Smallcaps outperform in volatile week; these stocks gave double-digit returns

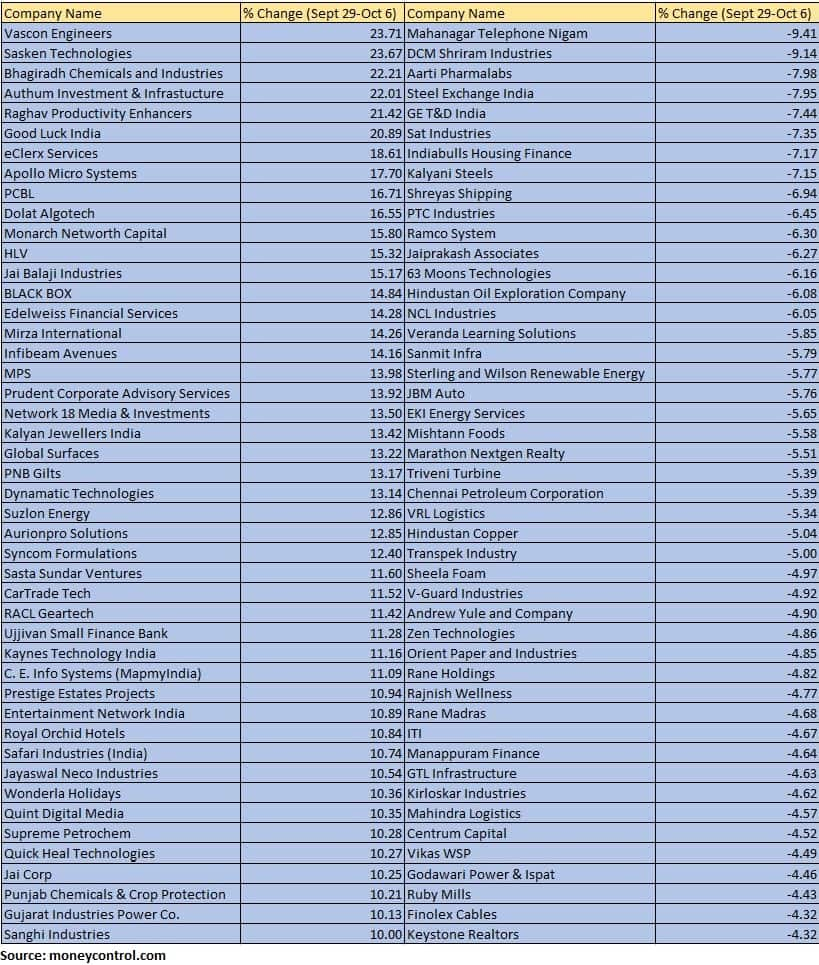

The BSE Small-cap index gained 0.8 percent with Vascon Engineers, Sasken Technologies, Bhagiradh Chemicals and Industries, Authum Investment & Infrastucture, Raghav Productivity Enhancers and Good Luck India rising 20 percent each.

In the truncated week, the Indian equity indices ended on a flat note amid mixed cues including aggressive selling by foreign investors, elevated global bond yields, US dollar appreciation in the initial part of the week, while recovery in the crude oil prices, bond yields, and as expected policy outcome by RBI led recovery in the later part of the week.

In this week, BSE Sensex was up 0.25 percent or 167.22 points to finish at 65,995.63, while Nifty50 added 15.2 points to ends at 19,653.50.

BSE Small-cap index gained 0.8 percent, BSE Mid-cap Index shed 0.8 percent and BSE Large-cap Index ended flat.

“Amidst mounting concerns stemming from escalating crude oil prices and inflationary pressures, which were compounded by fears of another rate hike by the Fed, the domestic market grappled with volatility throughout the week. The increase in US bond yields and volatility in the INR further diminished the attractiveness of domestic indices for foreign investors. Further, due to low liquidity and a lack of catalysts to stimulate buying, the market is encountering strong resistance at higher levels,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Throughout the week, IT stocks underperformed due to adverse global cues, while the pharma sector witnessed strong buying interest as investors adopted a defensive strategy in response to global uncertainties. Yet the market concluded the week on a positive note, boosted by healthy momentum in industrial growth, up by 12% YoY.”

“Volatility is expected to remain elevated in the short term, given the upside risk of domestic inflation on account of higher crude prices. Investors will closely monitor upcoming releases of domestic, US, and Chinese PMI data, among other indicators, as they are expected to shape future market trends,” he added.

Among sectors, BSE Realty index added 2 percent, BSE Information Technology index rose 1.8 percent, BSE Capital Goods index gained 1 percent, while BSE Power Index shed 2.5 percent, BSE Metal index fell 2.3 percent and BSE Telecom index fell 2 percent.

Aggressive selling from Foreign institutional investors (FIIs) continued in this week also as they offloaded equities worth Rs 8,412.65 crore, while domestic institutional investors (DIIs) purchased equities worth Rs 4,435.17 crore in this week.

The BSE Small-cap index gained 0.8 percent with Vascon Engineers, Sasken Technologies, Bhagiradh Chemicals and Industries, Authum Investment & Infrastucture, Raghav Productivity Enhancers and Good Luck India rising 20 percent each.

On the other hand, Mahanagar Telephone Nigam, DCM Shriram Industries, Aarti Pharmalabs, Steel Exchange India, GE T&D India, Sat Industries, Indiabulls Housing Finance and Kalyani Steels fell between 7-9 percent.

Where is Nifty50 headed?

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

On the weekly charts we can observe that the Nifty has closed in the green and in term of pattern it has formed a Dragonfly Doji which has bullish implications.

We expect this pullback to continue till 19778 – 19800 where resistance in the form of the 50% Fibonacci retracement level and the 20-day moving average is placed. In the case of a dip towards 19530 – 19580 it should be used as a buying opportunity.

Rupak De, Senior Technical analyst at LKP Securities:

Nifty ended the week with a modest gain despite the selling in the banking sector. Overall, sentiment is expected to stay positive as long as it maintains above the critical support level of 19,500, as put writers are likely to offer support at this level. On the upside, resistance is positioned around 19,750-19,800. A strategy of buying on dips would be favorable as long as it holds above 19,500.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.