Here are the 10 biggest wealth-destroyers of 2023, do you own any?

caution is advised as picking such stocks is risky and challenging. It’s akin to finding a needle in a haystack

In 2023, despite the Indian markets doing well, Moneycontrol research found 10 stocks that fell over 95 percent, severely impacting investor wealth. These stocks, considered penny stocks, draw investors due to low investment requirements and high-profit potential. However, caution is advised as picking such stocks is risky and challenging. It’s akin to finding a needle in a haystack. Here’s the list of 10 stocks that caused significant wealth destruction for investors.

In 2023, despite the Indian markets doing well, Moneycontrol research found 10 stocks that fell over 95 percent, severely impacting investor wealth. These stocks, considered penny stocks, draw investors due to low investment requirements and high-profit potential. However, caution is advised as picking such stocks is risky and challenging. It’s akin to finding a needle in a haystack. Here’s the list of 10 stocks that caused significant wealth destruction for investors.

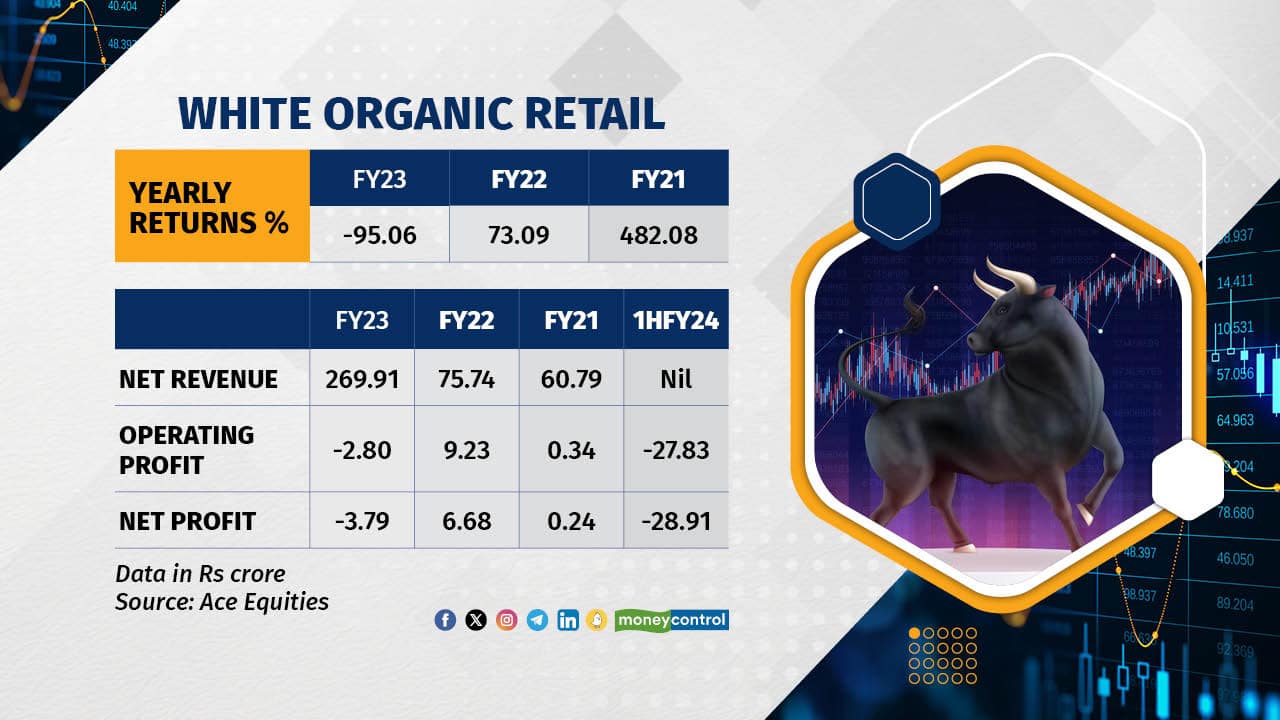

White Organic Retail, known for its organic products, has seen a staggering 95 percent drop in its shares in 2023, plummeting from Rs 151.8 to Rs 7.5 per share since the beginning of the year. The company, engaged in farming, distribution, and exports of aloe vera and moringa, faced losses in FY23 due to increased expenses in raw materials and selling/administration. With a loss of Rs 3.79 crore in FY23 and a significant Rs 29 crore loss in the first half of 2024, the company’s revenue surged to Rs 270 crore from Rs 76 crore in FY22, but recent quarters reported zero revenues.

White Organic Retail, known for its organic products, has seen a staggering 95 percent drop in its shares in 2023, plummeting from Rs 151.8 to Rs 7.5 per share since the beginning of the year. The company, engaged in farming, distribution, and exports of aloe vera and moringa, faced losses in FY23 due to increased expenses in raw materials and selling/administration. With a loss of Rs 3.79 crore in FY23 and a significant Rs 29 crore loss in the first half of 2024, the company’s revenue surged to Rs 270 crore from Rs 76 crore in FY22, but recent quarters reported zero revenues.

