Dalal Street Week Ahead | India, US inflation, quarterly earnings among 10 key factors to watch next week

Market will focus on quarterly results from the IT and banking sectors starting next week

The market snapped two-week losing streak and closed moderately higher for the week ended October 6 after showing smart recovery from weekly low, may be partly due to oversold conditions. The recovery may continue in the coming week too, but volatility can’t be ruled out with more stock specific action given the beginning of September quarter earnings season, experts said, adding the participants will also closely watch the September inflation numbers by US and India along with FOMC minutes.

The equity market uptrend was supported majorly by falling oil prices, healthy domestic PMI data, and Monetary Policy Committee’s status quo in repo rate, but the RBI still sees inflation as a major risk and tone was hawkish with announcement of OMO (open market operations) sale to manage liquidity that on Friday lifted 10-year bond yield sharply. The significant FII outflow due to elevated US bond yields and US dollar index capped gains.

The BSE Sensex gained 167 points at 65,996, and the Nifty50 rose 15 points to 19,654, while the Nifty Midcap 100 index lost 0.6 percent and Smallcap 100 index climbed 0.7 percent during the week. Auto, banks, energy, pharma, oil & gas stocks were under pressure, whereas technology, and realty stocks trended higher.

“The rising US bond yields and a stronger dollar index have deterred foreign investors, causing weakness in the market. Additionally, robust job data from the US this week has raised concerns about a potential rate hike by the Fed, with the surge in US bond yields indicating an impending increase in interest rates,” Vinod Nair, head of research at Geojit Financial Services said.

He further said the RBI’s hawkish stance, particularly in its management of liquidity to counter inflationary risks, has also impacted the market, however, the market found some support from strong domestic PMI data and corrections in crude oil prices.

Now, attention will focus on quarterly results from the IT and banking sectors starting next week, he feels.

Here are 10 key factors to watch out for:

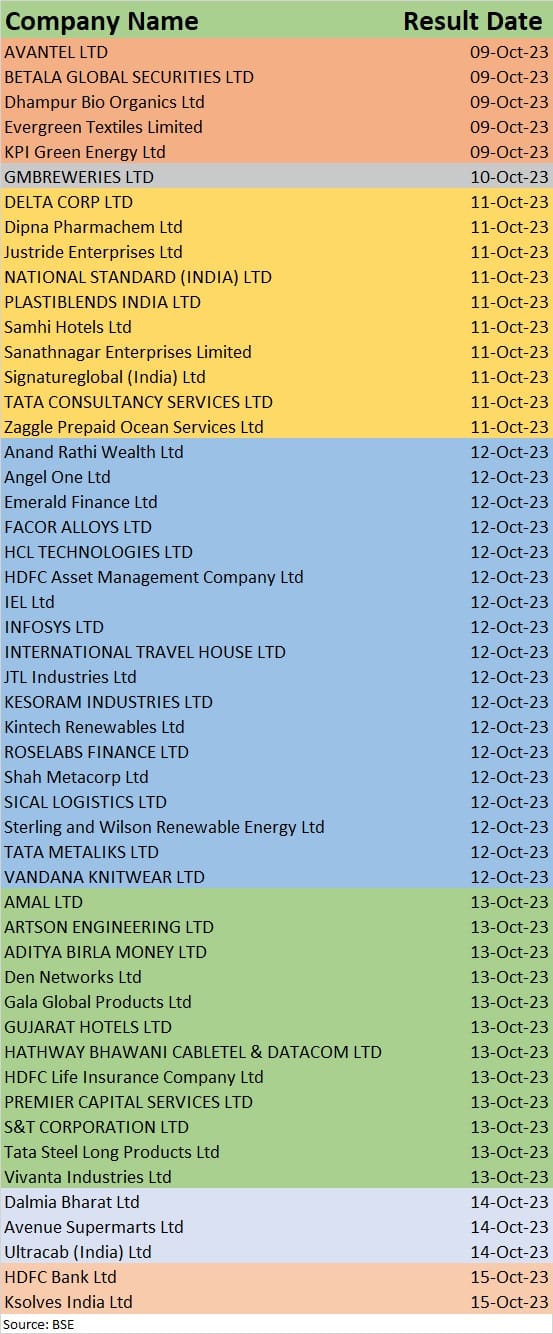

The corporate earnings season for the July-September period FY24 will be kicked off by IT majors next week, with TCS releasing scorecard on October 11.

HCL Technologies, Infosys, and HDFC AMC will announce quarterly earnings on October 12, while HDFC Life Insurance Company will release numbers on October 13, Avenue Supermarts on October 14, and HDFC Bank on October 15.

Even the recently listed companies like Samhi Hotels, Signature Global (India) and Zaggle Prepaid Ocean Services will also be announcing numbers next week on October 11.

Most of brokerages expect the Nifty50 earnings growth to be 21-23 percent year-on-year for July-September period, largely driven by banks, auto and oil marketing companies.

