Here are the 10 biggest wealth-creators of 2023, do you own any?

Moneycontrol research identified 10 stocks surging over 1,000%, delivering substantial returns.

In 2023, so far, investors have reaped substantial gains by betting on penny or low-value stocks amid the Indian market’s ongoing rally. Moneycontrol research identified 10 stocks surging over 1,000%, delivering substantial returns. Penny stocks attract investors due to minimal investment requirements and potential for significant profits. However, it’s crucial to investigate why a stock remains in the penny category. Analysts caution that selecting penny stocks is challenging and risky, akin to finding a needle in a haystack. Thorough research into factors like promoter quality, business potential, and the possibility of a turnaround story is essential to mitigate potential risks. Here are 10 stocks that created most wealth for investors:

In 2023, so far, investors have reaped substantial gains by betting on penny or low-value stocks amid the Indian market’s ongoing rally. Moneycontrol research identified 10 stocks surging over 1,000%, delivering substantial returns. Penny stocks attract investors due to minimal investment requirements and potential for significant profits. However, it’s crucial to investigate why a stock remains in the penny category. Analysts caution that selecting penny stocks is challenging and risky, akin to finding a needle in a haystack. Thorough research into factors like promoter quality, business potential, and the possibility of a turnaround story is essential to mitigate potential risks. Here are 10 stocks that created most wealth for investors:

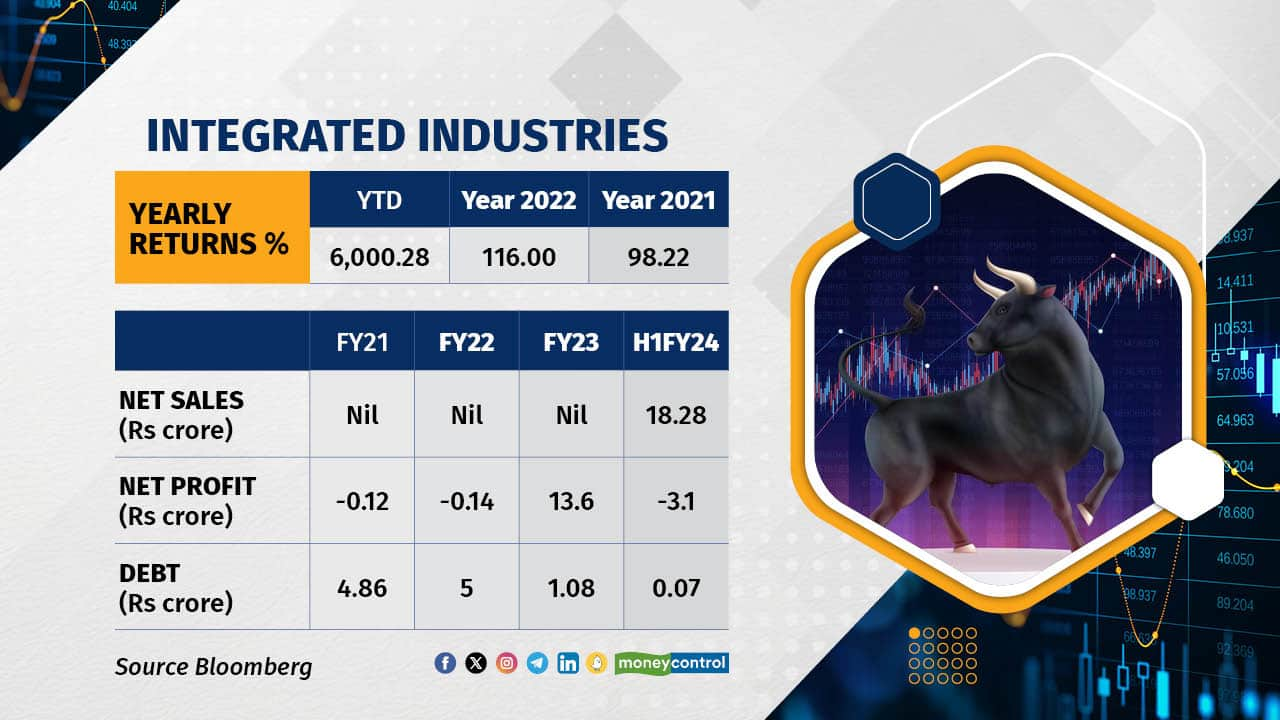

Integrated Industries Ltd has emerged as the top wealth creator of 2023, soaring over 6,000 percent from Rs 7.23 to Rs 441 a share. Specialising in food products, it offers organic, inorganic, and bakery items. Despite nine years of zero revenue and losses, the company reported revenue and profits in the June and September 2023 quarters. Its total debt also considerably declined from Rs 5 crore in FY22 to Rs1.08 crore in FY23. As of September, its debt stood at Rs 70 lakh. Notably, it acquired Nurture Well Foods Pvt Ltd, gaining a biscuit manufacturing plant in Neemrana, Rajasthan, and a Sharjah-based subsidiary, Nurture Well LLC, though the acquisition amounts remain undisclosed. The firm recently announced the issuance of 2.05 million warrants at Rs 366 crore, with participation from the Manan Garg promoter group and Pirmus Overseas Pvt Ltd.

