Trade setup for Friday: 14 things to know before opening bell

Nifty seems marching towards 21,500 in coming days

The market made a remarkable journey on December 14, coming back strongly after six-day consolidation and climbed to a new high on the benchmark indices as well as Bank Nifty. Given the strong momentum and holding 20,850 as a strong support in the past six days on closing basis, the Nifty50 is likely march towards 21,400-21,500 levels in coming sessions with sector rotation support, experts said.

On December 14, the BSE Sensex hit 70,500 levels for the first time, rising 930 points to 70,514 after dovish commentary by the Federal Chair Jerome Powell, while the Nifty 50 hit a new high of 21,211 and closed at new all-time high of 21,183, up 256 points. The index has formed bullish candlestick pattern on the daily charts, after strong gap up opening.

After the formation of long legged Doji type candle pattern on Wednesday, the market seems to have witnessed a decisive upside breakout on Thursday. The significant opening upside gap of recent session remains intact. If Thursday’s upside gap doesn’t get filled in the next 2-3 sessions, then one may presume Nifty in a middle of a sharp uptrend,” Nagaraj Shetti, senior technical research analyst, HDFC Securities said.

Normally, such unfilled crucial upside gaps middle of uptrend are considered as a bullish runaway gaps.

He believes there is a possibility of Nifty reaching towards the important resistance of 21,550 levels-78.6 percent Fibonacci extension (taken from March bottom, September top and October bottom) in the coming week. “Immediate support is placed at 21,050 levels.

Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas, also feels the momentum setup also suggests continuation of the current upmove. Thus, both price and momentum are suggesting continuation of the current upmove, he said.

The broader markets continued northward journey with the Nifty Midcap 100 and Smallcap 100 indices rising 1.3 percent and 0.9 percent. respectively.

Story continues below Advertisement

We have collated 14 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,208 followed by 21,240 and 21,293, while on the lower side, it can take support at 21,104 followed by 21,072 and 21,020 levels.

On December 14, the Bank Nifty also had a strong day after Fed meeting outcome, and hit a new high of 47,944. The index jumped 640 points or 1.36 percent to 47,732 and formed bullish candlestick pattern with long upper shadow on the daily charts, indicating some profit taking at higher levels.

“The overall market sentiment remains bullish, and any temporary declines are considered buying opportunities, with a strong support level identified at 47,000,” Kunal Shah, senior technical & derivative analyst at LKP Securities said.

He feels the ongoing momentum is expected to be driven by active participation from both private and PSU banks, propelling the Bank Nifty index towards the 50,000 mark.

As per the pivot point calculator, the index is expected to see resistance at 47,894, followed by 47,996 and 48,162, while on the lower side, it may take support at 47,564, followed by 47,462 and 47,296.

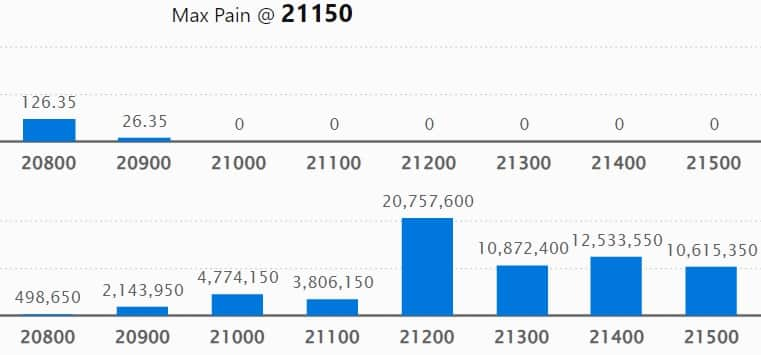

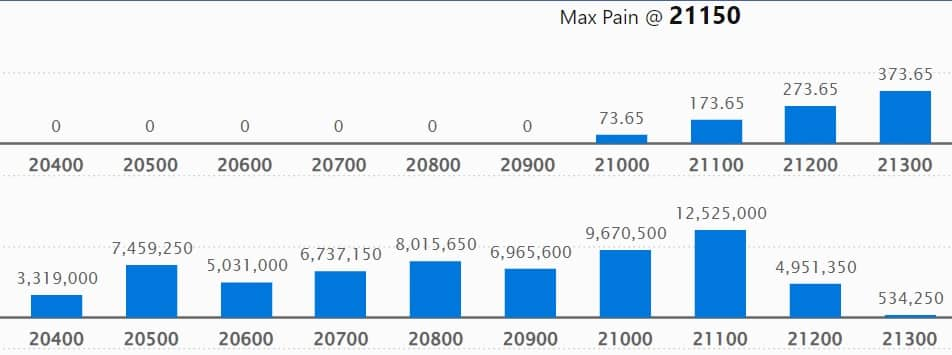

With the stellar run on the weekly expiry day, the support and resistance levels shifted higher. On the Call side, the 21,200 strike owned the maximum open interest (OI), with 2.07 crore contracts, which can act as a key resistance level for the Nifty.

It was followed by the 21,400 strike, which had 1.25 crore contracts, while the 21,300 strike had 1.08 crore contracts.

