F&O Manual | Nifty trades in a range, needs to stay above 19,800 to see buying

.

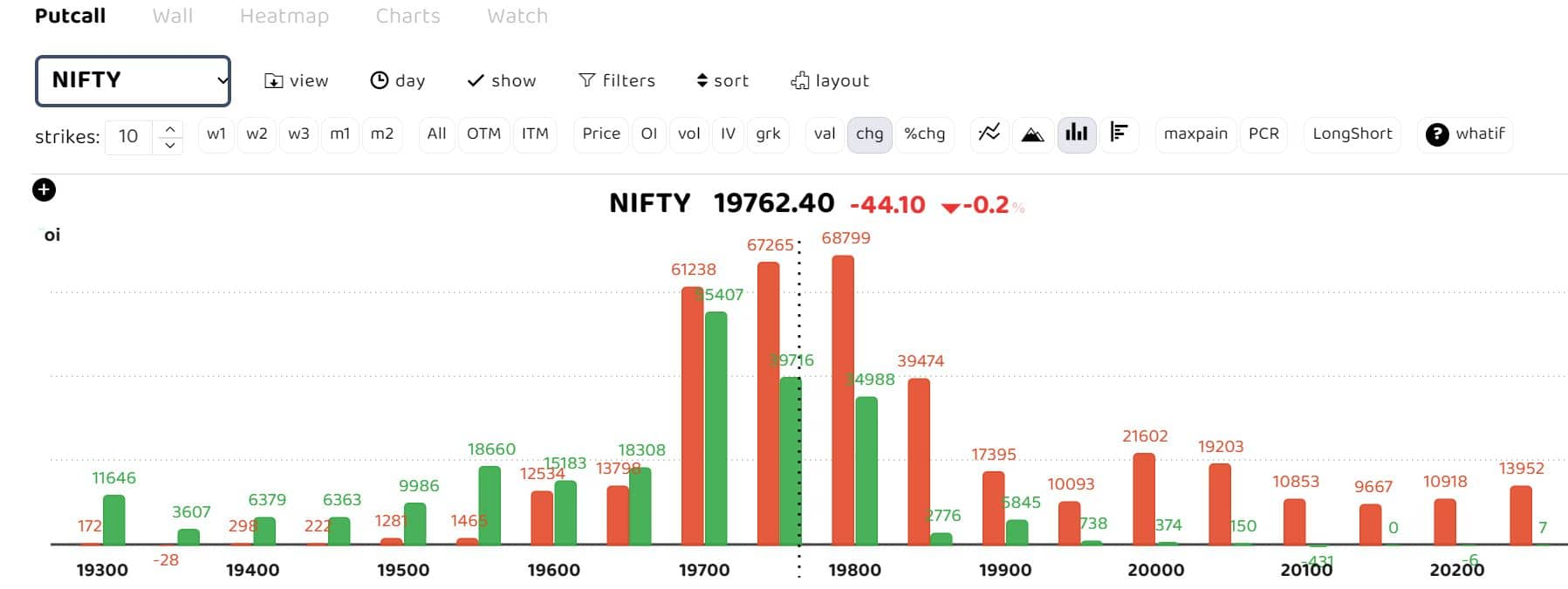

The market traded within a range as consolidation and sideways momentum persisted since morning on November 20. Nifty options data indicates a struggle between call and put writers around 19,750 strike, suggesting the formation of key straddle positions at these levels.

The week began on a negative note for the Nifty. Options data reveals a battle between call and put writers around the 19,750 levels. “On the weekly chart, the index has formed a long bullish candle, displaying higher highs and lows compared to the previous week. It last week closed above the previous week’s high, indicating a positive bias,” Axis Securities said.

“The chart pattern suggests that leading the index towards 20,000-20,200 levels. However, if the index breaks below the 19,600 level, it would experience selling pressure, taking the index towards 19,400-19,300,” Axis Securities added.

For the week, the brokerage anticipates the Nifty to trade in the range of 20,200-19,600 with a positive bias. The daily and weekly strength indicator RSI is above its respective reference lines, indicating a positive bias.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.