Integrated Industries Ltd has emerged as the top wealth creator of 2023, soaring over 6,000 percent from Rs 7.23 to Rs 441 a share. Specialising in food products, it offers organic, inorganic, and bakery items. Despite nine years of zero revenue and losses, the company reported revenue and profits in the June and September 2023 quarters. Its total debt also considerably declined from Rs 5 crore in FY22 to Rs1.08 crore in FY23. As of September, its debt stood at Rs 70 lakh. Notably, it acquired Nurture Well Foods Pvt Ltd, gaining a biscuit manufacturing plant in Neemrana, Rajasthan, and a Sharjah-based subsidiary, Nurture Well LLC, though the acquisition amounts remain undisclosed. The firm recently announced the issuance of 2.05 million warrants at Rs 366 crore, with participation from the Manan Garg promoter group and Pirmus Overseas Pvt Ltd.

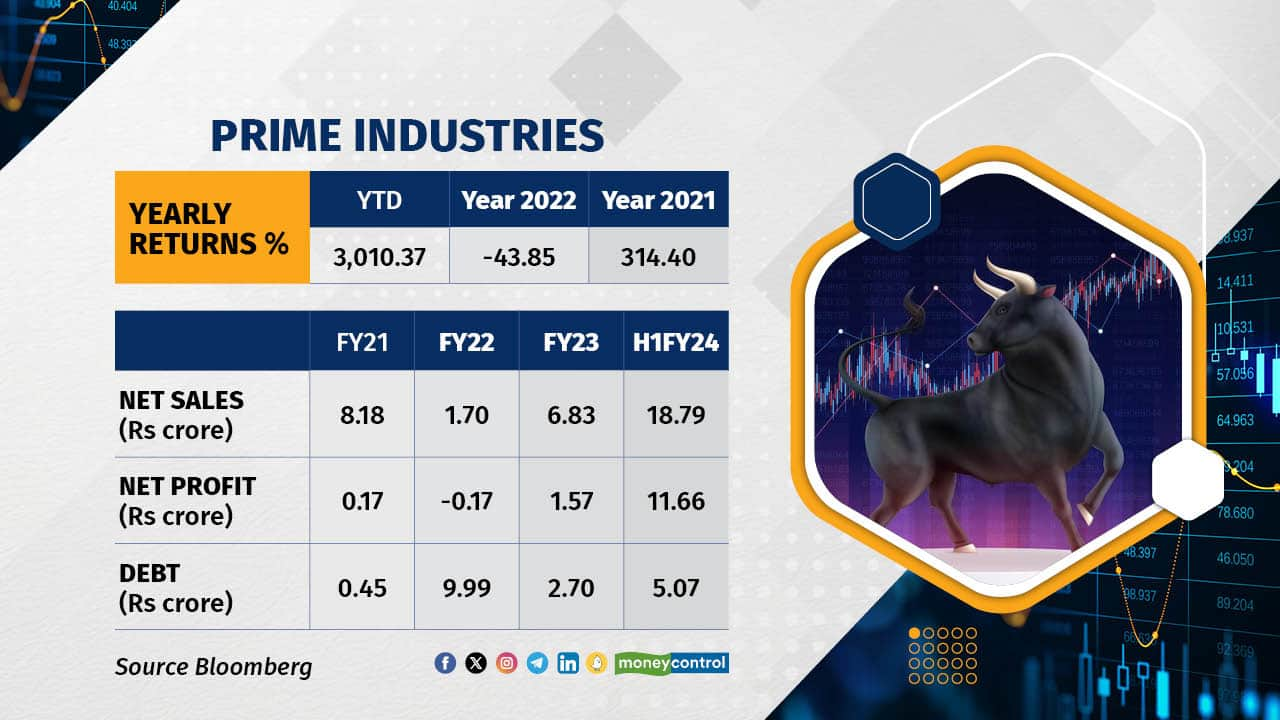

Prime Industries Ltd ranks as the second-highest surging stock of 2023, boasting a gain of over 3000 percent. Specialising in tissue and paper-based products like napkins, paper towels, and wet wipes, the company’s stock has continued to rise due to improved earnings. Its revenue surged from Rs 1.7 crore in FY22 to Rs 6.83 crore in FY23, reaching Rs 18.79 crore for the six months ending September 2023. While it reported a net loss of Rs 17 lakh in FY22, it turned profitable with a net profit of Rs 1.57 crore in FY23 and Rs 11.66 crore for the six months ending September. The company also pared its debt from Rs 9.99 crore in FY22 to Rs 5 crore in the September quarter of FY24.

Prime Industries Ltd ranks as the second-highest surging stock of 2023, boasting a gain of over 3000 percent. Specialising in tissue and paper-based products like napkins, paper towels, and wet wipes, the company’s stock has continued to rise due to improved earnings. Its revenue surged from Rs 1.7 crore in FY22 to Rs 6.83 crore in FY23, reaching Rs 18.79 crore for the six months ending September 2023. While it reported a net loss of Rs 17 lakh in FY22, it turned profitable with a net profit of Rs 1.57 crore in FY23 and Rs 11.66 crore for the six months ending September. The company also pared its debt from Rs 9.99 crore in FY22 to Rs 5 crore in the September quarter of FY24.