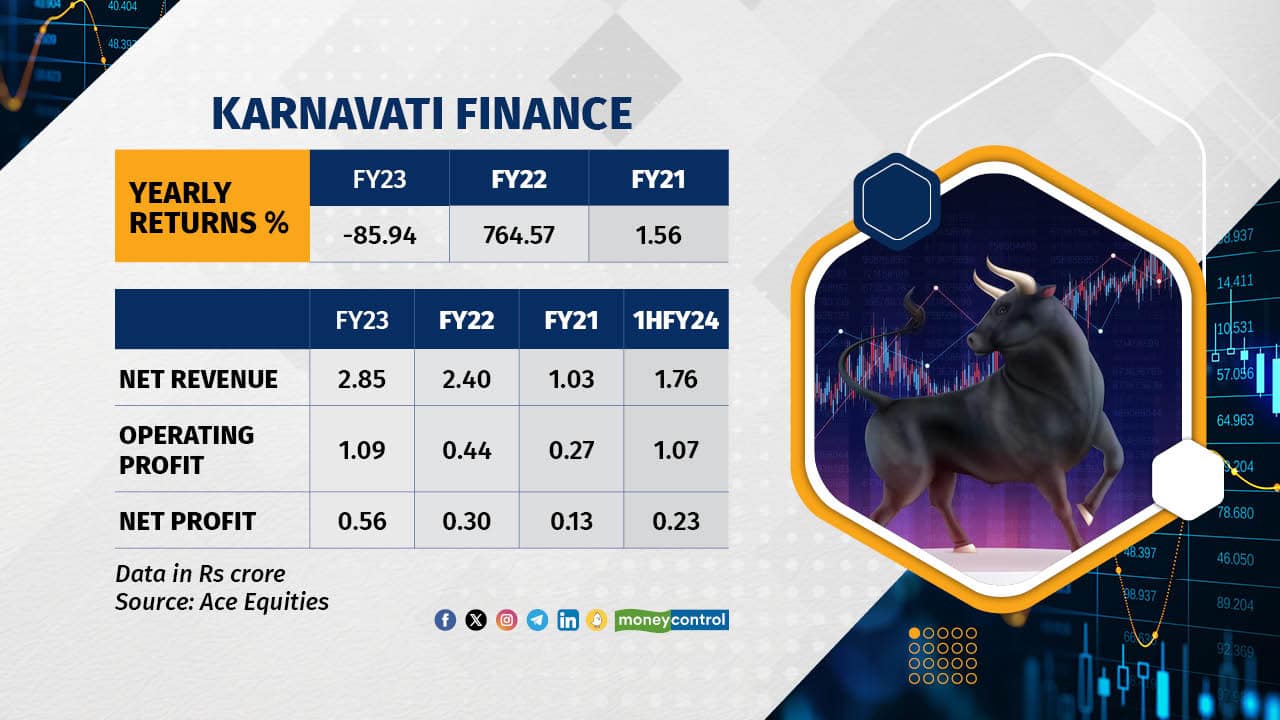

Karnavati Finance Ltd, which surged by 764 percent in 2022, turned into a wealth destroyer in 2023, plummeting by 86 percent to Rs 2.42 per share from Rs 17.21 per share. As a Non-Banking Finance Company (NBFC) registered with the RBI, KFL provides financial services like personal and business loans, vehicle loans, and money-changing services via an FFMC License. Despite doubling its revenue to Rs 2.40 crore and increasing net profit to Rs 30 lakh in FY22, FY23 saw revenue at Rs 2.85 crore and net profit at Rs 56 lakh. Notably, in the September quarter, revenue surged to Rs 1.19 crore from Rs 57 lakh in the previous quarter, with a net profit of Rs 59 lakh compared to a Rs 36 lakh loss.

Karnavati Finance Ltd, which surged by 764 percent in 2022, turned into a wealth destroyer in 2023, plummeting by 86 percent to Rs 2.42 per share from Rs 17.21 per share. As a Non-Banking Finance Company (NBFC) registered with the RBI, KFL provides financial services like personal and business loans, vehicle loans, and money-changing services via an FFMC License. Despite doubling its revenue to Rs 2.40 crore and increasing net profit to Rs 30 lakh in FY22, FY23 saw revenue at Rs 2.85 crore and net profit at Rs 56 lakh. Notably, in the September quarter, revenue surged to Rs 1.19 crore from Rs 57 lakh in the previous quarter, with a net profit of Rs 59 lakh compared to a Rs 36 lakh loss.

