Broader indices outperform with nearly 100 smallcaps gaining up to 41%

Broader indices outperformed the main indices with BSE Small-cap, Mid-cap and Large-cap indices rose 3 percent, 2.5 percent and 1.6 percent, respectively.

The Indian equity indices started Samvat 2080 on a positive note, extending a winning streak for the third week, backed by easing inflation print, buying by foreign institutions, falling crude oil prices, moderation in US yields, and riding on hopes of longer pause on rate hikes by major central banks.

In the truncated week ended November 17, BSE Sensex gained 1.37 percent or 890.05 points to finish at 65,794.73, while Nifty50 added 306.45 points or 1.57 percent to 19,731.80.

Broader indices outperformed the main indices with the BSE SmallCap, MidCap and LargeCap indices rising 3 percent, 2.5 percent and 1.6 percent, respectively.

“The domestic markets ended the week in the green, buoyed by global cues and favourable Indian macroeconomic indicators hinting at controlled inflation. Softer-than-expected inflation figures in the US, UK, and at home bolstered investor optimism, fuelling hopes for an end to the interest rate cycle. This sentiment propelled gains across the broader market, particularly in small and mid-cap stocks,” said Vinod Nair, research head at Geojit Financial Services.

“Confidence in export-oriented sectors like IT and Pharma resurged, anticipating increased spending, while the auto and real estate sectors gained favour during the festival season. Towards the week’s end, however, banking stocks were impacted by the RBI’s decision to raise risk weights for unsecured loans. Despite this, the market is likely to maintain its positive momentum in the short term, supported by declining oil prices and moderating US yields,” he added.

Among sectors, the Nifty Information Technology index added 5 percent, Nifty Realty index 4.7 percent, Nifty Auto index nearly 4 percent, and Nifty Metal index was up 3 percent.

Domestic institutional investors (DIIs) continued buying, picking up equities worth Rs 1,675.7 crore during the week, while foreign institutional investors (FIIs) sold shares worth Rs 404.82 crore, far lower than the previous week’s Rs 3,105.27 crore selloff.

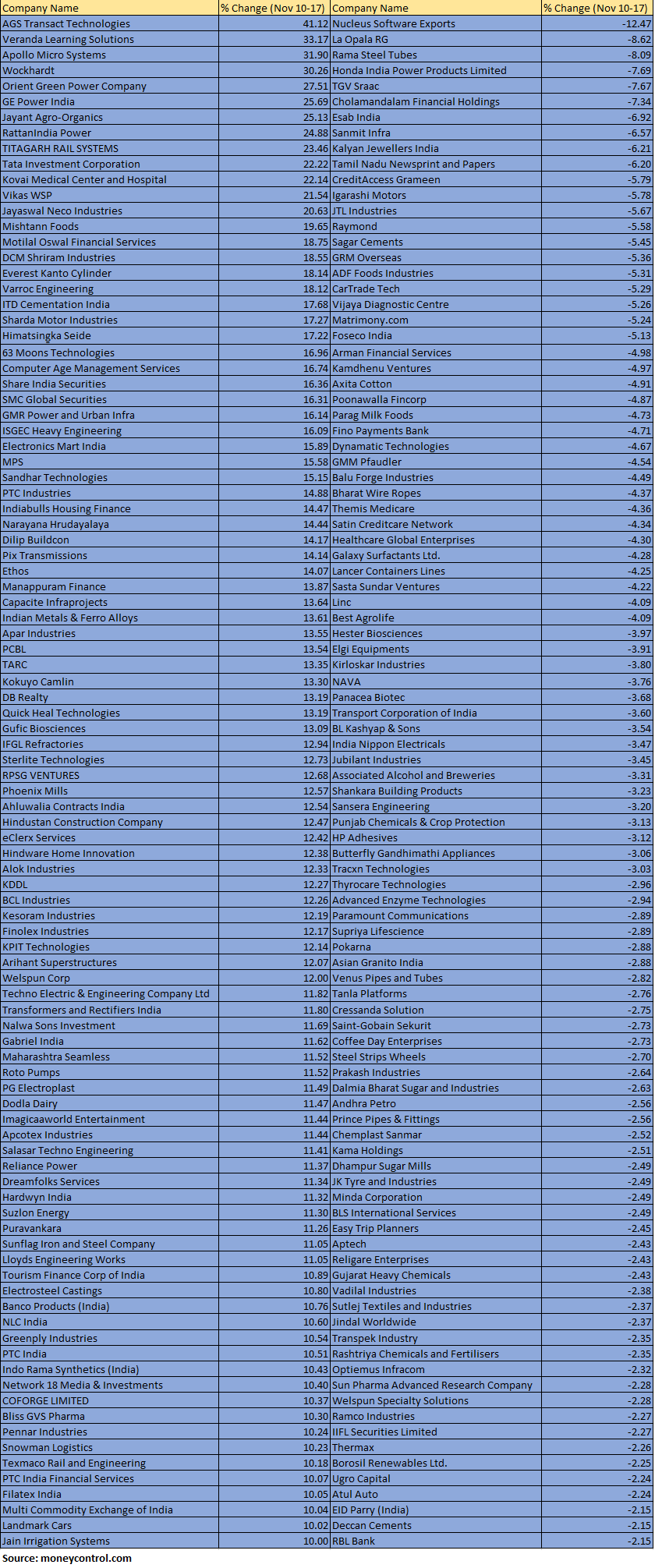

The BSE SmallCap index gained 3 percent with AGS Transact Technologies, Veranda Learning Solutions, Apollo Micro Systems, Wockhardt, Orient Green Power Company, GE Power India, Jayant Agro-Organics, RattanIndia Power, TITAGARH RAIL SYSTEMS, Tata Investment Corporation, Kovai Medical Center and Hospital, Vikas WSP and Jayaswal Neco Industries rising 20-41 percent.

Losers included Nucleus Software Exports, La Opala RG, Rama Steel Tubes, Honda India Power Products, TGV Sraac, Cholamandalam Financial Holdings, Esab India, Sanmit Infra, Kalyan Jewellers India and Tamil Nadu Newsprint and Papers.

So, where is the Nifty50 headed? Let’s check out what experts say.

Ajit Mishra, SVP – Technical Research, Religare Broking

Going ahead, the performance of the global markets, especially the US, will remain in focus for cues. We suggest continuing with the positive bias until the Nifty breaches 19,450 and prefer sectors other than banking and financials for long trades.

Rupak De, Senior Technical Analyst at LKP Securities

The Nifty has largely traded within a range, showing a predominantly bullish sentiment. Over the past two to three days, a ‘buy on dips’ approach has been loved by the street since the Nifty crossed the crucial 19,500 mark.

The trend is expected to stay positive as the Nifty consistently concludes trading sessions above the critical moving averages. Support levels are situated at 19,630/19,500 on the lower end, while resistance is placed at 19,850/ 20,000 on the higher end.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.