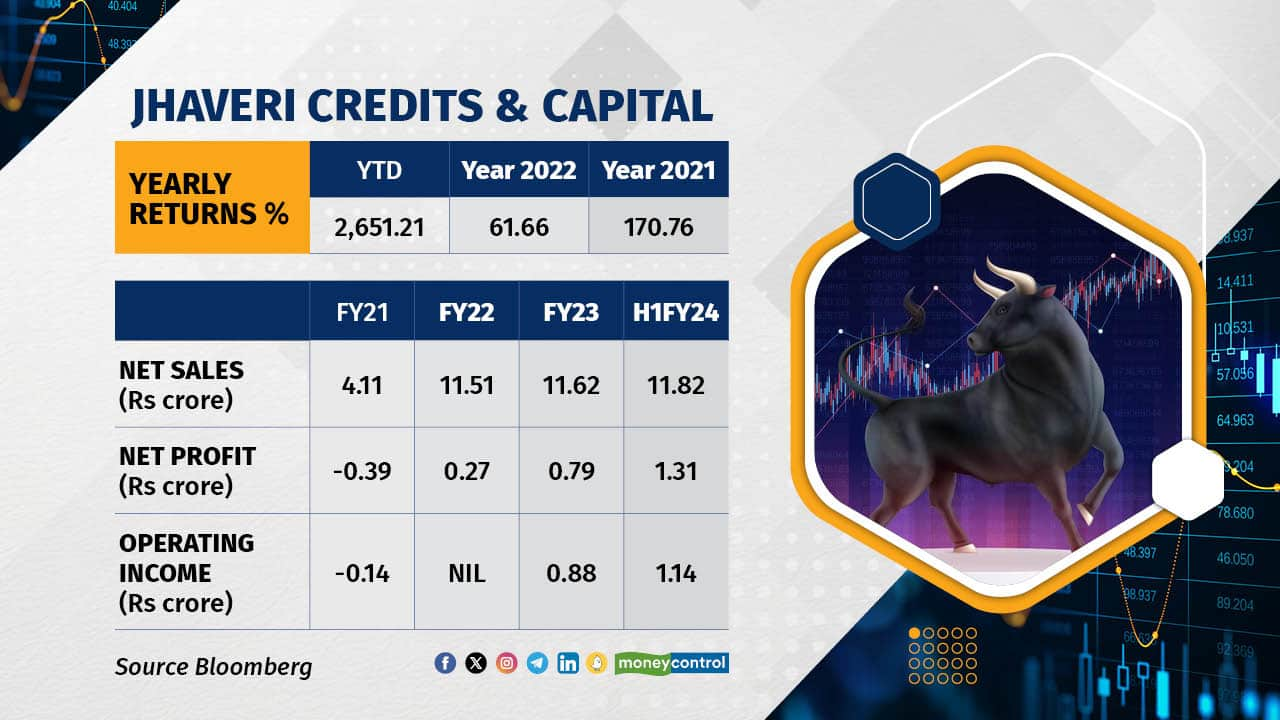

Jhaveri Credits & Capital Ltd surged by over 2,650 percent in 2023 — from Rs 10.33 to Rs 284. The company specialises in commodities broking, providing a platform for clients to trade commodities on various exchanges — present, spot, and future dealings. It holds broking memberships with exchanges such as National Commodity and Derivatives Exchange Ltd, MCX, and NSEL. Associated with the Jhaveri group, it offers financial advisory services in mutual funds, initial public offerings, fixed deposits, and insurance. The stock surge can be attributed to improving earnings, with revenue rising consistently to Rs 4.11 crore, Rs 11.51 crore, and Rs 11.62 crore in FY21, FY22, and FY23, respectively. Revenue for the six months ending September 2023 stood at Rs 11.82 crore. Though it reported a net loss of Rs 39 crore in FY21, the company clocked net profit of Rs 27 lakh, Rs 79 lakh, and Rs 1.31 crore in FY22, FY23, and the six months ending September 2023, respectively.

Jhaveri Credits & Capital Ltd surged by over 2,650 percent in 2023 — from Rs 10.33 to Rs 284. The company specialises in commodities broking, providing a platform for clients to trade commodities on various exchanges — present, spot, and future dealings. It holds broking memberships with exchanges such as National Commodity and Derivatives Exchange Ltd, MCX, and NSEL. Associated with the Jhaveri group, it offers financial advisory services in mutual funds, initial public offerings, fixed deposits, and insurance. The stock surge can be attributed to improving earnings, with revenue rising consistently to Rs 4.11 crore, Rs 11.51 crore, and Rs 11.62 crore in FY21, FY22, and FY23, respectively. Revenue for the six months ending September 2023 stood at Rs 11.82 crore. Though it reported a net loss of Rs 39 crore in FY21, the company clocked net profit of Rs 27 lakh, Rs 79 lakh, and Rs 1.31 crore in FY22, FY23, and the six months ending September 2023, respectively.