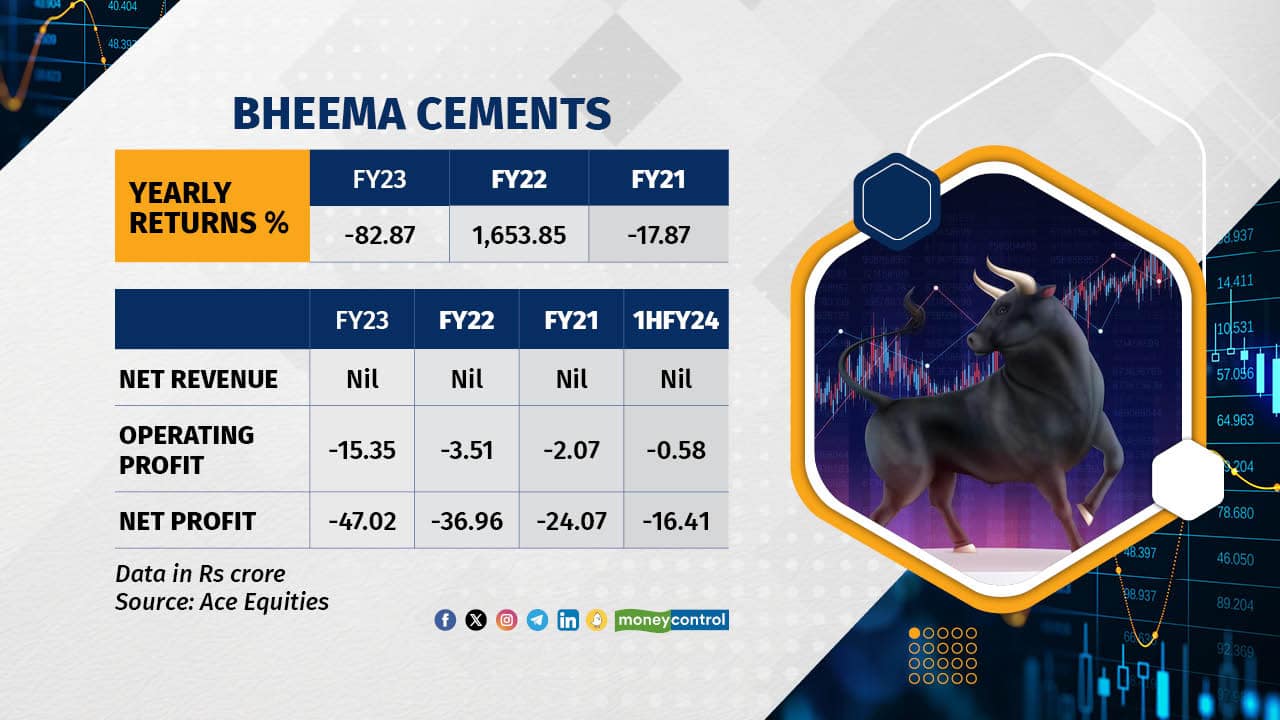

Bheema Cements, a once high-performing stock in 2022, has plummeted over 83 percent to Rs 27.34 from Rs 159.60 per share in 2023. Despite a massive 1650% surge previously, the company reported zero revenue and continuous losses over six years. In FY23, it incurred a loss of Rs 47 crore, up from Rs 37 crore the previous year, with a debt increase from Rs 178 crore to Rs 199 crore. Facing bankruptcy and repayment issues with lenders, efforts to revive the company are underway, as indicated by recent reports. The company has requested an extension for its FY23 annual general meeting, as stated in the latest BSE notice.

Bheema Cements, a once high-performing stock in 2022, has plummeted over 83 percent to Rs 27.34 from Rs 159.60 per share in 2023. Despite a massive 1650% surge previously, the company reported zero revenue and continuous losses over six years. In FY23, it incurred a loss of Rs 47 crore, up from Rs 37 crore the previous year, with a debt increase from Rs 178 crore to Rs 199 crore. Facing bankruptcy and repayment issues with lenders, efforts to revive the company are underway, as indicated by recent reports. The company has requested an extension for its FY23 annual general meeting, as stated in the latest BSE notice.

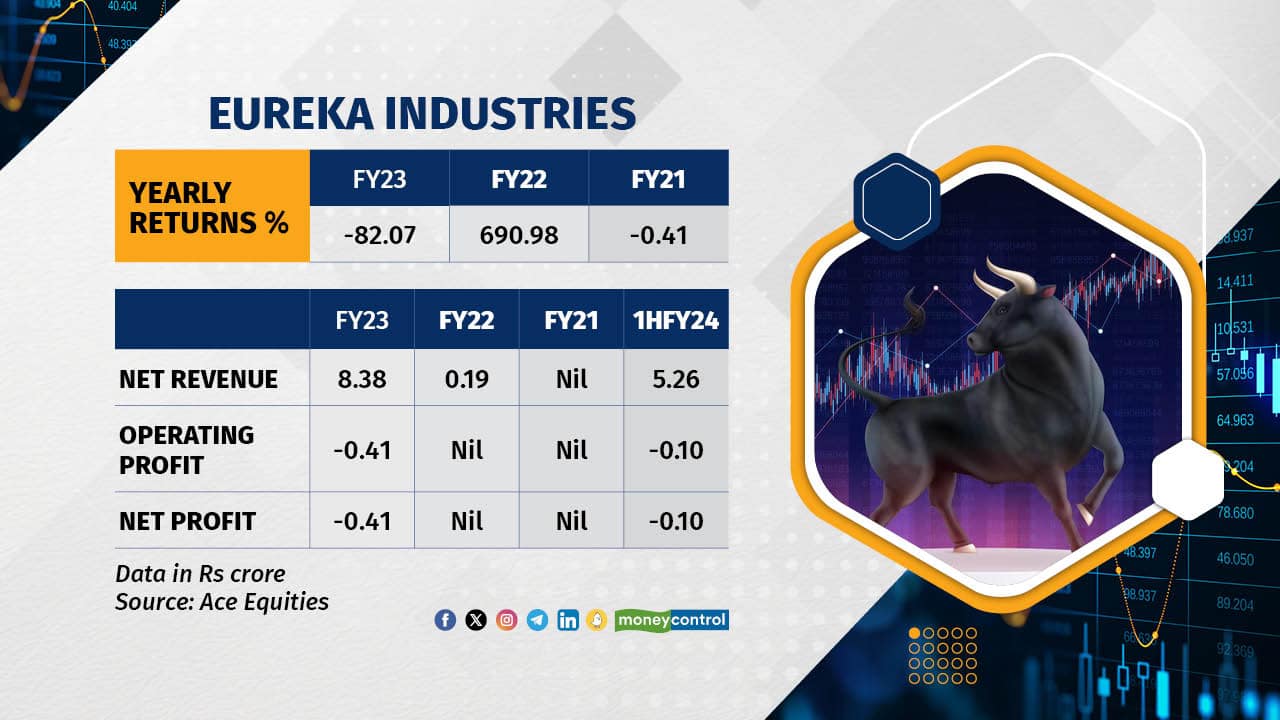

Eureka Industries Ltd, previously a high gainer at 690 percent in 2022, has drastically plummeted by 83 percent in 2023, trading at Rs 3.46 from Rs 19.3 per share. Specializing in cotton yarn, the company reported zero revenue and consistent losses since 2018. Revenue for FY23 improved to Rs 8.38 crore from Rs 19 lakh in FY22, with a six-month revenue of Rs 5.26 crore and a net loss of Rs 10 lakh. The firm’s total debt decreased to Rs 3.8 crore in FY23 from Rs 7.72 crore in FY22. The annual report states the company isn’t engaged in specific business operations, deriving its revenue from interest on investments.

