F&O Manual | Nifty hits 21k after RBI decision, overbought conditions spark minor retracement

Among individual stocks, GMR Infra, REC Ltd, HDFC Bank and RBL Bank witness long build up. While, short build up can be seen in BHEL, Idea and Glenmark.

Indian benchmark indices celebrated the RBI monetary decision, aligning with D Street’s expectations with Nifty touching the 21,000 mark. The India VIX, down 7.77 percent leading up to the RBI policy announcement scheduled for December 8, indicates that option participants harbored little fear regarding the uncertainty surrounding the event.

At 12 pm, the Sensex was up by 300.05 points or 0.43 percent at 69,821.74, and the Nifty was up by 73.30 points or 0.35 percent at 20,974.50. About 1,664 shares advanced, 1,471 shares declined, and 85 shares remained unchanged. Nifty took 61 sessions to reach 21,000 from 20,000 levels.

Also Read: Das’s speech adds cheer to market that’s scaled Mount 21k

Nifty has witnessed its longest winning streak since December 2020, marking a sixth consecutive week of gains. This week’s surge of 3 percent represents the best weekly performance since July 2022.

Hemang Jani, an Independent Market Expert, commented, “Nifty managed to surpass yet another milestone of 21,000 today. The Nifty is up 1 percent in CY23 year to date. Nifty made a smart comeback on the back of strong earnings for Q2 2023, positive outcomes of state elections in favor of BJP, stable global markets and bond yields, renewed flows by FPIs coupled with a drop in crude oil prices globally. Valuations are not looking stretched for Nifty as it’s still quoting at 18.5 times next year’s EPS with strong growth visibility for FY24. The next big trigger for the markets would be global bond yield movement and flows into emerging markets along with earnings expectations for Q3.”

Follow our market blog for all the live action

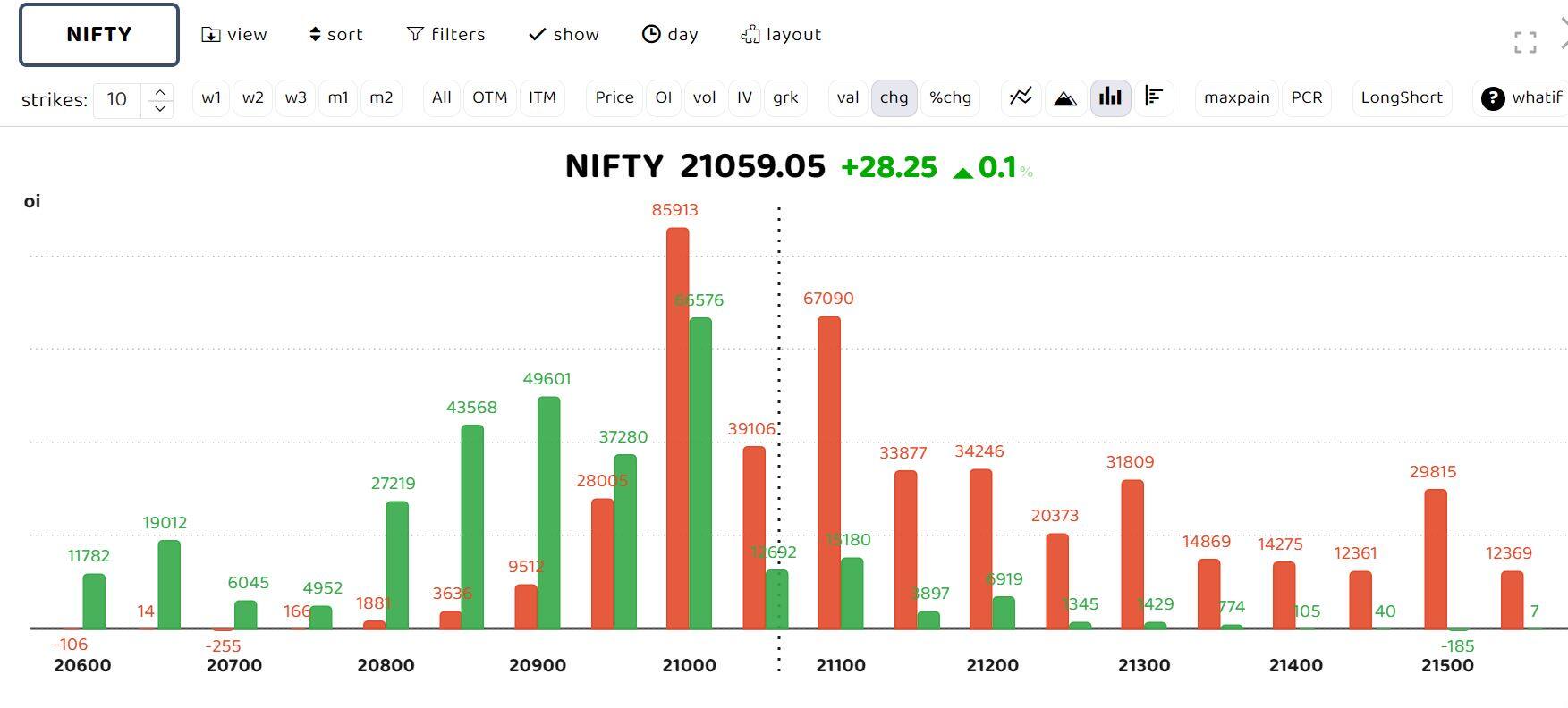

On the weekly front, significant call writing buildup is witnessed in 21,000 and 21,100 strikes, while on the puts front, 20,900-20,800 witnessed considerable Open Interest additions. According to Sudeep Shah, Head of Technicals and Derivatives Research at SBI Securities, “Overall, the range for the day could be 20,800 on the downside and 21,077 on the upside.”

Story continues below Advertisement

Sameet Chavan, Head of Research – Technical and Derivatives at Angel One Ltd, mentioned, “Nifty has encountered a crucial resistance point, with indicators in a high overbought zone. Our earlier perspective holds, suggesting that the levels around 21,000-21,100 will likely pose a substantial hurdle in the near term. This level, a reciprocal golden (161.8 percent) retracement of the recent fall, holds technical significance. Hence, one should avoid being complacent with their long bets. However, the bullish undertone prevails for the primary trend, and any correction in terms of price-wise or time-wise is anticipated to be short-term, which would be ideal for a healthier bull trend going ahead.”

Among individual stocks, GMR Infra, REC Ltd, HDFC Bank and RBL Bank witness long build up. While, short build up can be seen in BHEL, Idea and Glenmark.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Get ₹100 cashback on checking your free Credit Score on Moneycontrol. Gain valuable financial insights in just two clicks! Click here