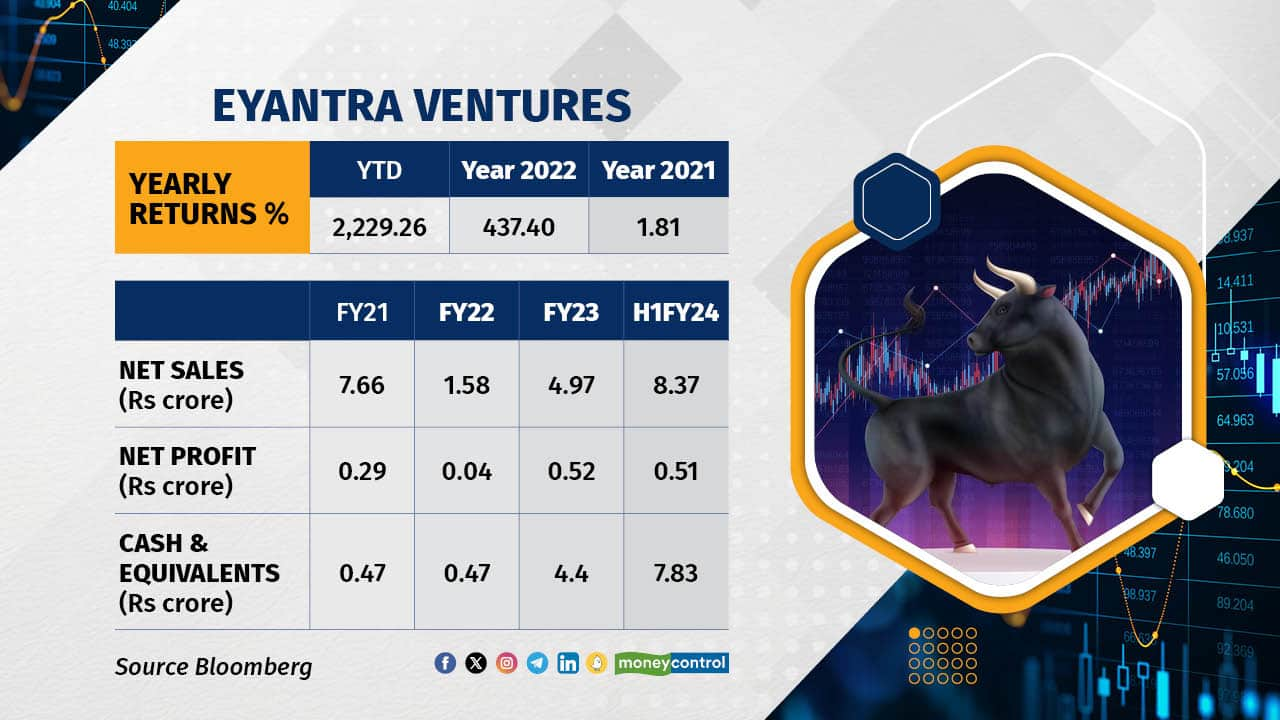

Eyantra Ventures Ltd surged by over 2,230 percent in 2023, leaping from Rs 17.6 to Rs 410 a share. The company specialises in trading jewellery and deals with rough and polished diamonds. Reporting a revenue of Rs 5 crore in FY23 and Rs 8.37 crore for the six months ending September 2023, it attained net profits of Rs 52 lakh and 51 lakh respectively. With just four permanent employees, the managing director, Vinita Raj Narayananm, holding a 73 percent stake, took no salary in FY23. Eyantra acquired Prismberry Technologies Pvt Ltd for Rs 4.2 crore in August.

Eyantra Ventures Ltd surged by over 2,230 percent in 2023, leaping from Rs 17.6 to Rs 410 a share. The company specialises in trading jewellery and deals with rough and polished diamonds. Reporting a revenue of Rs 5 crore in FY23 and Rs 8.37 crore for the six months ending September 2023, it attained net profits of Rs 52 lakh and 51 lakh respectively. With just four permanent employees, the managing director, Vinita Raj Narayananm, holding a 73 percent stake, took no salary in FY23. Eyantra acquired Prismberry Technologies Pvt Ltd for Rs 4.2 crore in August.