Eureka Industries Ltd, previously a high gainer at 690 percent in 2022, has drastically plummeted by 83 percent in 2023, trading at Rs 3.46 from Rs 19.3 per share. Specializing in cotton yarn, the company reported zero revenue and consistent losses since 2018. Revenue for FY23 improved to Rs 8.38 crore from Rs 19 lakh in FY22, with a six-month revenue of Rs 5.26 crore and a net loss of Rs 10 lakh. The firm’s total debt decreased to Rs 3.8 crore in FY23 from Rs 7.72 crore in FY22. The annual report states the company isn’t engaged in specific business operations, deriving its revenue from interest on investments.

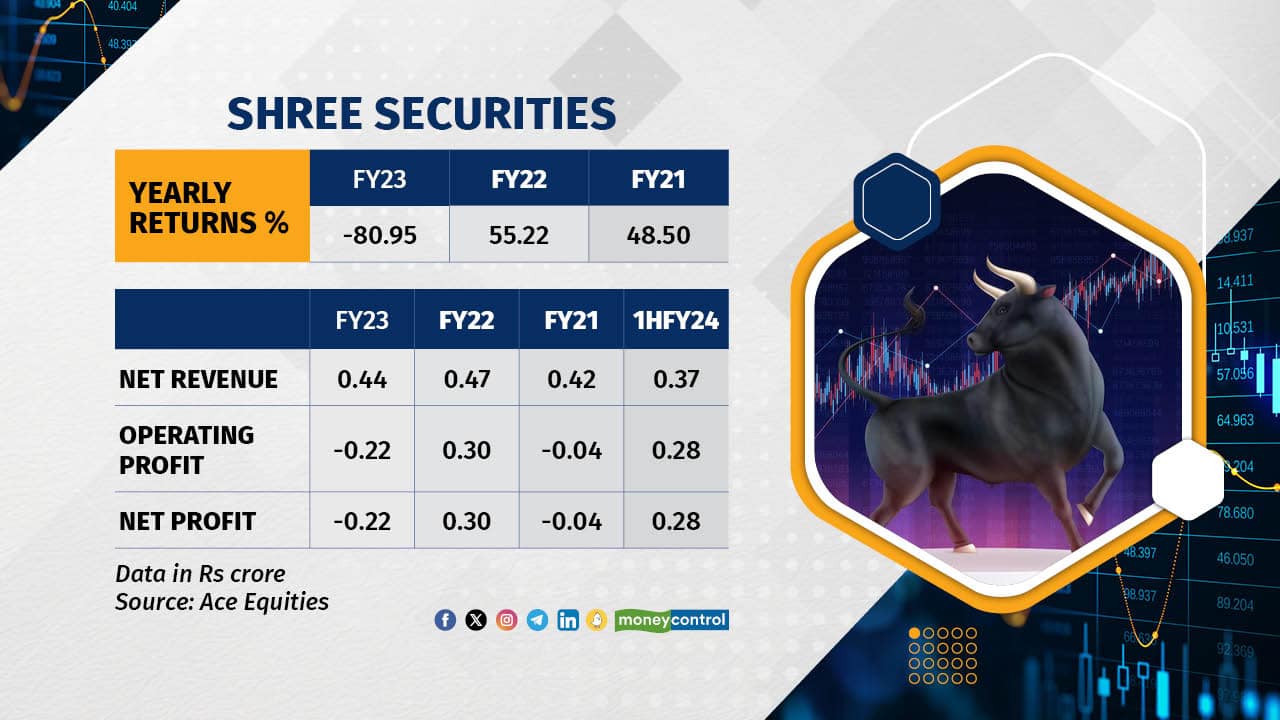

Shree Securities Ltd stock plunged by 81 percent in 2023, trading at Rs 0.44 from Rs 2.31 at the year’s start. The company, a Non-Banking Finance Company, primarily deals in Investing and Financing. In FY23, its revenue decreased by over 6 percent to Rs 44 lakh from Rs 47 lakh, resulting in a loss of Rs 22 lakh compared to net profit of Rs 30.3 lakh the previous year. In the six-month period, revenue rose by 44 percent to Rs 37 lakh, with a significant 83 percent increase in net profit to Rs 28 lakh.

Shree Securities Ltd stock plunged by 81 percent in 2023, trading at Rs 0.44 from Rs 2.31 at the year’s start. The company, a Non-Banking Finance Company, primarily deals in Investing and Financing. In FY23, its revenue decreased by over 6 percent to Rs 44 lakh from Rs 47 lakh, resulting in a loss of Rs 22 lakh compared to net profit of Rs 30.3 lakh the previous year. In the six-month period, revenue rose by 44 percent to Rs 37 lakh, with a significant 83 percent increase in net profit to Rs 28 lakh.

