was at 19,800 strike, which shed 68.66 lakh contracts followed by 19,900 strike and 20,000 strike, which shed 55.7 lakh contracts and 17.31 lakh contracts.

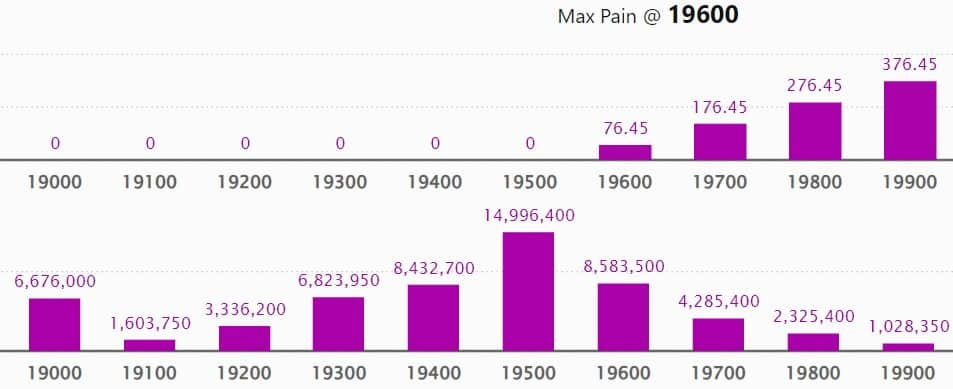

On the Put side, the maximum open interest remained at 19,500 strike with 1.49 crore contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,600 strike comprising 85.83 lakh contracts and 19,400 strike with 84.32 lakh contracts.

The meaningful Put writing was at 19,500 strike, which added 25.73 lakh contracts followed by 19,300 strike and 19,400 strike, which added 12.62 lakh and 11.94 lakh contracts.

Put unwinding was at 19,700 strike, which shed 63.81 lakh contracts followed by 19,600 strike and 19,000 strike, which shed 45.58 lakh and 34.92 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Prudential Life Insurance Company, Zydus Lifesciences, Shriram Finance, Info Edge India and TVS Motor Company have seen the highest delivery among the F&O stocks.

Here are the top 10 stocks which saw the highest rollovers on expiry day including Grasim Industries, Dabur India, Max Financial Services, JK Cement and HDFC Bank with 98 to 98.38 percent rollovers.

A long build-up was seen in 4 stocks namely Crompton Greaves Consumer Electricals, Manappuram Finance, MCX India and Axis Bank. An increase in open interest (OI) and price indicates a build-up of long positions.

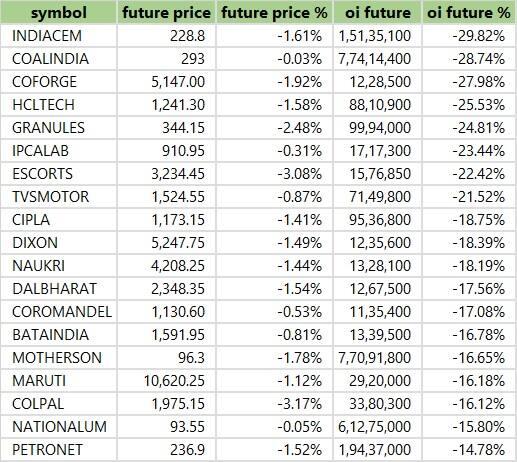

Based on the OI percentage, a total of 151 stocks including India Cements, Coal India, Coforge, HCL Technologies and Granules India saw long unwinding. A decline in OI and price indicates long unwinding.

19 stocks see a short build-up

A short build-up was seen in 19 stocks, including Asian Paints, Kotak Mahindra Bank, BHEL, Tech Mahindra and ICICI Bank. An increase in OI along with a fall in price points to a build-up of short positions.

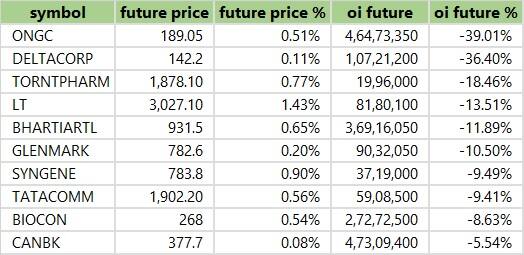

Based on the OI percentage, 14 stocks were on the short-covering list. These included ONGC, Delta Corp, Torrent Pharma, Larsen & Toubro and Bharti Airtel. A decrease in OI along with a price increase is an indication of short-covering.

(For more bulk deals, click here)

Investors meeting on September 29

Punjab Chemicals and Crop Protection, Senco Gold, Insecticides (India): Companies’ officials will meet Arihant Capital and its clients.

Crompton Greaves Consumer Electricals: Senior officials of the company will interact with Schonfeld Strategic Advisors.

CARE Ratings: Officials of the company will meet Bryanston Investment.

Nuvoco Vistas Corporation: The company’s senior officials will interact with Birla Life Insurance.

Anupam Rasayan India: Senior officials of the company will meet Wellington Management.

Surpeme Petrochem: Officials of the company will meet lClCl Prudential MF.

JSW Steel: The company’s senior officials will interact with institutional investors.

Stocks in the news

SBI Life Insurance Company: The life insurance company has received board approval for the appointment of Amit Jhingran as the Managing Director & CEO with effect from October 1, 2023. Present Managing Director & CEO of the life insurance company, Mahesh Kumar Sharma, has been posted as Deputy Managing Director in SBI, Corporate Centre.

Happiest Minds Technologies: Promoter Ashok Soota has sold about a 1.1 percent stake in the company via block deals, according to a CNBC-TV18 report. He sold the said shares to fund SKAN, the public charitable trust for medical research, and Happiest Health. With this, Ashok Soota’s shareholding fell to 50.13 percent from 51.24 percent earlier.

Adani Green Energy & Adani Energy Solutions: Abu Dhabi-based International Holding Company (IHC), which held more than one percent stakes in two Adani group companies, Adani Green Energy and Adani Energy Solutions, has entered into a pact with a buyer to dispose off its investments, reported CNBC-TV18.

Emami: The personal care and healthcare company has announced its foray into the juice category with AloFrut through strategic investment in Axiom Ayurveda and its subsidiaries/associates by acquiring a 26 percent equity stake for an undisclosed amount. Axiom markets beverage products under the brand AloFrut, a proprietary fusion of aloe vera pulp with fruit blend.

Saregama India: The music label giant will acquire 51.8 percent shares in digital entertainment company Pocket Aces Pictures, which owns direct relationship with 95M+ younger digital-first customers across Instagram, YouTube etc. It will buy a 51.8 percent stake for Rs 174 crore with a clear path to further acquire another ~41 percent stake in the next 15 months at pre-agreed multiples. The transaction is an all-cash deal.

Piramal Pharma: The US FDA has conducted a good manufacturing practices (GMP) inspection of the company’s Bethlehem facility during September 18-27, and issued a Form-483 with 2 observations. Both observations relate to system improvement only, and none are related to data integrity.

Tamilnad Mercantile Bank: S Krishnan has resigned as Managing Director and CEO of the bank, citing personal reasons. S Krishnan will continue to be the MD & CEO, till the guidance/advice is received from RBI.

Fund Flow (Rs Crore)

Foreign institutional investors (FII) sold shares worth Rs 3,364.22 crore, while domestic institutional investors (DII) bought Rs 2,711.48 crore worth of stocks on September 28, provisional data from the National Stock Exchange (NSE) showed.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.