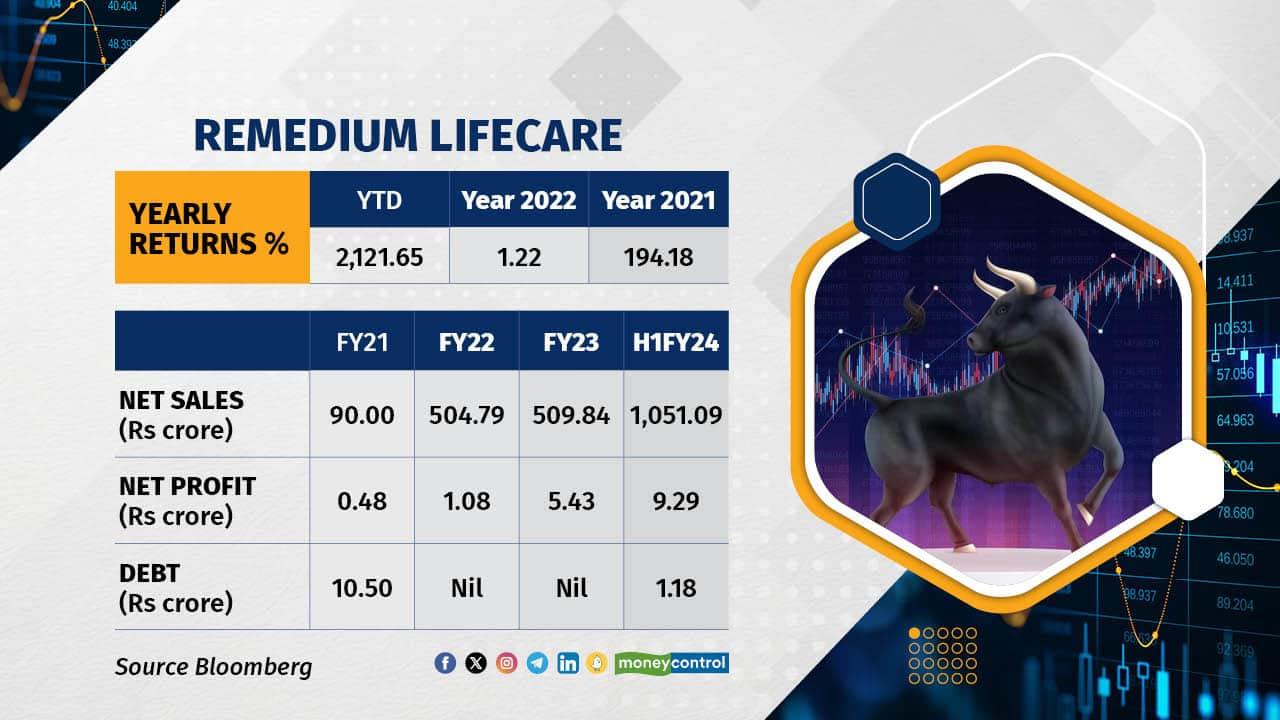

Remedium Lifecare Ltd has surged by an impressive 2,120 percent in 2023, skyrocketing from Rs 25.13 to Rs 558 a share. Specialising in manufacturing and trading atmospheric water generating machines, the company has been listed on the BSE since 2017, consistently delivering positive returns. Its revenue soared from Rs 2.89 crore in FY20 to Rs 509.84 crore in FY23, reaching Rs 1051.09 crore for the six months ending September 2023. Similarly, its net profit surged from Rs 28 lakh in FY20 to Rs 5.43 crore in FY23, reaching Rs 9.3 crore for the six months ending September 2023. The company managed to reduce its debt significantly, lowering it to Rs 1.18 crore as of September 2023 from Rs 10.50 crore in FY21.

Remedium Lifecare Ltd has surged by an impressive 2,120 percent in 2023, skyrocketing from Rs 25.13 to Rs 558 a share. Specialising in manufacturing and trading atmospheric water generating machines, the company has been listed on the BSE since 2017, consistently delivering positive returns. Its revenue soared from Rs 2.89 crore in FY20 to Rs 509.84 crore in FY23, reaching Rs 1051.09 crore for the six months ending September 2023. Similarly, its net profit surged from Rs 28 lakh in FY20 to Rs 5.43 crore in FY23, reaching Rs 9.3 crore for the six months ending September 2023. The company managed to reduce its debt significantly, lowering it to Rs 1.18 crore as of September 2023 from Rs 10.50 crore in FY21.

