F&O Manual | Indices trade flat, small bullish candle holds out hope for Nifty upmove

About 1710 shares advanced, 1492 shares declined, and 139 shares unchanged

The Indian market traded flat at noon on November 28, as sideways momentum continued. The weekly price action data shows that the benchmark Nifty formed a small bull candle carrying higher lows, indicating continuation of the upward momentum.

“The market construct is turning favourable aided by global and domestic factors. Globally, there is tailwind from the US market with S&P 500 up by 8.7 percent so far this month, which, in turn, is supported by falling US bond yields,” VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said.

The week is likely to be volatile but a rally is likely soon. Foreign institutional investors (FIIs) have already turned buyers. Their and domestic institutional investors money flows can trigger a large-cap-led rally, he said.

Among sectors, oil & gas and power were up 2 percent each, while metal, auto and PSU Bank indices gained 0.5 percent each.

At noon, the Sensex was down 4.39 points or 0.01 percent at 65,965.65, and the Nifty was up 35.80 points or 0.18 percent at 19,830.50. About 1,710 shares advanced, 1,492 declined and 139 were unchanged.

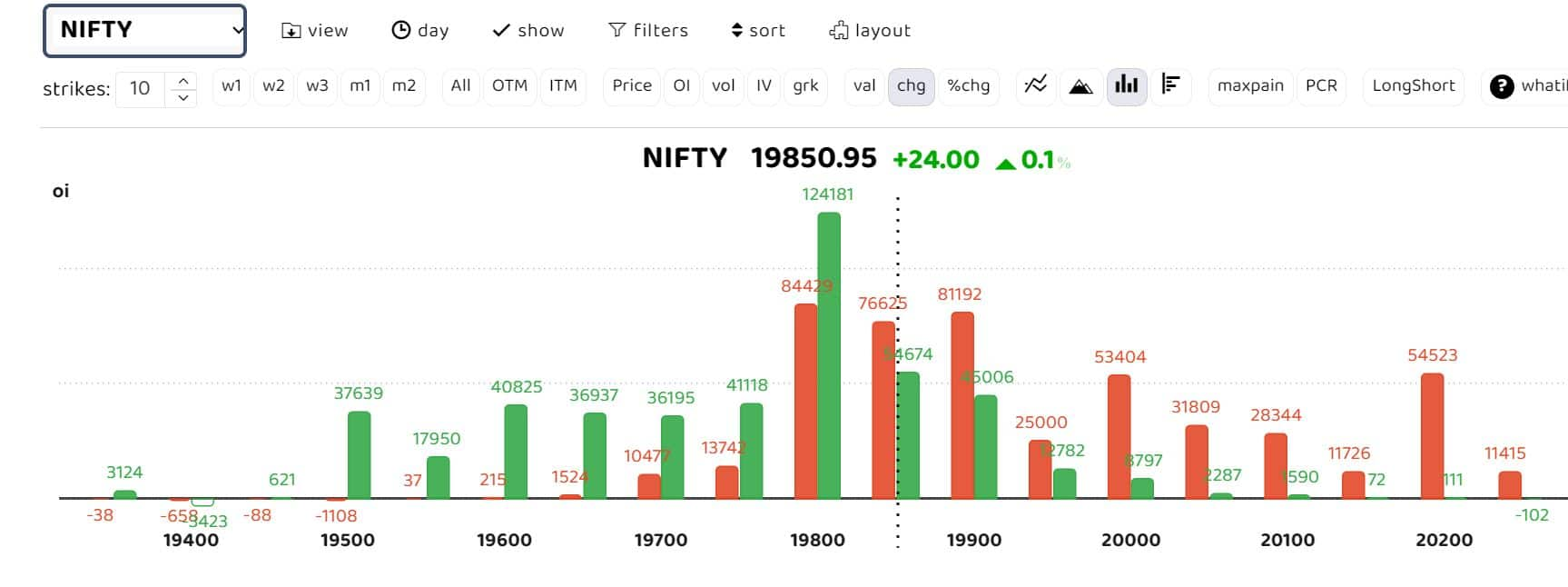

The options data suggests sideways momentum in the Nifty with key straddle positions formed at 19,800 and 19,900 strikes.

“In this truncated week, we expect index to gradually head towards the psychological mark of 20,000 as it is 80 percent retracement of Sept-Oct decline (20,222-18,838), placed at 19945,” ICICI Securities said.

Volatility will remain high, tracking monthly expiry session coupled with state elections verdict, which will weigh on market sentiment. “Hence, temporary cool off should be utilised as incremental buying opportunity wherein strong support is placed at 1,9400, which we expect to hold,” it said.

Bank Nifty

Vaishali Parekh, vice president-technical Research, Prabhudas Lilladher, said, “The index has been in consolidation for quite some time having a tough resistance near the significant 50EMA level of 43,900 zone and further ahead, a decisive breach above the 100-period MA of 44,400 level is necessary to overall improve the bias and anticipate for further move upward.”

For the week, the index should maintain support near 43,400, which is also where the important 200 period MA lies. A breach of it would weaken the trend and could trigger a further slide, Parkeh said. A move past 44,400 would strengthen the trend and the index can move towards 44,800 and 45,200 in the coming days.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.