F&O Manual | Nifty sustains positive momentum, can move to 19,840 on weekly expiry day

Nifty formed a Bullish hammer candle with a long lower shadow indicating support-based buying

The Indian equity markets were trading marginally higher on November 16 on positive global cues stemming from a cooling global inflation print in October.

At 11 am, the 30-pack Sensex was up 359.85 points or 0.55 percent at 66,035.78, and the Nifty was up 100.10 points or 0.51 percent at 19,775.60. About 1,900 shares advanced, 1,174 declined and 101 remained unchanged.

With the exception of metals, all sectoral indices were trading in positive territory, with pharma, metal, and oil & gas up 0.5-1 percent.

On a weekly basis, the Nifty is up by 1.44 percent at 19,675. The Nifty Volume Weighted Average Price (VWAP) for the week is in the 19,585 zone, trading 90 points higher, suggesting a bullish stance, analysts said.

On a weekly basis, the Nifty is up by 1.44 percent at 19,675. The Nifty Volume Weighted Average Price (VWAP) for the week is at 19,585 zones, trading 90 points above the same, suggesting an overall bullish stance according to analysts.

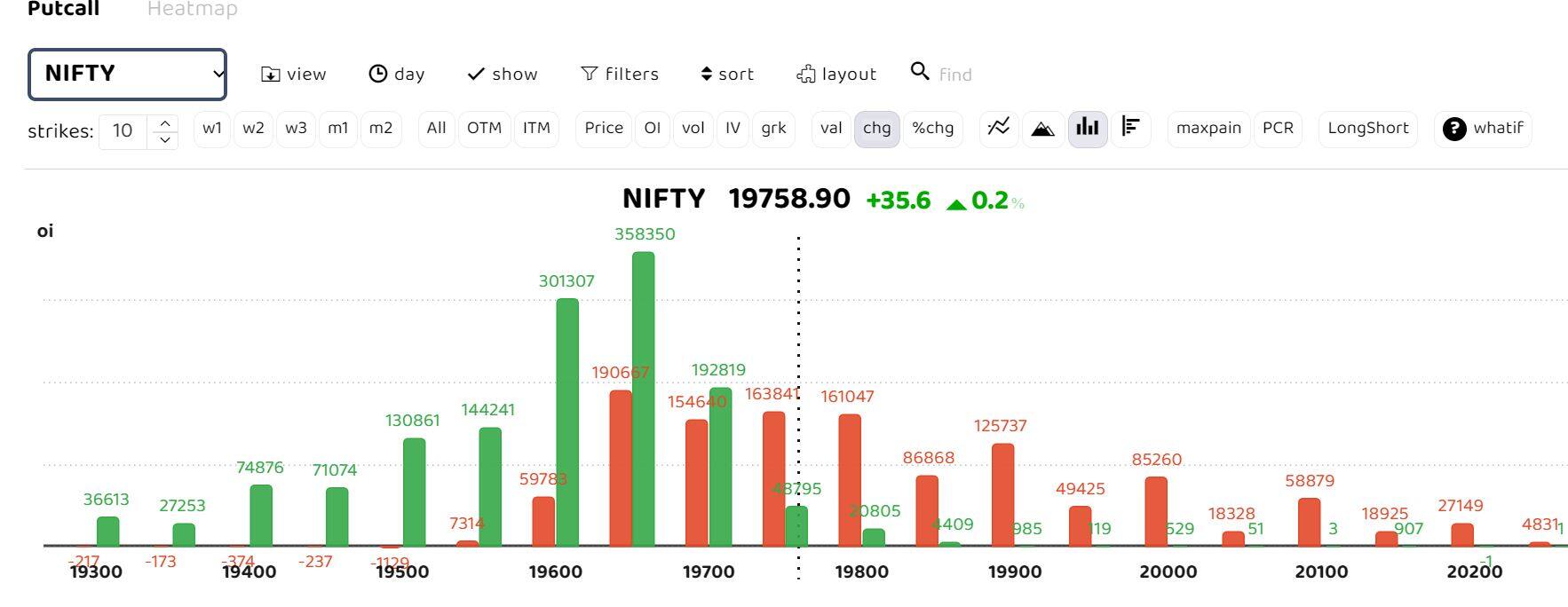

On the weekly front, significant Put Writing is witnessed at 19,600 and 19,500 strikes, while on the calls front, 19,700, 19,800, and 20,000 witnessed considerable open interest additions.

The options data suggests a tussle between call and put writers around the 19,450 level, indicating key straddle positions being formed at this strike. The crucial support for the day can be seen at 19,500 and 19,400 strikes, while the immediate resistance is at 19,900 and 20,000 levels.

According to Sudeep Shah, Head of Technical and Derivative Research at SBI Securities, technically, the Nifty witnessed a downward sloping trend-line break-out above 19,550-19,575, joining the swing highs of 20,222 (September 2023) and 19,849 (October 2023). With the move, the index broke above the resistance zone of 19,550, which is a 50 percent retracement of the entire fall from 20,222 to 18,837 and hence is significant.

“The 19,550-19,580 zone should act as strong support and till this holds, the Index can move up to 19,790-19,830 in the coming few sessions. Profit booking below 19,550 could be witnessed up to 19,430-19,400 zone where the 20 day exponential moving average (EMA) is placed,” he said. The overall range for the day could be 19,550-19,600 on the downside and 19,810-19,840 on the upside, he said.

According to Motilal Oswal Financial Services (MOFSL), “After yesterday’s session, the Nifty formed a bullish hammer candle with a long lower shadow indicating support-based buying. On today’s expiry day, it has to hold above 19,650 zones for an up move towards 19,750 then 19,850 zones, whereas supports are gradually shifting higher at 19,550 then 19,442 zones.”

Nifty expiry day strategy recommendation by MOFSL

Options strategy: Options traders can initiate a bull call spread (Buy 19,650 call option and sell 19,750 call option) to play the upswing.

Option writing: Option writers can sell Nifty 19,550 put option and sell 19,800 call option with a strict double stoploss.