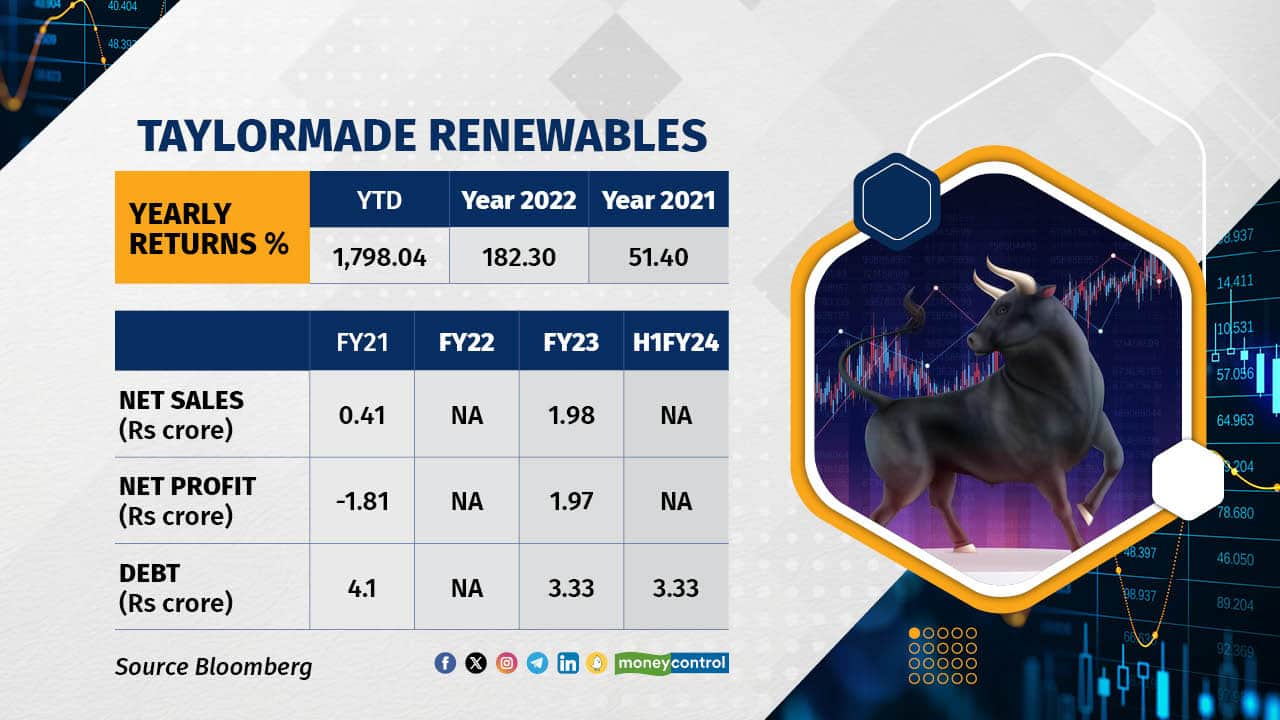

In 2023, Taylormade Renewables surged nearly 1,800 percent, climbing from Rs 38.25 to Rs 726. Specialising in solar energy equipment, the company offers products like photovoltaics, heat pumps, and biomass gasifiers. Their FY23 report highlighted optimism in the electricity-generation sector with growing opportunities for financial products, emphasising the shift towards renewable energy over fossil fuels. Revenue rose from Rs 41 lakh in FY21 to Rs 19.79 crore in FY23, leading to a transition from a Rs 1.81 crore net loss in FY21 to a Rs 1.97 crore net profit in FY23. The company reduced its debt to Rs 3.33 crore in FY23 from Rs 4.1 crore in FY21.

In 2023, Taylormade Renewables surged nearly 1,800 percent, climbing from Rs 38.25 to Rs 726. Specialising in solar energy equipment, the company offers products like photovoltaics, heat pumps, and biomass gasifiers. Their FY23 report highlighted optimism in the electricity-generation sector with growing opportunities for financial products, emphasising the shift towards renewable energy over fossil fuels. Revenue rose from Rs 41 lakh in FY21 to Rs 19.79 crore in FY23, leading to a transition from a Rs 1.81 crore net loss in FY21 to a Rs 1.97 crore net profit in FY23. The company reduced its debt to Rs 3.33 crore in FY23 from Rs 4.1 crore in FY21.

SG Mart Ltd surged by over 1,725 percent in 2023, reaching Rs 7,681 from Rs 420 per share. Specialising in renewable energy generation, the company operates solar and wind energy projects. It also expanded into B2B trading of building materials and was appointing channel partners for construction penetration. While the financial year 2022-23 saw a remarkable 319 percent rise in gross revenue to Rs2.58 crore, there was a 35 percent EBITDA decrease to Rs26.71 lakhs and a 34 percent net profit decline to Rs19.71 lakhs. Despite this, the company remains optimistic about the real estate sector’s resurgence, expecting improved business performance with reduced inflationary pressures. Reporting revenues of Rs 50.62 crore (September quarter) and Rs 15.09 crore (June quarter), it achieved net profits of Rs 9 crore and Rs 1.28 crore, respectively, during these periods.

SG Mart Ltd surged by over 1,725 percent in 2023, reaching Rs 7,681 from Rs 420 per share. Specialising in renewable energy generation, the company operates solar and wind energy projects. It also expanded into B2B trading of building materials and was appointing channel partners for construction penetration. While the financial year 2022-23 saw a remarkable 319 percent rise in gross revenue to Rs2.58 crore, there was a 35 percent EBITDA decrease to Rs26.71 lakhs and a 34 percent net profit decline to Rs19.71 lakhs. Despite this, the company remains optimistic about the real estate sector’s resurgence, expecting improved business performance with reduced inflationary pressures. Reporting revenues of Rs 50.62 crore (September quarter) and Rs 15.09 crore (June quarter), it achieved net profits of Rs 9 crore and Rs 1.28 crore, respectively, during these periods.

