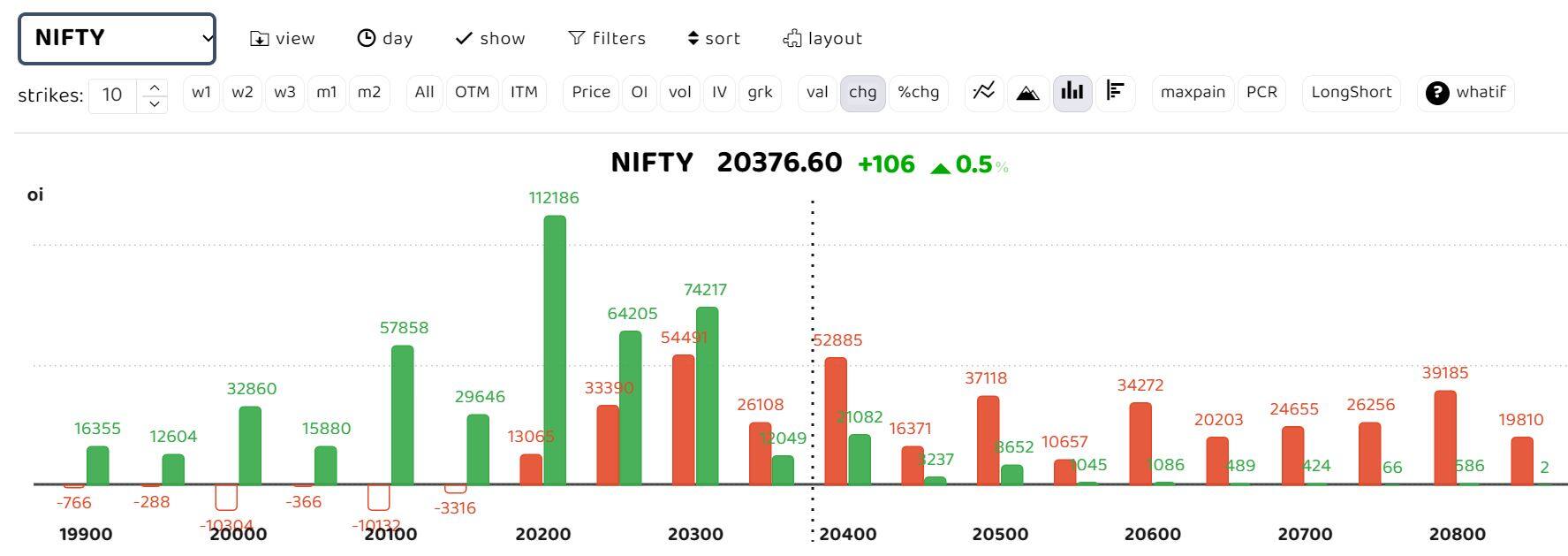

F&O Manual | A new high for market; Nifty needs to hold 20,400 for momentum to stay

Sensex gains 960 pts, Nifty at 20,550; all sectors in the green at 11 am

The Indian equity benchmark hit a new high on December 4 morning, as market participants cheered BJP’s win in three state elections amid positive global cues and resurgent FII flows.

The BJP’s win the Rajasthan, Madhya Pradesh and Chhattisgarh allayed concerns about political stability and fiscal populism, analysts said.

Top gainers on the Nifty included Adani Enterprises, Adani Ports, Coal India, BPCL, and L&T, while Maruti Suzuki, Britannia Industries, HDFC Life, Nestle, and Sun Pharma were among the losers.

With the exception of the pharma sector, all sectoral indices were trading in the green. The power and oil & gas indices were up 3 percent each, while the bank, capital goods, and metal indices were trading up to 2 percent higher.

At 12.05, the 30-pack Sensex was trading at 68,448.98, up 967.79 points, or 1.43 percent from the previous close, while the Nifty was at 20,571.95, up 304.05 points, or 1.50 percent.

The options data suggests put writers were dominant with heavy put writing at 20,100 and 20,000 strikes forming strong support.