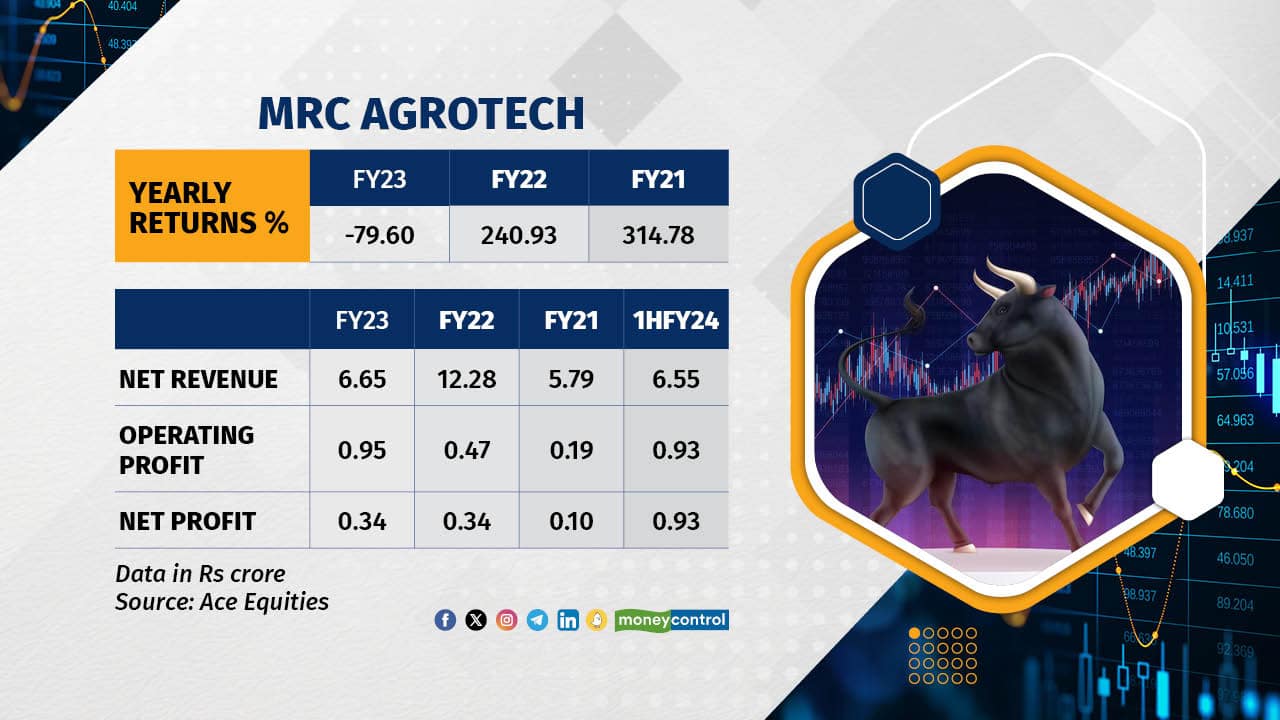

MRC Agrotech Ltd saw an 80% decline in 2023 after two consecutive years of significant gains (241% in 2022 and 314 percent in 2021). Functioning in agrotech, it provides knowledge, technologies, and business opportunities for farmers, traders, and investors. Recent news reports suggested deals with Dmart, Jio Mart, and a substantial Rs 85 crore deal with Sri Lanka, but the company denied involvement in such agreements. In FY23, it reported revenue of Rs 6.65 crore, down nearly 45 percent from a year ago while net profit stood at Rs 34 lakh in FY23. The firm notably reduced its debt to Rs 7 lakh as of September 2023 from Rs 75 lakh in FY22.

MRC Agrotech Ltd saw an 80% decline in 2023 after two consecutive years of significant gains (241% in 2022 and 314 percent in 2021). Functioning in agrotech, it provides knowledge, technologies, and business opportunities for farmers, traders, and investors. Recent news reports suggested deals with Dmart, Jio Mart, and a substantial Rs 85 crore deal with Sri Lanka, but the company denied involvement in such agreements. In FY23, it reported revenue of Rs 6.65 crore, down nearly 45 percent from a year ago while net profit stood at Rs 34 lakh in FY23. The firm notably reduced its debt to Rs 7 lakh as of September 2023 from Rs 75 lakh in FY22.