Story continues below Advertisement

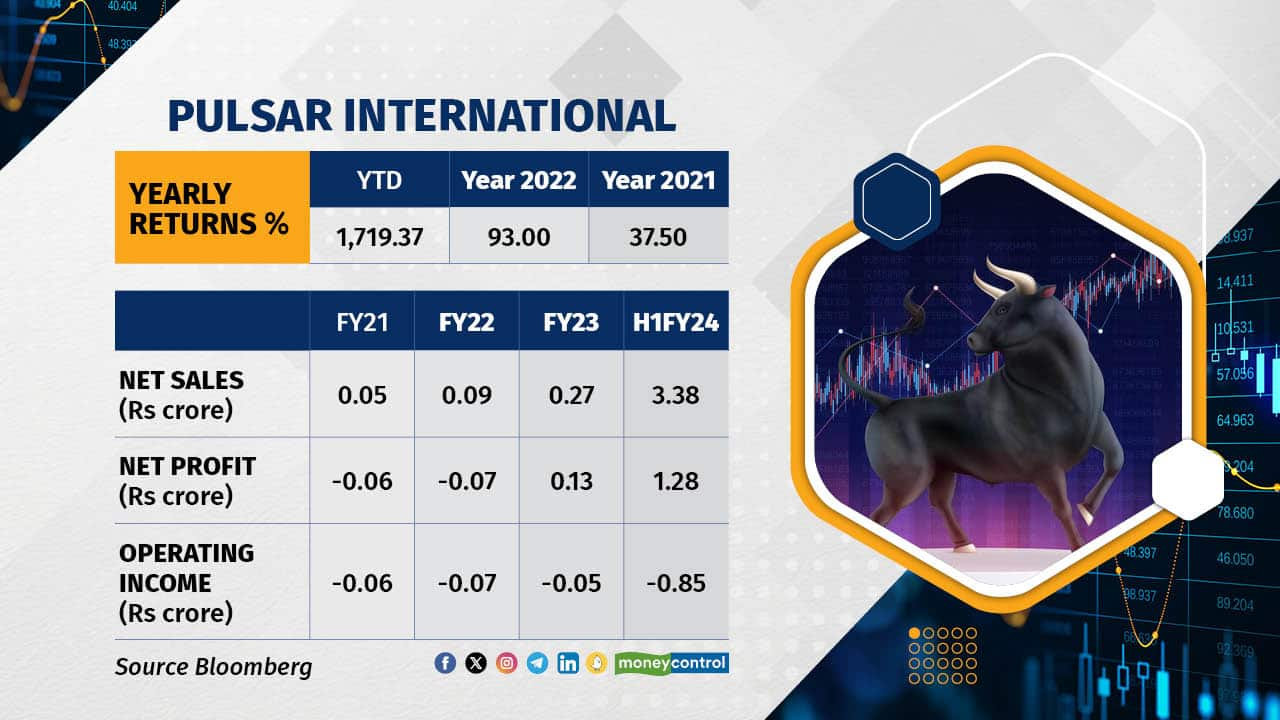

Pulsar International Ltd saw a surge of over 1720% in 2023, rising to Rs 70 per share from Rs 3.82 a share. Engaged in buying, selling, and dealing in various industrial and consumer goods, the company deals with materials such as chemicals, pesticides, petrochemicals, and pharmaceutical products in India and beyond. It also operates in processing, marketing, and trading of agro, agricultural, and food products. Despite continuous losses since FY18, FY23 marked a turnaround with a profit of Rs 13 lakh and revenue of Rs 27 lakh. For the six months ended, it reported revenue of Rs 3.38 crore and a profit of Rs 1.28 crore.

Pulsar International Ltd saw a surge of over 1720% in 2023, rising to Rs 70 per share from Rs 3.82 a share. Engaged in buying, selling, and dealing in various industrial and consumer goods, the company deals with materials such as chemicals, pesticides, petrochemicals, and pharmaceutical products in India and beyond. It also operates in processing, marketing, and trading of agro, agricultural, and food products. Despite continuous losses since FY18, FY23 marked a turnaround with a profit of Rs 13 lakh and revenue of Rs 27 lakh. For the six months ended, it reported revenue of Rs 3.38 crore and a profit of Rs 1.28 crore.

Tine Agro Ltd surged over 1,120 percent in 2023, rising to Rs 123 a share from Rs 10 at the year’s start. Functioning as an agriculture and commodity company, it focuses on developing agriculture, forest resources, and cultivating various plants. Its revenue declined from Rs 11.27 crore in FY22 to Rs 7.7 crore in FY23, with net profit of Rs 10 lakh each in FY22 and FY23. For the six months ended September 2023, it reported revenue of Rs 10.12 crore and a net profit of Rs 33 lakh. The company managed to reduce its debt to Rs 10 lakh from Rs 1.03 crore in FY21. Sykes and Ray Equities India recently acquired around a 3 percent stake in the company at an average cost of Rs 47 a share.

Tine Agro Ltd surged over 1,120 percent in 2023, rising to Rs 123 a share from Rs 10 at the year’s start. Functioning as an agriculture and commodity company, it focuses on developing agriculture, forest resources, and cultivating various plants. Its revenue declined from Rs 11.27 crore in FY22 to Rs 7.7 crore in FY23, with net profit of Rs 10 lakh each in FY22 and FY23. For the six months ended September 2023, it reported revenue of Rs 10.12 crore and a net profit of Rs 33 lakh. The company managed to reduce its debt to Rs 10 lakh from Rs 1.03 crore in FY21. Sykes and Ray Equities India recently acquired around a 3 percent stake in the company at an average cost of Rs 47 a share.

