Making losses on 9.20 short straddle? Backtest suggests adjustments to improve strategy

The Bank Nifty straddle strategy, like any trading approach, demands adaptability and careful scrutiny to weather changing market conditions.

The 9.20 short options straddle has become popular among algorithmic traders for a simultaneous call and put options play on the Bank Nifty index. This strategy involves selling a call and a put option with the same strike price and expiration date at 9:20 am. Traders aim to profit from the intraday time decay in the options’ price and typically exit the positions by 3:15 pm.

However, a backtest performance study by Nikhil Zelawat, Founder and CEO of StocksEmoji, indicates that the 9.20 Bank Nifty short options straddle with a 50 percent stoploss experienced periods of significant drawdowns. Zelawat conducted this strategy live from October 2018 to January 2022 but stopped it in January 2022 as it was no longer generating substantial profits.

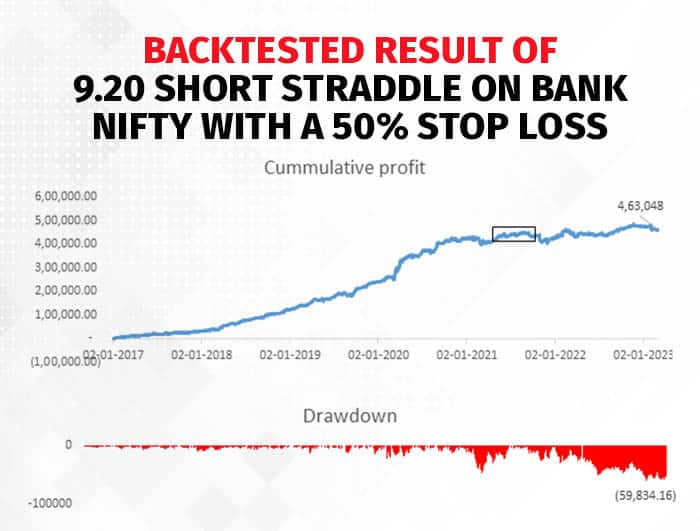

The backtest results revealed profitability until the end of 2020, followed by significant drawdowns from February 2021 to April 2021 (three months) and from August 2021 to January 2022 (a continuous 105-day drawdown). The backtesting involved shorting one lot each of Bank Nifty call and put options, considering a slippage rate of 0.5 percent. The equity curve and drawdown curve for the strategy are shown below.

From the above graphs, it can be seen that though the maximum drawdown (in monetary terms) is not reached initially when the equity curve has started to flatten, the time drawdown analysis indicates that there is a need to either halt the strategy or reconsider the parameters used to make it profitable.

To enhance profitability, Zelawat suggests a few potential solutions for the 9.20 Bank Nifty short options straddle strategy: (a) adjusting stop-loss levels to a narrower band, or (b) entering the trade earlier than 9.20 am, or (c) halting trading and implementing paper trading to study behaviour.

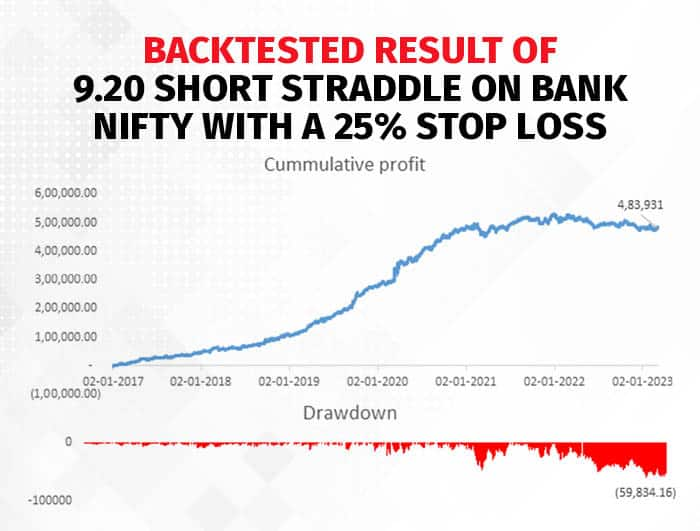

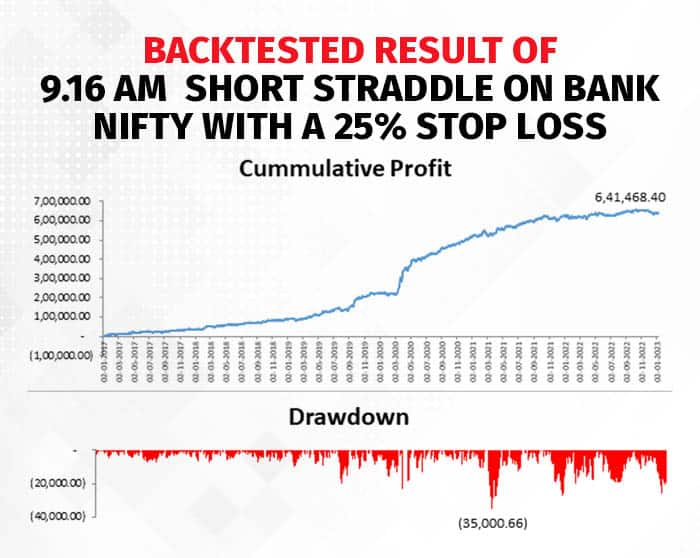

For algo traders continuing this strategy and experiencing losses, he suggests, “algo traders need to go beyond their systems and make manual adjustments to revive profitability in this strategy. Two solutions are considered: first, implementing a 25 percent stop-loss instead of 50 percent for individual legs, but results show marginal improvement and an increasing drawdown. Second, altering the execution time to 9.16 AM, a more volatile period, coupled with a 25 percent stop loss, results in drastic performance improvement.”

Proposed Solutions:

Story continues below Advertisement

Adjusting stop-loss levels to a narrower band:

Initial attempts to improve the strategy involve reducing the individual leg stop-loss from 50 percent to 25 percent. However, the backtested results show only marginal improvements with an increasing drawdown. Below are the backtested results of the same strategy when the loss is limited to 25 percent.

Exploring entry earlier than 9.20 am:

Testing the strategy in different time frames can help identify the optimal time for executing trades. Moving the execution up to 9.16 am, a more volatile period, coupled with a 25 percent stop loss, results in a drastic performance improvement. Below are the backtested results where the strategy is run at 9.16 am with a stop loss of 25 percent.

Halting trading, and implementing paper trading:

Another solution can be to halt the strategy if it is making losses for a substantial period. The strategy can be tracked using paper trading and executed once the previous high of the equity curve is broken.

“The Bank Nifty straddle strategy, like any trading approach, demands adaptability and careful scrutiny to weather changing market conditions. By adjusting stop-loss levels and exploring optimal execution times, traders enhance their chances of success. However, no strategy is foolproof, and losses are inherent. Vigilance, continuous reassessment, and readiness to adapt to evolving market dynamics are imperative for traders,” said Zelawat.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Get ₹100 cashback on checking your free Credit Score on Moneycontrol. Gain valuable financial insights in just two clicks! Click here