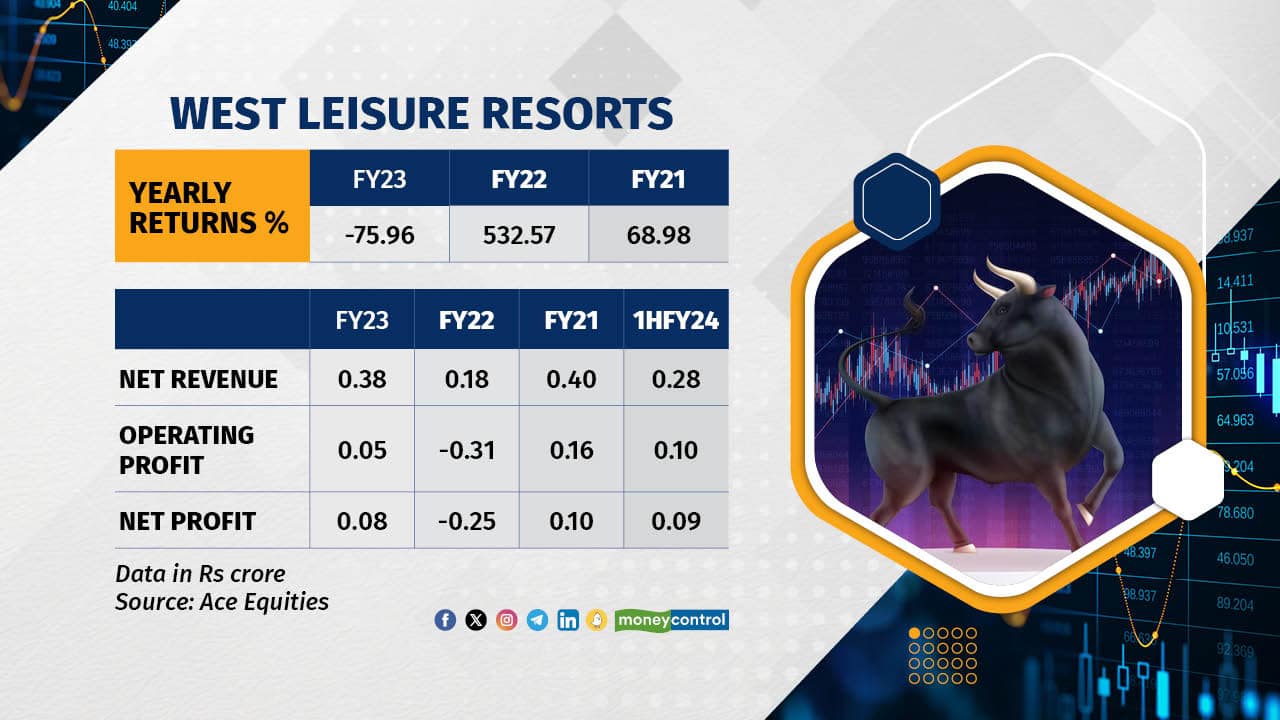

West Leisure Resorts witnessed a drastic 76 percent stock price decline in 2023, dropping from Rs 786 to Rs 189 per share. Since its debut on the BSE in 2014, the company consistently achieved annual gains until this year, notably surging by 533 percent in 2022 and 70 percent in 2021. The company’s main stated objectives include engaging in leisure and hospitality industries, such as resorts, entertainment, restaurants, shopping malls, and related activities. However, it currently operates by providing human resources services, investing in shares, mutual funds, and securities due to a lack of suitable opportunities in the hospitality sector. In the latest September quarter, the company’s revenue decreased significantly from Rs 22 lakh to Rs 6 lakh, leading to a net loss of Rs 3 lakh compared to the previous quarter’s net profit of Rs 12 lakh.

West Leisure Resorts witnessed a drastic 76 percent stock price decline in 2023, dropping from Rs 786 to Rs 189 per share. Since its debut on the BSE in 2014, the company consistently achieved annual gains until this year, notably surging by 533 percent in 2022 and 70 percent in 2021. The company’s main stated objectives include engaging in leisure and hospitality industries, such as resorts, entertainment, restaurants, shopping malls, and related activities. However, it currently operates by providing human resources services, investing in shares, mutual funds, and securities due to a lack of suitable opportunities in the hospitality sector. In the latest September quarter, the company’s revenue decreased significantly from Rs 22 lakh to Rs 6 lakh, leading to a net loss of Rs 3 lakh compared to the previous quarter’s net profit of Rs 12 lakh.

