Boom in luxury keeps real estate stocks on top. Can the rally sustain?

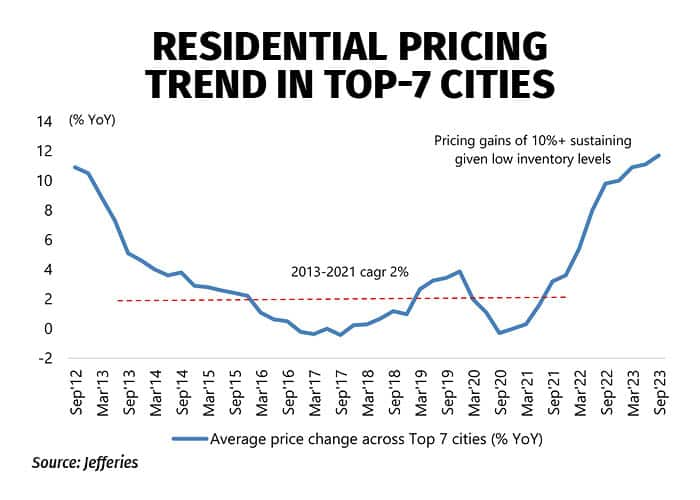

Jefferies expects property prices to rise 10 percent year-on-year (~25-30 percent higher in three years).

Nifty Realty has gained more than 55 percent this year, outperforming all other major sectoral indices, as demand remains robust, inventories shrink and sellers rule the market. Wealth creators from capital markets as well as high-income salaried individuals are making a beeline to add prime real estate assets to their portfolio.

This growing interest has upped the demand for real estate stocks and the relentless rally has pushed them to a point where investors might turn a bit sceptical on valuations, analysts say.

The story of real estate stocks has been the boom in luxury housing, while commercial has been lacklustre due to funding slowdown for startups and “higher-for-longer” interest rate environment.

Propequity data shows that the average ticket size of houses is now 50 percent larger than pre-COVID and the share of premium/luxury housing has risen to 75 percent this year against 60 percent in the pre-covid FY20.

Also read: Mumbai real estate: Property registrations increase over 3% year-on- year in November 2023

In a recent interaction with Moneycontrol, Yes Securities’ Amar Ambani said that listed developers would continue to see momentum as the market consolidates. “All these reputed names command premium pricing, which is upwards of 10-15 percent, and in some cases, like Oberoi, even 20 percent, than the developer next door. So, I think on the margin front, the companies will do very well,” he said.

.

.

Sector recovery

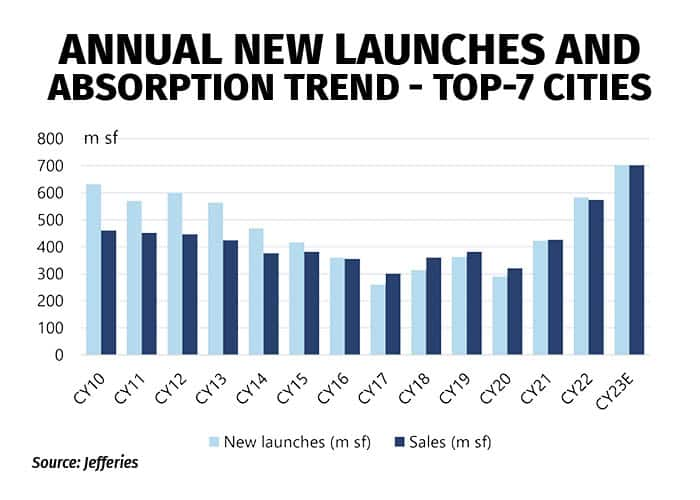

Real estate sales boomed between 2004 and 2008, which resulted in players buying excessive land. But for a decade starting 2010, sales were slow, unsold inventory was high, construction was getting delayed and projects stalled. Factors such as GST and demonetisation also weighed on spending.

This, according to Niket Shah, fund manager, Motilal Oswal Asset Management, changed with the Covid pandemic which reinforced the need to buy buying property. This was either to address the need for larger spaces with dedicated working rooms or high net worth individuals (HNIs)and non-resident Indians (NRIs) seeking to safeguard their investments amid global macroeconomic uncertainties.

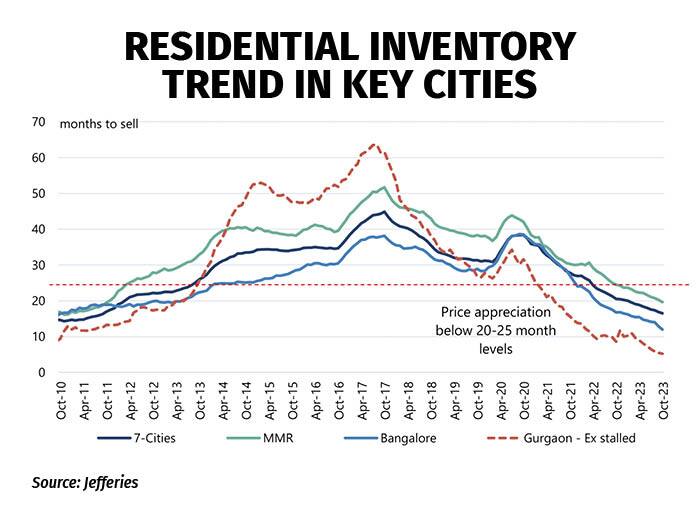

“In that duration, a lot of people who were sitting on the fences went and bought real estate. The inventory, which used to be very high, went down to below 15 months (for at least the Mumbai market). Luxury inventory is closer to a year or slightly below a year now,” Shah explains.

