Nifty scales new high: Hero Moto leads gainers, UPL, Adani Enterprises top losers

Post the October low, the benchmark has recovered 7.4 percent till date

Bulls charged the benchmark NSE Nifty 50 to fresh record high levels well above 20,250 points on December 1 on the back of positive global cues, strong domestic GDP print, and return of foreign funds flow.

Since September 15, when the Nifty 50 touched its record high, around seven out of 50 Nifty stocks have registered more than 10 percent gains, data showed.

Tracking the trends in Nifty 50 since then, the benchmark hit a low of 18,837 levels on October 26 weighed down by the Middle-East conflict that spooked bond yields and the dollar. Since the October low, the benchmark has recovered 7.5 percent to date.

Follow live blog for all the market action

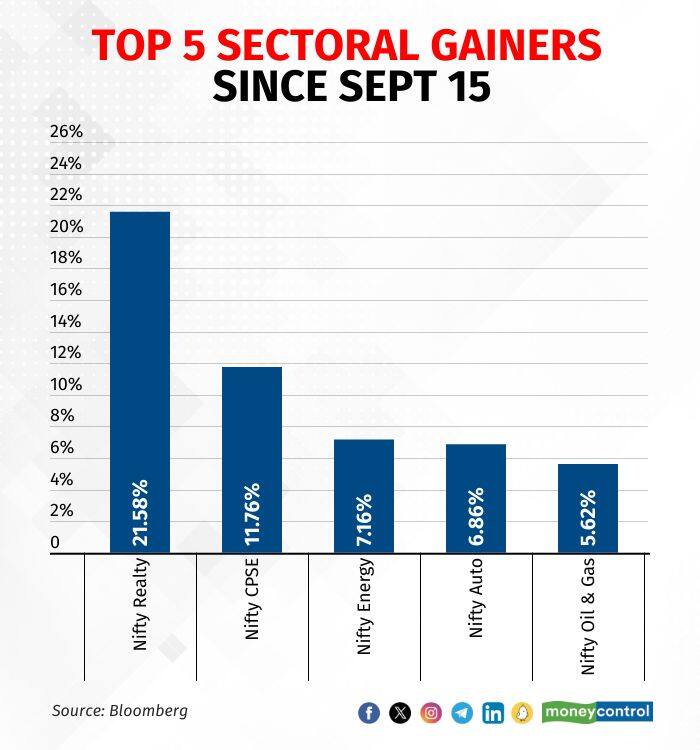

Nifty Realty top gainer since Sept 15

Among sectoral indices, Nifty Realty was the top sectoral gainer since September 15, surging up to 21.5 percent.

Analysts at Motilal Oswal believe that the listed real estate universe clocked its second best quarter with cumulative pre-sales of Rs 25,200 crore, up 54 percent year-on-year. “The growth was primarily driven by a strong momentum sustenance sales as launches were subdued for most of the companies, barring a few,” the brokerage firm said in a recent note.

Other top sectoral gainers since September 15 include Nifty Central Public Sector Enterprises (CPSE), Energy, Auto, and Oil & Gas indices. The gains for these indices range from 5.6 percent to 11.7 percent.

Also read: How to trade Nifty in Dec? Watch out for poll results, check out seasonal sectors: Experts

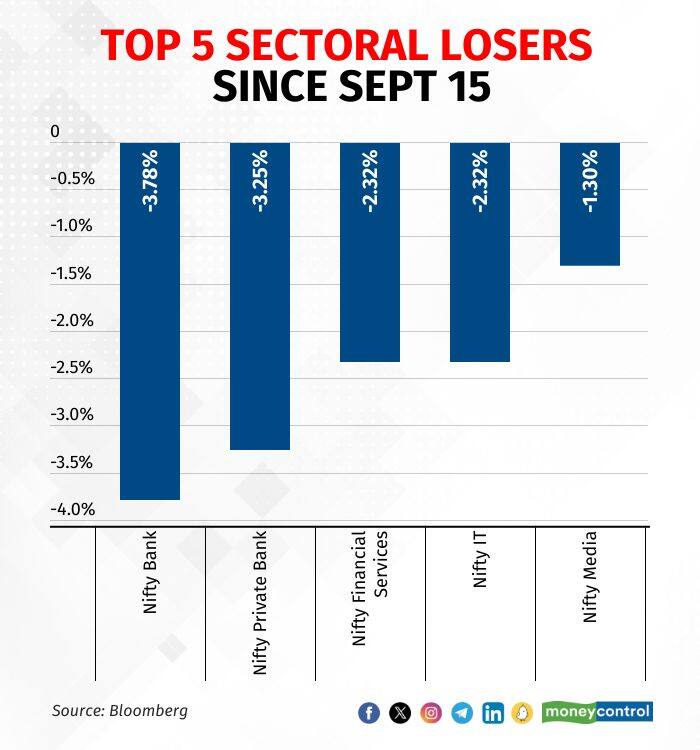

Nifty Bank top sectoral loser since Sept 15

On the flipside, Nifty Bank was the top sectoral loser since September 15, declining as much as 4 percent (see chart).

