F&O Manual | Weakness in bank stocks drags Nifty down, heavyweights limit losses

Nifty may spend some time consolidating above 19500 levels before fresh up move.

The equity market continued to trade flat amid neutral global cues. Sudden weakness banking stocks over the last two sessions led the Nifty to shed some momentum but buying seen in other index heavyweights restricted the losses. As per analysts, recovery among banking biggies is crucial for a fresh up-move in the index.

The BSE Midcap index was up 0.2 percent and the Smallcap index was up 0.5 percent by 12 noon on November 23. Hero MotoCorp, Bajaj Auto, Eicher Motors, IndusInd Bank and Wipro are among the top gainers on the Nifty, while losers included Cipla, SBI Life Insurance, UltraTech Cement, Divis Labs and Apollo Hospitals.

At 12pm, the Sensex was down 3.05 points to 66,020.19, and the Nifty was down 10.80 points to 19,801. About 1,821 shares advanced, 1,235 declined, and 115 traded unchanged.

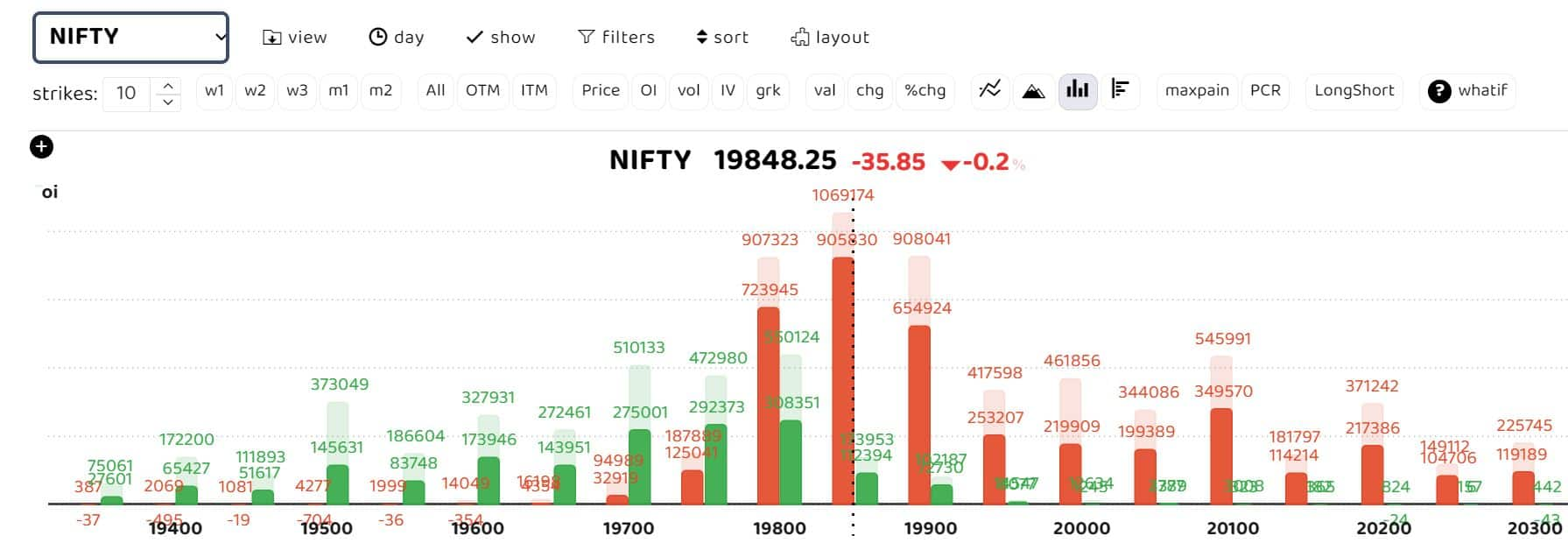

Options data suggests that Nifty trades within a range or in the negative on expiry day with strong resistance at 19,900 and 20,000 strikes. On the Nifty, the 19,900 Call strike holds noteworthy open interest (OI) of Rs 126 lakh shares. On the Put side, 19,800 strike holds substantial OI of Rs 121 lakh shares. “Nifty may spend some time consolidating above the 19,500 levels before a fresh up-move. For today’s expiry, the Nifty is expected to

trade in the range between 19,800 and 19,900,” ICICI Securities said.

Derivative strategy recommended by ICICI securities

November 30 expiry

Sell Nifty 19750 Put option in the range of Rs 46-48

Target: Rs 20 Stop loss: Rs 61

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.