According to the latest Motilal Oswal report, with inventory for listed companies below 10 months, launches are expected to double in the second half of FY2024 to 60 million square feet. In value terms, launches are expected to grow to Rs 82,000 crore from Rs 26,000 crore in the first half of FY24.

Also read: 5 reasons why Mumbai’s real estate market is glittering this festive season

November 2023 saw a significant push for marquee project launches by listed companies, foreign broking firm Jefferies has said. Oberoi marked its Thane entry with the launch of the Rs 2000-crore (Phase-1) Kolshet project. Lodha expanded to Bengaluru with Rs 1,200-crore Mirabelle Manyata project.

Prestige launched its large 10m sf Hyderabad ‘Prestige City’ Township, while DLF’s Rs 5000 crore Arbour-2 project will open in Gurugram this month.

With a drop in inventory, prices have begun to rise, especially in the top five cities of Mumbai, Delhi, Bengaluru and Hyderabad. This increase, Shah says, gives further confidence to investors who were earlier on the fringes about investing in real estate.

Widening gap

Axis Mutual Fund’s Shreyash Devalkar says the real estate segment is expected to see growth after a decade of prices being down. Luxury is seeing a faster growth, which is not surprising due to a widening rich versus poor gap in the market, he says.

“After every crisis, you will see divergence in big economies. Inflation hurts the poor more than anyone else. That is the K-shaped recovery. In India, the upper part of K, which is a bigger chunk, is seeing recovery faster. After any crisis, the gap widens, more beneficiaries emerge, and the cycle starts,” he explains.

An extra push that boosted luxury segment were the new provisions on capital gains. In the Budget 2023, the government capped the deduction from capital gains on residential property investment at Rs 10 crore. Earlier there was no such limit and high net worth individuals often used this route to reduce tax liability. With the new provision set to be enforced in April 2024, many HNIs wanted to buy luxury real estate before the deadline.

According to Shah, there might be slight moderation in the segment once the provision is in place, which means prices could also taper off but long-term structural drivers are still strong. The luxury segment is poised to see growth of around 30 percent, primarily because that segment of customers is either benefited by stronger equity market flows, capital gains, ESOPS, etc.

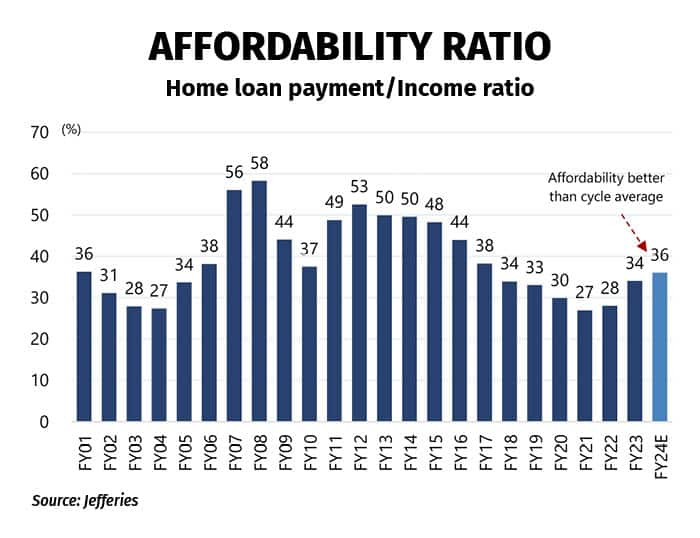

The non-luxury segment is not doing badly but high interest rates have weighed on EMI-dependent consumers looking for affordable housing options. Jefferies expects property prices to rise 10 percent year-on-year (around 25-30 percent higher in three years).

“If you adjust for inflation, prices are still much lower than they were in the previous cycle. Once interest rate cuts start, the affordable segment will also see a renewed uptick,” said Ambani.

Trend to continue but what about valuations?

The realty index is up close to 90 percent since March 2023 bottom, following strong sales and RBI rate hike pause. Sector valuations are now significantly above the +1 standard deviation levels and near the 2021 peak multiples, reducing rerating headroom, Jefferies has said.

Any uptick in debt levels or slowing pre-sales can make investors cautious. Net debt of top eight listed developers reduced from Rs 40,500 crore in FY20 to over Rs 23,000 crore in FY23.

That said, Jefferies says, relative valuations are still attractive for Godrej Properties and Sunteck, making them the brokerage house’s preferred picks.

Domestic broking firm Motilal Oswal Financial Services also picked the two stocks after the BJP won assembly elections in three key states, setting the tone for the 2024 general elections.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.