The banking universe’s margins have been under pressure since two consecutive quarters amid rising cost of funds due to delayed implementation of interest rate increases, analysts said. Moreover, the new Reserve Bank of India’s (RBI’s) risk-weight norms on unsecured retail lending is further expected to create pressure on lenders borrowing rates.

If we look at the chart, the financial segment of the Nifty is impacted as Private Bank and Financial Services indices also claim top spots in laggards.

Apart from that, Nifty IT and Nifty Media indices sit with up to 2 percent losses, suggested data.

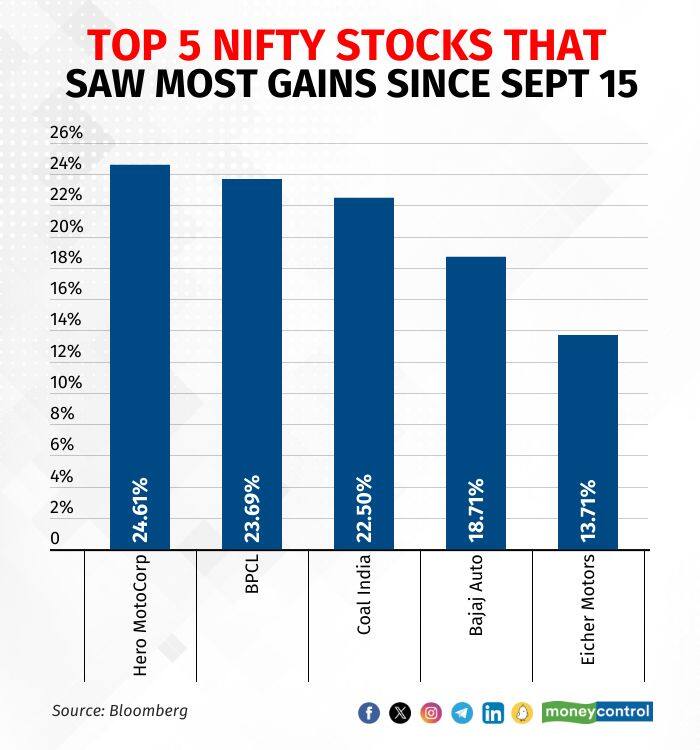

Best Nifty performers since Sept 15: Hero Moto, BPCL

Among individual stocks, Hero MotoCorp emerged as the top winner as it gained over 24 percent since September 15.

Analysts at BOB Capital believe steady rural recovery, export market revival, and the company’s aggressive launch programme will help Hero MotoCorp grow in the upcoming quarters as well.

Other than Hero Moto, BPCL, Coal India, Bajaj Auto, and Eicher Motors were the top stocks that gained the most since September 15.

Also read: Poll outcome, GDP growth to keep momentum going after pushing Nifty to record highs

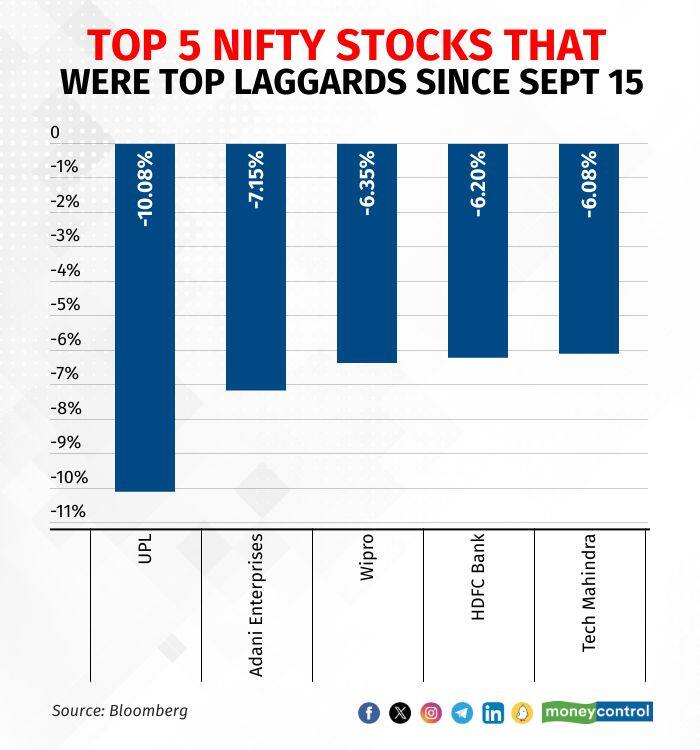

Worst Nifty performers since Sept 15: UPL, Adani Enterprises

On the contrary, agro-chemical player UPL was the worst performer as it tumbled over 10 percent since September 15.

Analysts believe that UPL’s unpopularity among investors comes amid drop in chemical prices across world, sticky debt situation, and erratic monsoon trends.

Apart from UPL, Adani Enterprises slipped up to 7 percent, whereas Wipro, HDFC Bank, and Tech Mahindra skid over 6 percent each since September 15.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.