Abrupt spikes trigger caution; FinNifty option premiums spike for second time this month

Price overreaction was observed in many OTM calls between 19800 and 20100 strikes.

After last week’s surge in the premiums of FinNifty and Sensex options, this week once again began with a spike in FinNifty premiums. Algo and derivatives traders found themselves perplexed by the sudden increase in out-of-the-money (OTM) premiums. The put premiums are spiking due to the anticipation of a downside rally, while call premiums spiked due to anticipated upside.

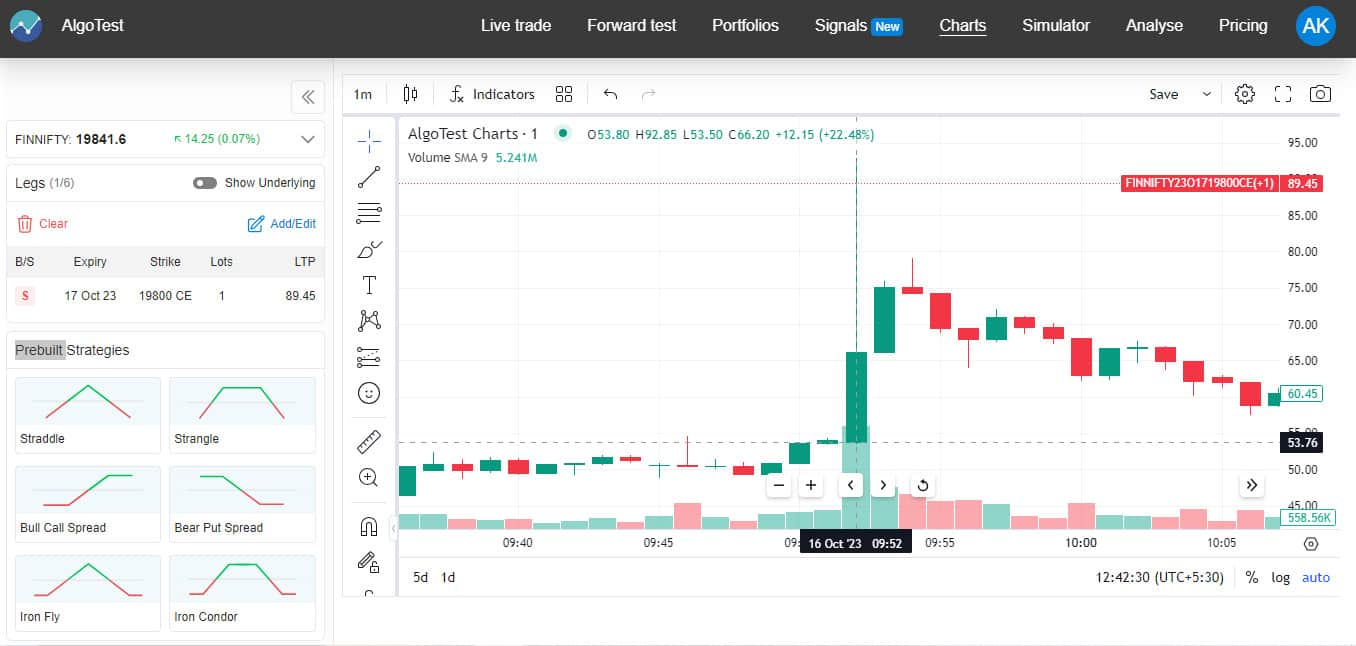

Within a minute (from 9:51 am to 9:52 am), FINNIFTY 19,800 call option increased by 35 points, which is a significant move for such a short timeframe.

What was intriguing was the overreaction in the pricing of at-the-money (ATM) and out-of-money OTM calls. For instance, a 35-point index move should have corresponded to roughly a Rs 17 change in the 19,800 CE call option, but it actually moved by Rs 38. This price overreaction was observed in many OTM calls between 19,800 and 20,100 strikes.

At 9:52 am, 19,800 call option Finnifty chart (Source Algotest.in)

Why is this happening?

According to Raghav Malik, Co-founder & CEO of AlgoTest.in, “It’s possible that stop-loss orders placed by option sellers in advance with their brokers are triggering these reactions. Underreaction and overreaction of this type is the reason why opportunities exist in the market.”

Newbie option traders are learning some tough lessons because of these abrupt spikes, making their options strategies obsolete.

Several traders are turning to the X platform (formally twitter) and suggesting that it’s wiser to opt for at-the-money (ATM) options instead of out-of-the-money (OTM) options, considering them to be the ‘safer choice’.

A similar incident occurred in FinNifty options on October 10, where put premiums saw a dramatic surge on the expiry day. This surge triggered stop-losses for many traders and made many trading strategies less profitable. Put option premiums increased by as much as 40-50 times compared to the previous closing levels.

Mehul Jiyani, Founder of Traders Cafe, attributed today’s Finnifty premium spikes to the HDFC bank Q2 results scheduled to be announced today. He said that in the past month spikes in the premiums were seen on expiry day after 12 pm due to the gamma effect and on important events day.

He advises newbie traders to always hedge their positions and to keep track of important events and dates before taking positions.

Traders often expect losses when the market undergoes sharp fluctuations, but what set today and last week’s events apart was that traders were taken by surprise in sectors of the market where minimal volatility was anticipated.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.