Indian derivative market outlook as US stock plunge, VIX curve inversion spark concerns

The Cboe Volatility Index, often referred to as the VIX, surged 2.2 points to 19.80, pushing its spot price above that of its three-month futures.

The US stock market witnessed a significant downturn in the October 3 trading session, with the Dow Jones Industrial Average turning negative for the year, and the Cboe Volatility Index (VIX) displaying an inverted curve, signalling potential turbulence in the coming days, raising concerns about Indian shares.

The Indian share market may not be able to withstand the global pressures despite robust local fundamentals, analysts said.

The Dow Jones Industrial Average fell 430.97 points, or 1.29 percent, marking its worst performance since March. The index ended the day at 33,002.38, reaching its lowest level since May 31.

Simultaneously, the S&P 500 experienced a 1.37 percent decline, touching a four-month low and closing at 4,229.45. The Nasdaq Composite, dominated by growth stocks, plummeted by 1.87 percent to close at 13,059.47.

These losses were primarily attributed to surging Treasury yields, sparking concerns about higher interest rates affecting the housing market and potentially pushing the economy into a recession.

The 10-year Treasury yield reached 4.8 percent, its highest level in 16 years, while the 30-year yield hit 4.925 percent, a level not seen since 2007.

The average rate on a 30-year fixed mortgage in the US approached 8 percent, further intensifying worries about the potential impact on consumer spending and economic growth.

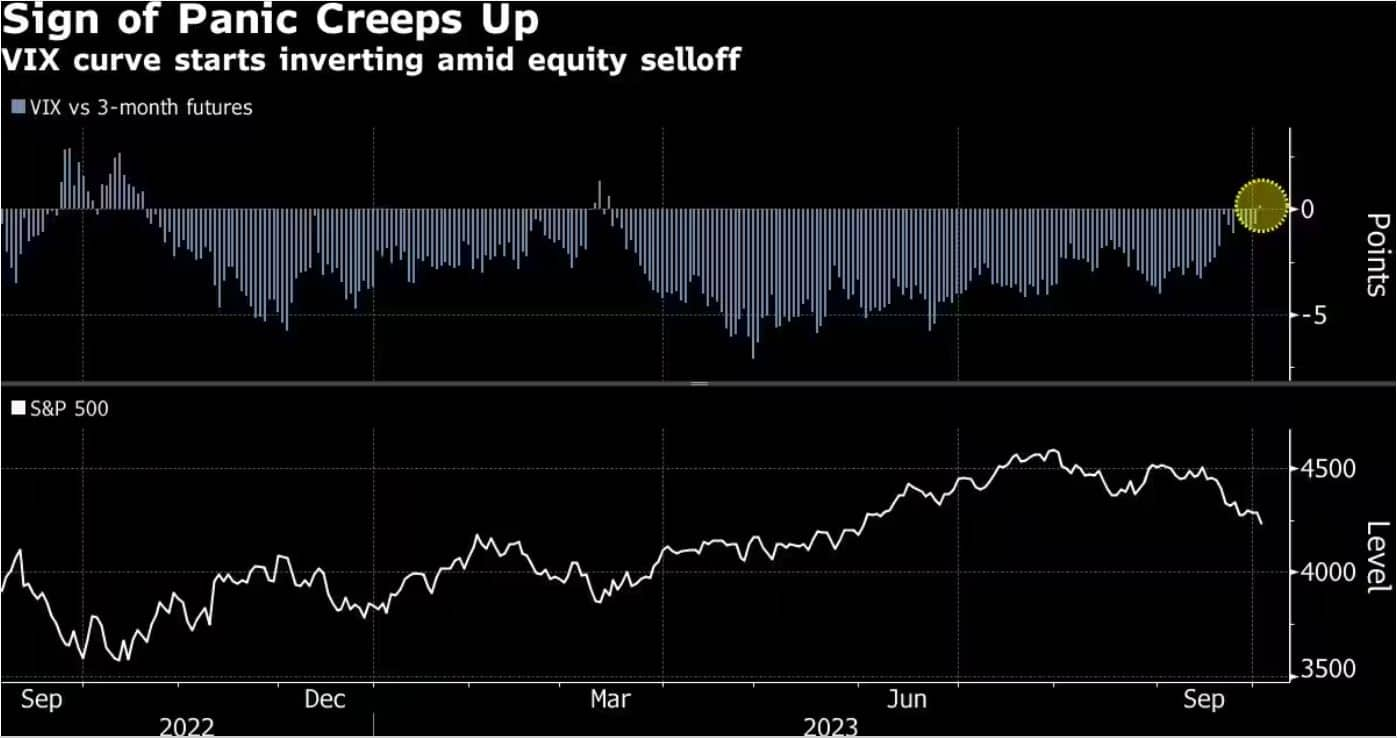

One notable development contributing to market jitters was the inversion of the VIX curve.

The Cboe Volatility Index, often referred to as the VIX, surged 2.2 points to 19.80, pushing its spot price above that of its three-month futures. This phenomenon, known as an inverted VIX curve, has occurred twice in the past year and has historically signaled market bottoms.

What will be the impact of the US market’s performance and the inverted VIX curve on the Indian derivative market?

Analysts Views

Analysts are divided on the extent of the impact, with some advocating caution and others emphasising India’s resilience and domestic flows as a mitigating factor against adverse effects.

Amit Saraf, trader and director at Avyaan Capital P Ltd, stated, “It has been a sharp rise in the US VIX, coupled with a significant fall in major US indices in the last two-three sessions. Here in the domestic markets, FIIs are net sellers in the last few weeks. Keeping these data points in mind, we can expect headwinds for Indian equities.”

“Even with bullish domestic sentiments, we may not be able to shield ourselves from the global impact,” he said. From a trader’s perspective, a cautious approach is needed. Indian markets may experience increased volatility. “Keeping a bearish bias on the markets is recommended,” Saraf said.

Raj Deepak Singh, Derivatives Research Head at ICICI Securities, however, offered a more optimistic view. Indian markets have been outperforming US indices significantly in the last two years. Domestic flows are taking care of any FII outflow. That’s the reason why the US markets are nearly at a four-month low and Indian indices are still with significant gains.

There has been no corrections in broader markets, so far, as midcap and small-cap space has remained firm. “While Nifty may have come under some pressure due to selling among key index heavyweights, overall strength remains,” Singh said. The August lows of 19,200-19,250 should act as important support below, which is the only point of concern, he said.

Rajesh Palviya, Senior Vice-President of Research and Head of Technical Derivatives at Axis Securities, said, “We are trading near to the support area of 19,500, and if that level is breached, then we can go down to the next put base concentration of 19,400 and 19,350.”

Based on the US market’s performance, the Indian markets would open gap- down and remain under pressure, he said. However, a pullback is expected if the crucial level of 19,500 is not breached, with 19,600 being a key challenging level on the higher side.