Meaningful Call writing was seen at the 21,200 strike, which added 1.09 crore contracts followed by 21,400 and 21,300 strikes, which added 80.69 lakh and 46.3 lakh contracts.

The maximum Call unwinding was at the 21,000 strike, which shed 1.14 crore contracts followed by 20,900 and 21,100 strikes, which shed 70.24 lakh and 68.14 lakh contracts.

On the Put front, the 21,100 strike has the maximum open interest, which can act as a key support area for the Nifty, with 1.25 crore contracts. It was followed by 21,000 strike comprising 96.7 lakh contracts and 20,800 strike with 80.15 lakh contracts.

Meaningful Put writing was at 21,100 strike, which added 1.2 crore contracts followed by 21,000 strike and 21,200 strike, which added 59.63 lakh contracts and 44.84 lakh contracts.

Put unwinding was at 20,500 strike, which shed 26.56 lakh contracts followed by 20,600 strike, which shed 22.43 lakh contracts and 20,900 strike which shed 20.5 lakh contracts.

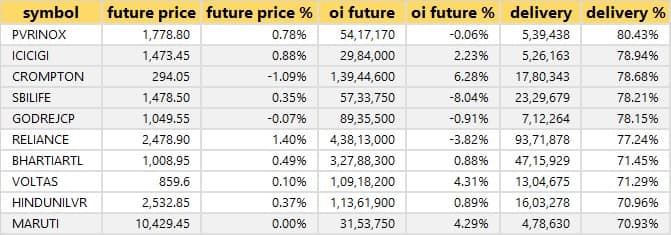

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. PVR INOX, ICICI Lombard General Insurance Company, Crompton Greaves Consumer Electricals, SBI Life Insurance Company, and Godrej Consumer Products saw the highest delivery among the F&O stocks.

A long build-up was seen in 69 stocks, which included SAIL, Manappuram Finance, Apollo Tyres, Exide Industries, and Mphasis. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 20 stocks saw long unwinding, including Dr Reddy’s Laboratories, GMR Airports Infrastructure, Zee Entertainment Enterprises, Bajaj Auto, and Siemens. A decline in OI and price indicates long unwinding.

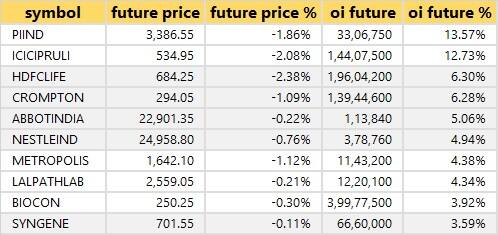

21 stocks see a short build-up

A short build-up was seen in 21 stocks, which were PI Industries, ICICI Prudential Life Insurance Company, HDFC Life Insurance Company, Crompton Greaves Consumer Electricals, and Abbott India. An increase in OI along with a fall in price points to a build-up of short positions.

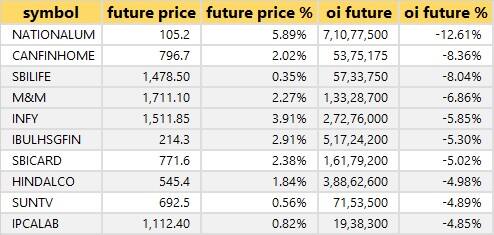

Based on the OI percentage, 77 stocks were on the short-covering list. These include National Aluminium Company, Can Fin Homes, SBI Life Insurance Company, Mahindra & Mahindra, and Infosys. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, climbed above the 1 mark, to 1.37 on December 14, from 0.96 levels in the previous session. The above 1 PCR indicates that the traders are buying more Put options than Calls, which generally indicates an increase in bearish sentiment.

For more bulk deals, click here

Stocks in the news

Hero MotoCorp: The country’s largest two-wheeler maker will be buying additional stake in associate company Ather Energy from existing shareholder, for up to Rs 140 crore. Further, Hero has appointed Vivek Anand as the Chief Financial Officer (CFO), with effective from March 1, 2024.

State Bank of India: The country’s largest public sector lender has executed transactions documents for purchase of 3,70,644 shares or 6.35 percent stake in Canpac Trends, which provides paper-based packaging solutions, for nearly Rs 50 crore. The stake will be bought at a price of Rs 1,349 per share.

PVR INOX: Plenty Private Group & Multiples Private Group are likely to sell 2.33 percent stake in the multiplex chain, the CNBC-TV18 reported quoting sources. The offer price may be in the range of Rs 1,750-1,769.5 per share, and the offer size may be at Rs 404.5 crore.

M&M Financial Services: The non-banking finance company said it has received approval from the Board of Directors for entering in the areas of life, health and general insurance – both group and individual.

Texmaco Rail Engineering: The Ministry of Railways has awarded an order to the company for manufacture and supply of 3,400 BOXNS wagons valuing Rs 1,374.41 crore.

PB Fintech: The Income Tax officials visited Paisabazaar Marketing and Consulting, a wholly owned subsidiary and PB Fintech during December 13 & 14, and enquired about certain vendors of Paisabazaar.

Funds Flow (Rs Crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 3,570.07 crore, while domestic institutional investors (DIIs) purchased Rs 553.17 crore worth of stocks on December 14, provisional data from the National Stock Exchange (NSE) showed.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.