F&O | Strategies to trade Bank Nifty on expiry day

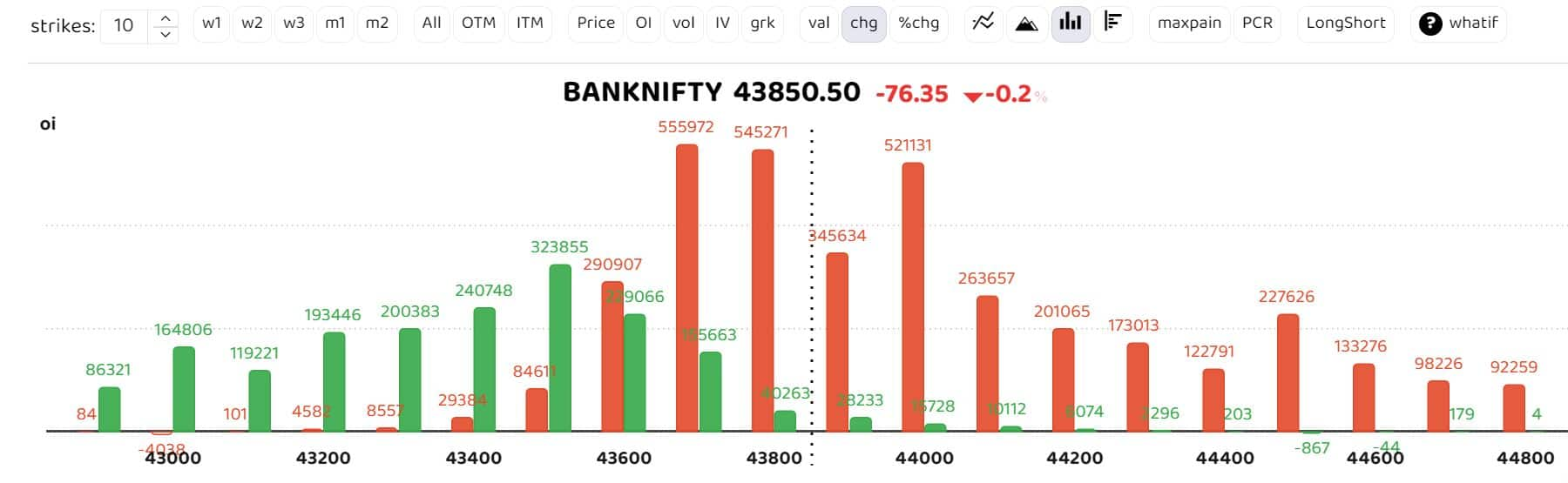

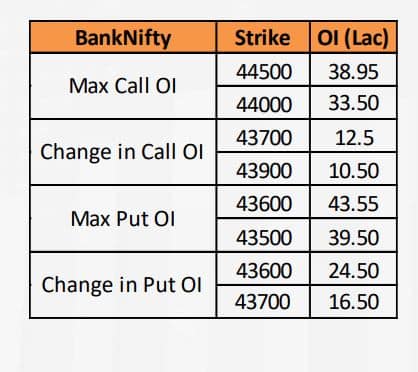

Heavy writing is witnessed in 43700 CE and 43500 PE levels

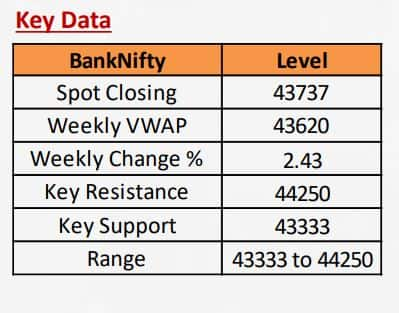

Bank Nifty trades moderately negative on the expiry day today. Heavy writing is witnessed in 43,700 CE and 43,500 PE levels. On a weekly basis, Bank Nifty is up by 2.43 percent at 43737. Bank Nifty VWAP of the week is at 43,620 zones and it is trading 120 points above the same which as per experts suggests buy on dips stance.

Source : Motilal Oswal Financial services

Source : Motilal Oswal Financial services

“This implies that a sustained rally over these obstacles would prompt a directional rally. PCR ratio stands at 0.81 suggesting if Nifty Bank sustains over spot 43700, a sharp upside can be seen,” Avdhut Bagkar, derivatives and technical analyst at StoxBox, said.

“On the technical front, the next hurdle for Nifty Banks falls at 44,000 – 44,200 levels, while support comes to 43,200 – 43,100 levels. The underlying bias continues to stay bullish,” he said.

“Bank Nifty formed a Bullish candle on daily scale with long lower shadow as buying is visible at lower zones,” Motilal Oswal Financial services (MOFSL) said.

Expiry day point of view : “Overall trend is likely to be positive and now it has to continue to hold above 43500 zones for an up move towards 44000 then 44250 zones while on the downside support is seen at 43500 then 43333 levels” MOFSL said.

Option Strategy: MOFSL advises option traders to initiate Bull Call Ladder Spread to play the up move

Buy 43600 CE

Sell 43900 CE and 44100 CE

Option Writing : Option writers are suggested to Sell Bank Nifty 43400 Put and Sell 44100 Call with strict double Stop loss

Bank Nifty open interest (OI) data

Bank Nifty open interest (OI) data

Bull Call Ladder Spread is an options trading strategy involving the simultaneous purchase and sale of call options at three different strike prices with two expiration dates. This strategy is used when an investor has a moderately bullish outlook on an underlying asset, anticipating a moderate rise in its price. It involves buying a lower strike call option, selling two higher strike call options, and buying one even higher strike call option. The structure allows for potential profit within a specific price range while capping potential losses.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.