According to Rupak De, Senior Technical Analyst at LKP Securities, “Technically, the Nifty had already surged past the critical resistance level of 19,850. Since then, there has been a significant shift in Put positions towards higher strike prices, anticipating a robust upward rally in the near future.”

The Bank Nifty showed a sharp upward movement after a Bat Action Magnet Move formation on the daily chart. The overall sentiment appears highly bullish until Nifty falls below 20,400, he said.

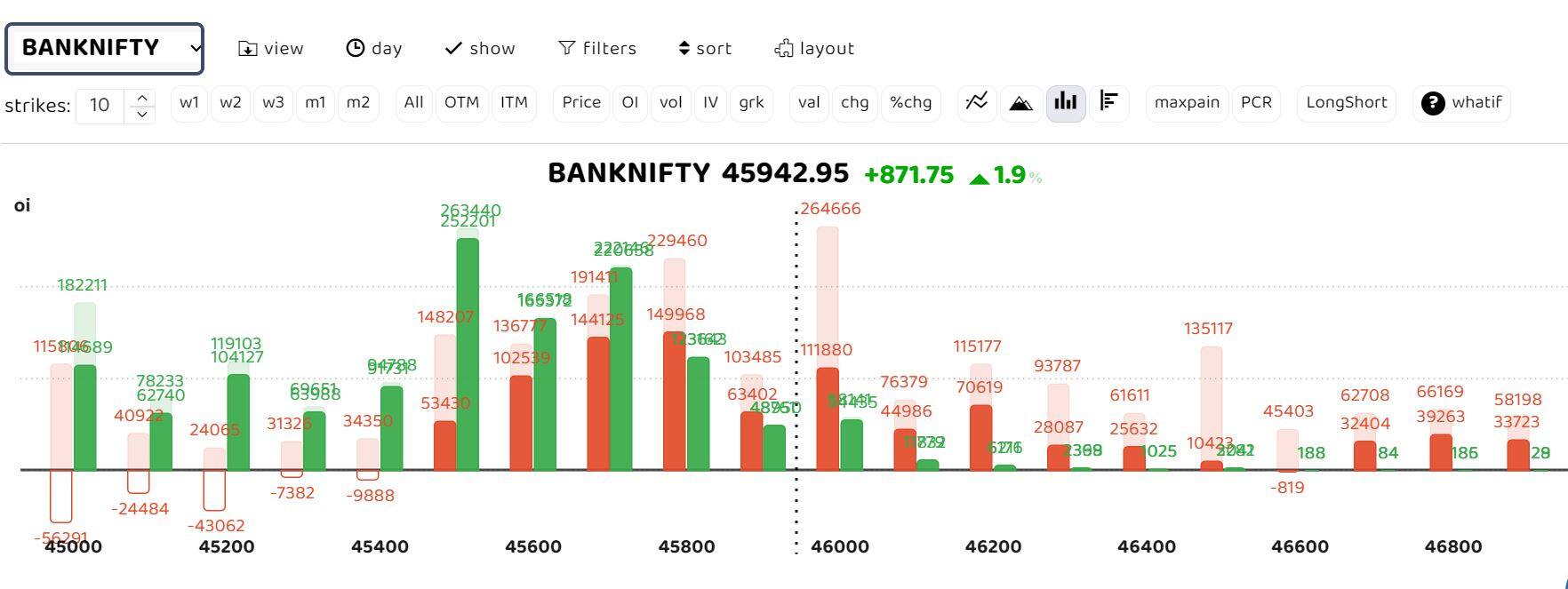

Bank Nifty

The Nifty Bank is overbought on the daily charts, with the next resistance at 46,265. Investors should book profits as a close below the support of 45,230 could take the index to 43,700 in the near term, said A R Ramachandran of Tips2Trade.

“… private sector banks along with large caps which have not done too well in terms of stock price returns over the past two years might be outperformers in the coming few months as valuations are cheaper as compared to the other sectors,” Ramachandran said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Get ₹100 cashback on checking your free Credit Score on Moneycontrol. Gain valuable financial insights in just two clicks! Click here