Story continues below Advertisement

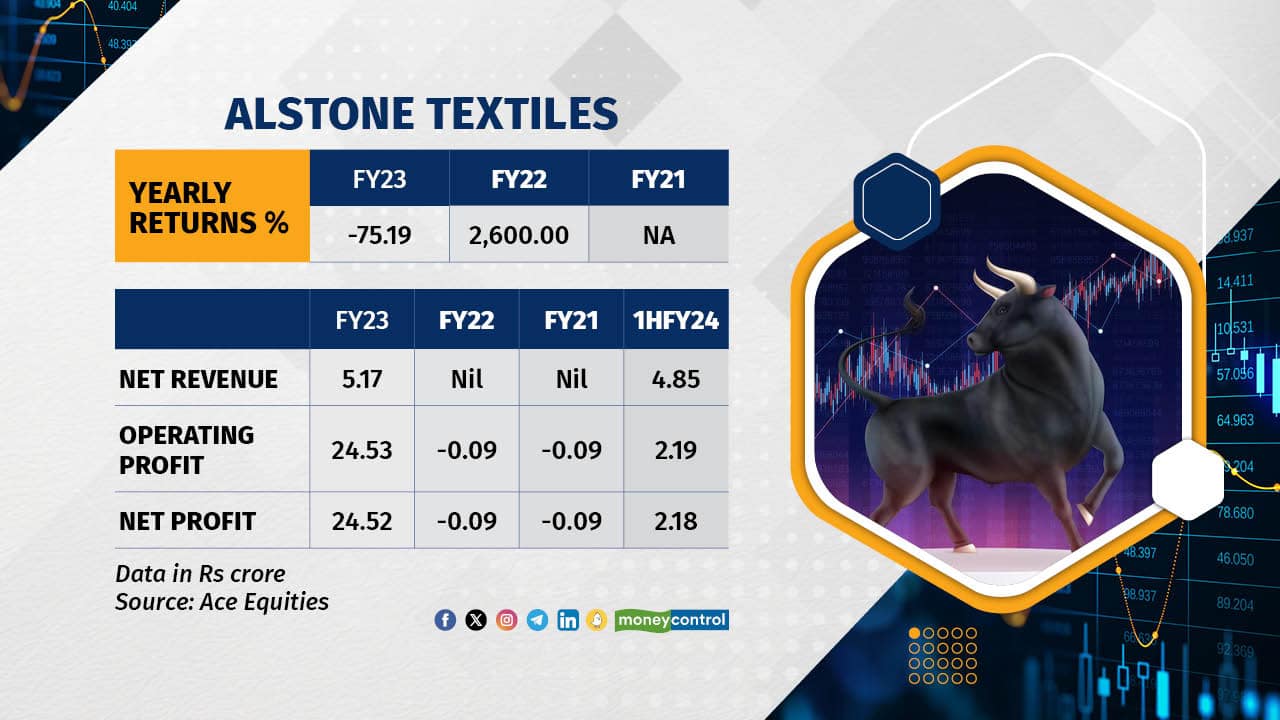

Alstone Textiles India experienced a significant over 75 percent decline in 2023, witnessing a drop from Rs 2.7 to Rs 0.67 per share. In 2022, the stock skyrocketed by nearly 2600 percent. Despite reporting zero revenue in FY21 and FY22, FY23 saw a revenue of Rs 5.17 crore along with other income of Rs 25 crore. Net losses in FY21 and FY22 were Rs 9 lakh each, but FY23 showed a net profit surge to Rs 24.52 crore. The company didn’t clarify the reason behind the substantial increase in other income for the fiscal year. For the six months ending September 2023, revenue reached Rs 4.85 crore, with a net profit of Rs 2.18 crore. Alstone Textiles India is engaged in the supply and trade of various textiles and related activities. The company has diversified its businesses from third-party product distributions to originating unsecured personal and corporate loans, aiming to capitalize on growth opportunities in the economy, as mentioned in its latest annual report.

Alstone Textiles India experienced a significant over 75 percent decline in 2023, witnessing a drop from Rs 2.7 to Rs 0.67 per share. In 2022, the stock skyrocketed by nearly 2600 percent. Despite reporting zero revenue in FY21 and FY22, FY23 saw a revenue of Rs 5.17 crore along with other income of Rs 25 crore. Net losses in FY21 and FY22 were Rs 9 lakh each, but FY23 showed a net profit surge to Rs 24.52 crore. The company didn’t clarify the reason behind the substantial increase in other income for the fiscal year. For the six months ending September 2023, revenue reached Rs 4.85 crore, with a net profit of Rs 2.18 crore. Alstone Textiles India is engaged in the supply and trade of various textiles and related activities. The company has diversified its businesses from third-party product distributions to originating unsecured personal and corporate loans, aiming to capitalize on growth opportunities in the economy, as mentioned in its latest annual report.

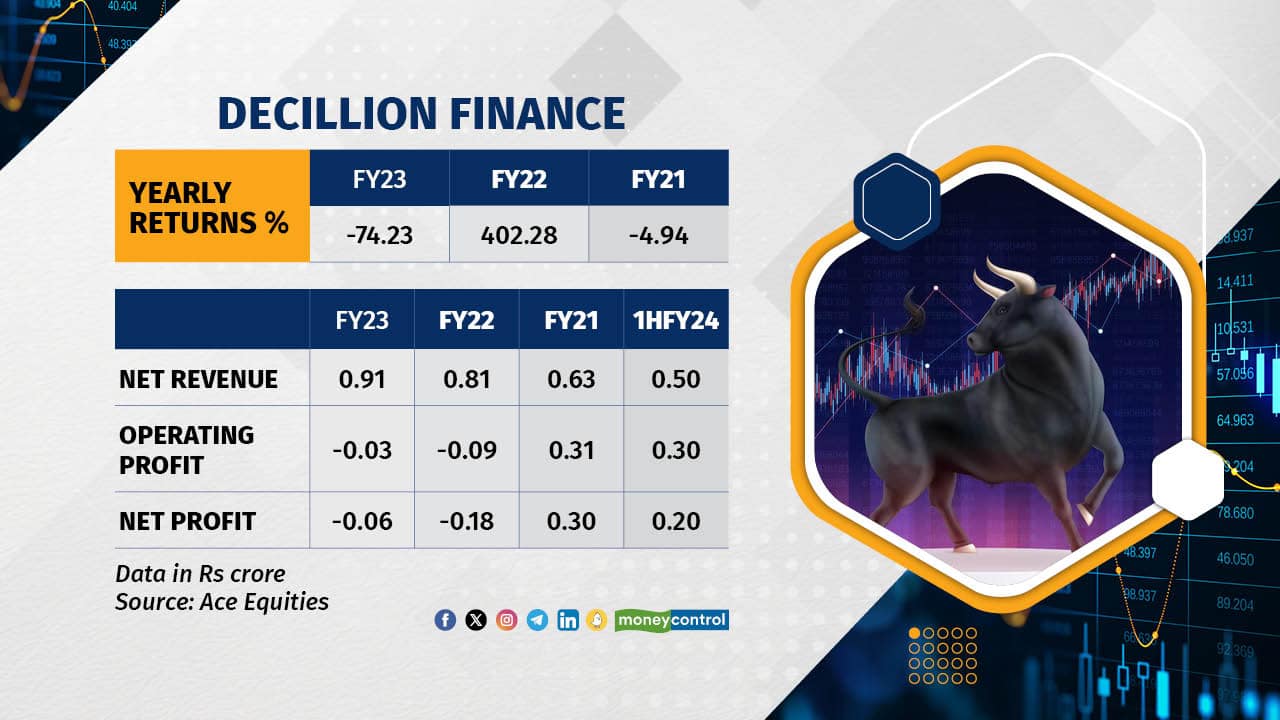

Decillion Finance declined 74 percent so far this 2023 to Rs 14.21 from Rs 55.15 a share at the start of the year. The stock in 2022 jumped over 400 percent. The firm in FY22 and FY23 reported a revenue of Rs 81 lakh and Rs 91 lakh while operating loss stood at Rs 9 lakh and 3 lakh respectively. Net loss stood at Rs 18 lakh and Rs 6 lakh respectively. The firm reported a revenue of Rs 50 lakh for the six month ended 2023 from Rs 45.33 lakh a year ago while net profit stood at Rs 20 lakh from Rs 18 lakh a year ago. The company said it has only one line of business, i.e., Financing and Investment Activities during the year.

