How to trade Fin Nifty in today’s expiry?

Representative image

Fin Nifty is trading positively, crossing the 21,000 mark in expiry day trading on December 5. On a weekly basis, Fin Nifty futures have observed a price increment of 5.35 percent, accompanied by a long build-up in open interest.

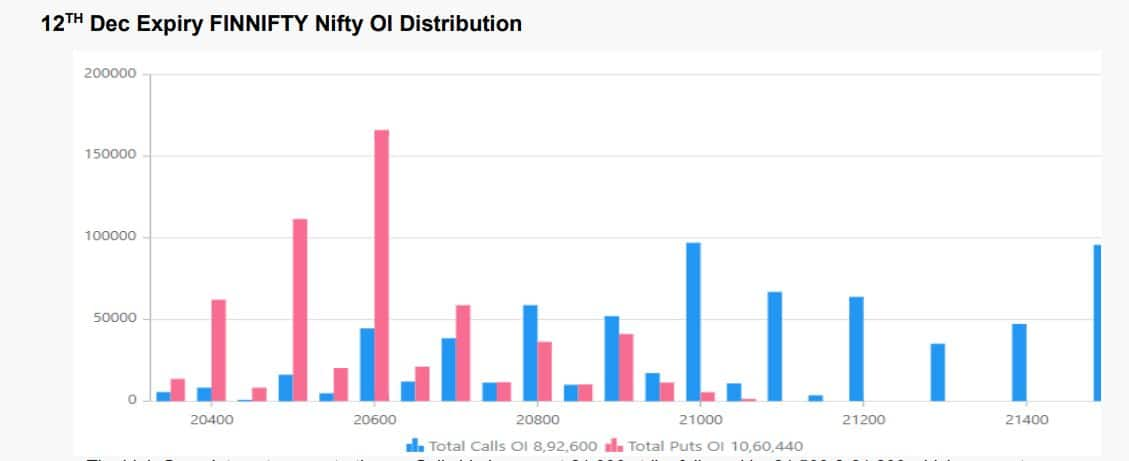

Finnifty open interest data | Source: Axis Securities

Finnifty open interest data | Source: Axis Securities

High open interest (OI) concentration on the call side is observed at the 21,000 strike, followed by 21,500 and 21,200, which may act as immediate resistance. On the put side, the high open interest concentration is seen at the 20,600 strike, followed by 20,500 and 20,400, which may act as immediate support.

“Fin Nifty is witnessing heavy traction around the 21,000 level, with the highest OI seen in both CE and PE. We anticipate a positive bias until this mark is defended. A breach of this mark could take Fin Nifty towards 20,900 on the expiry day,” stated Avdhut Bagkar, derivatives and technical analyst at StoxBox.

“While 20,200 CE is witnessing writing, the momentum seems to lack selling pressure. On the other hand, 20,900 PE is also witnessing writing. Inevitably, we anticipate Fin Nifty’s expiry to be above the 21,000 spot, underpinning a bullish bias on its expiry day,” he further added.

Derivative strategy recommendation for today’s expiry

Bagkar advises taking a Long 21000 CE option around 50 with a stop loss of 1, target 125.

Derivative outlook for next week’s expiry

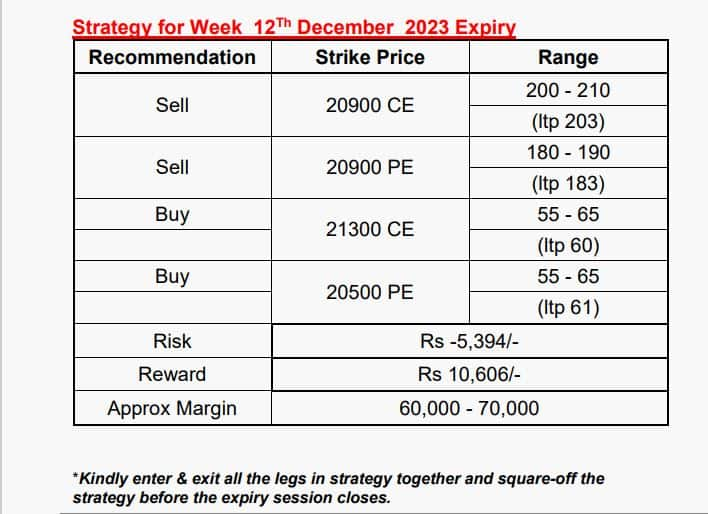

Four-legged spread strategy by Axis Securities. “Traders could initiate this spread strategy to generate modest returns with limited risk and reward. The suggested spread consists of buying one lot of the 20,500 strike put option, buying one lot of the 21,300 call option, and selling one lot each of the 20,900 call and put options,” stated Axis Securities.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Get ₹100 cashback on checking your free Credit Score on Moneycontrol. Gain valuable financial insights in just two clicks! Click here