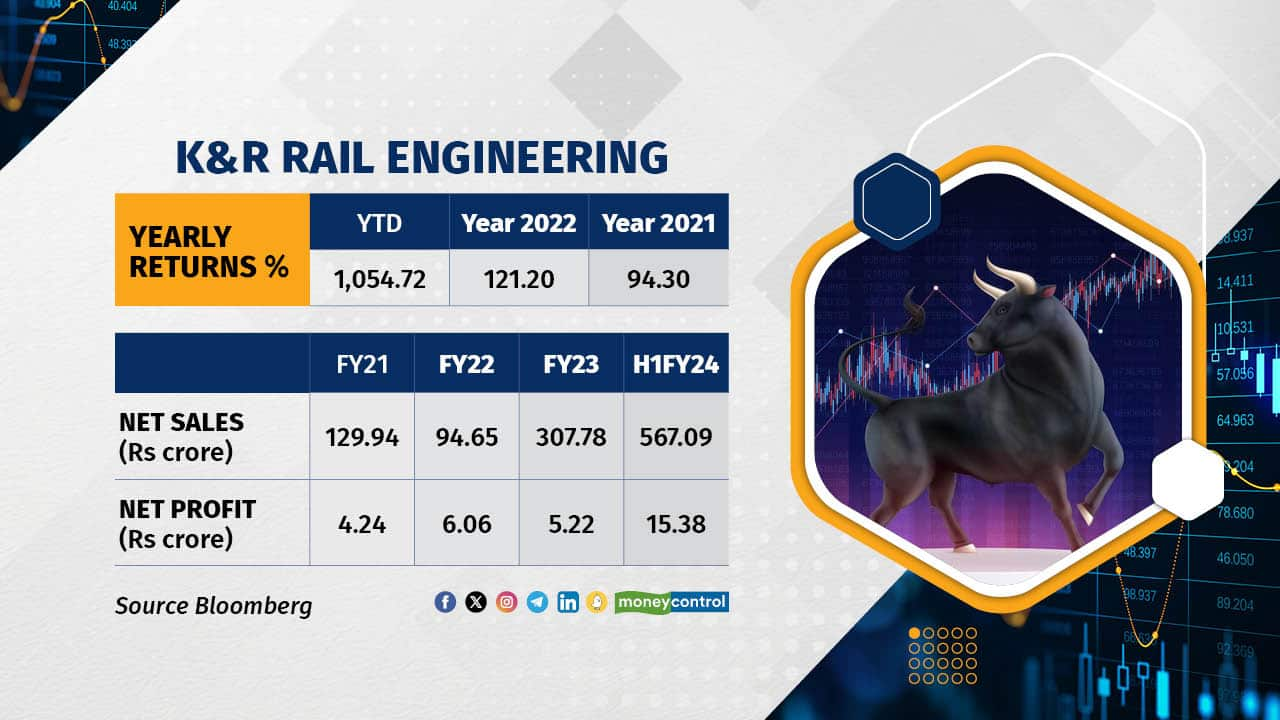

K&R Rail Engineering surged over 1,055 percent, rising from Rs 63 to Rs 728 a share. A leading railway construction company, K&R offers comprehensive EPCC services encompassing various rail construction segments like earthworks, bridges, track works, OHE, signalling and telecommunication, serving clients such as JSW, NTPC and Tata Projects. Its revenue grew consistently from Rs 130 crore in FY21 to Rs 308 crore in FY23, reaching Rs 567 crore for the six months ending September 30, 2023. Its net profit increased from Rs 4.24 crore in FY21 to Rs 5.2 crore in FY23 and Rs 15.38 crore for the six months ending September 30, 2023. Its total debt, however, rose from Rs 6.27 crore to Rs 14.25 crore as of the September quarter of FY24. Recently, K&R Rail Engineering signed an MoU for executing the world’s longest cable car project in Nepal, estimated at half a billion US dollars, connecting the Muktinath Temple in Gandaki province.

K&R Rail Engineering surged over 1,055 percent, rising from Rs 63 to Rs 728 a share. A leading railway construction company, K&R offers comprehensive EPCC services encompassing various rail construction segments like earthworks, bridges, track works, OHE, signalling and telecommunication, serving clients such as JSW, NTPC and Tata Projects. Its revenue grew consistently from Rs 130 crore in FY21 to Rs 308 crore in FY23, reaching Rs 567 crore for the six months ending September 30, 2023. Its net profit increased from Rs 4.24 crore in FY21 to Rs 5.2 crore in FY23 and Rs 15.38 crore for the six months ending September 30, 2023. Its total debt, however, rose from Rs 6.27 crore to Rs 14.25 crore as of the September quarter of FY24. Recently, K&R Rail Engineering signed an MoU for executing the world’s longest cable car project in Nepal, estimated at half a billion US dollars, connecting the Muktinath Temple in Gandaki province.