Decillion Finance declined 74 percent so far this 2023 to Rs 14.21 from Rs 55.15 a share at the start of the year. The stock in 2022 jumped over 400 percent. The firm in FY22 and FY23 reported a revenue of Rs 81 lakh and Rs 91 lakh while operating loss stood at Rs 9 lakh and 3 lakh respectively. Net loss stood at Rs 18 lakh and Rs 6 lakh respectively. The firm reported a revenue of Rs 50 lakh for the six month ended 2023 from Rs 45.33 lakh a year ago while net profit stood at Rs 20 lakh from Rs 18 lakh a year ago. The company said it has only one line of business, i.e., Financing and Investment Activities during the year.

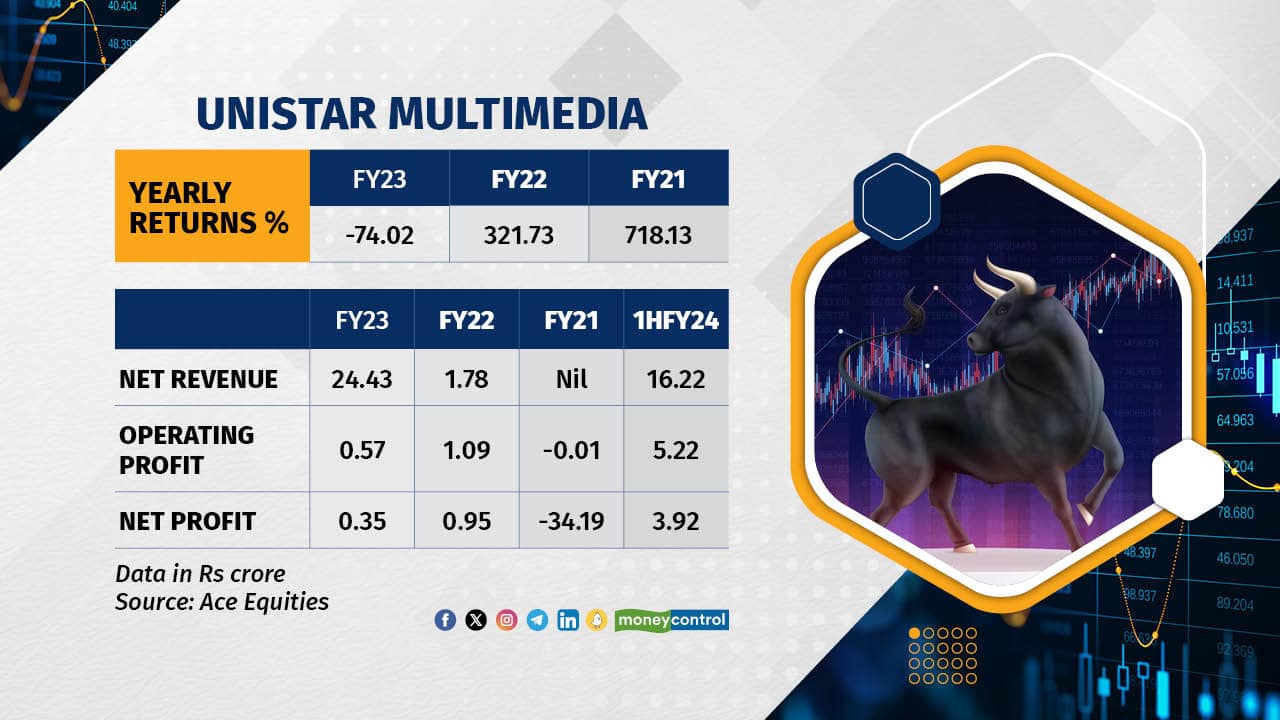

Unistar Multimedia’s stock plummeted by almost 74 percent in 2023, dropping from Rs 59 to Rs 15.33 per share. The company, known for substantial gains in 2021 and 2022, specializes in entertainment media, producing TV shows, films, music albums, and more. However, its revenue is declining significantly. In the September quarter, revenue fell to Rs 7 crore from Rs 9.3 crore in June, and in March, it was at Rs 19.3 crore. Net profit also decreased to Rs 1.13 crore from Rs 2.78 crore in the previous quarter, with a reported net loss of Rs 1.45 crore in the March quarter.

Unistar Multimedia’s stock plummeted by almost 74 percent in 2023, dropping from Rs 59 to Rs 15.33 per share. The company, known for substantial gains in 2021 and 2022, specializes in entertainment media, producing TV shows, films, music albums, and more. However, its revenue is declining significantly. In the September quarter, revenue fell to Rs 7 crore from Rs 9.3 crore in June, and in March, it was at Rs 19.3 crore. Net profit also decreased to Rs 1.13 crore from Rs 2.78 crore in the previous quarter, with a reported net loss of Rs 1.45 crore in the March quarter.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.