Also read: GST Council Key Takeaways: Human consumption ENA out of GST, tax cuts on molasses, millets

CPI Inflation

Apart from earnings, the market participants will keep an eye on CPI inflation for September releasing on October 12. The CPI inflation, an important data point for the MPC, is expected to cool down further due to falling vegetable prices and cut in LPG price.

“We estimate that CPI inflation slowed markedly in September to 5.3 percent YoY, from 6.8 percent in August, returning within the RBI’s target range of 2-6 percent after two months outside. An easing in food and fuel inflation likely drove a softening in the headline rate,” Rahul Bajoria, MD & Head of EM Asia (ex-China) Economics at Barclays said, adding the core inflation likely remained flat, which will allow the RBI to keep policy rates unchanged.

In addition, industrial output data for August will also be announced on October 12, while the WPI inflation & balance of trade data for September month, and foreign exchange reserves for week ended October 6 will be released on October 13.

FOMC Minutes & US Inflation

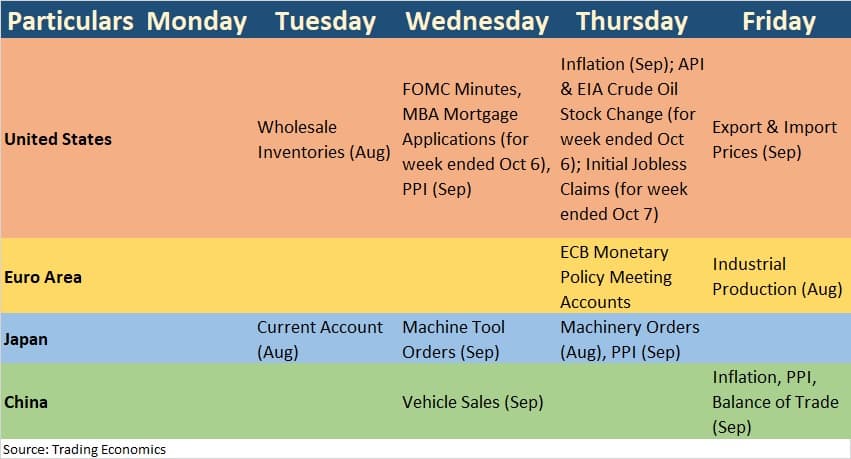

Globally investors will look for cues from the FOMC minutes for the September policy meeting releasing on October 11 and US inflation which is scheduled on October 12, while the speech by several Fed officials during the next week will also be watched.

Analysts expect the inflation, an important data point for the Federal Reserve to make a decision over the fed funds rate, to cool down a bit in September from 3.7 percent in August, but it is still way above the central bank’s 2 percent target. With holding rates in September policy meeting, Fed signalled that the interest rate may remain higher through the 2024, with one more rate hike by the end of 2023, while the Fed officials expect inflation at 2.6 percent by the end of 2024 with ruling out deep recession. Core inflation in August was at 4.3 percent, down from 4.7 percent in previous month.

China will also release its inflation numbers for September. In August, the inflation was 0.1 percent.

Global Economic Data Points

Here are key global economic data points to watch out for:

In the truncated week gone by, foreign institutional investors have net sold Rs 8,400 crore worth of shares in the cash segment as the US 10 year treasury yield jumped to 16-year high and US dollar index hit the highest level since November last year. Domestic institutional investors managed to offset the FII outflow, but unless and until there is cooling down in US bond yields and dollar index, the outflow may continue, experts said.

DIIs have net bought Rs 4,400 crore worth shares in first week of October, while US 10-year treasury yield settled the week at 4.8 percent and US dollar index at 106.10.

Also read: Hawkish tone maintained, rate cut in near future remains unlikely

Oil Prices

The sharp fall in oil prices from more than 10-month high was a positive for the Indian equity markets as India is the net oil importer. Rising US bond yields and stronger dollar along with global demand concerns impacted oil prices during the week. International benchmark Brent crude futures corrected by 8.26 percent during the week, the biggest weekly loss since March, to settle at $84.58 a barrel, continuing downtrend for third consecutive week from the high of $95.96 a barrel.

Saumil Gandhi, senior analyst – commodities at HDFC Securities anticipates the crude oil price should consolidate in a lower-end range with a negative bias after a sharp selloff in prices.

Technical View

The Nifty50 rebounded nicely after defending 19,300 mark and snapped two-week losing streak. The index has formed small bodied bullish candlestick pattern with long lower shadow and minor upper shadow on the weekly charts which resembles Hammer sort of candlestick pattern at the downtrend, which is a bullish reversal pattern. This raised hopes for northward journey in coming sessions, which if comes true in following trade then 19,800-20,000 can’t be ruled out with crucial support at 19,600-19,300 area, experts said.

Also read: TCS to consider share buyback along with Q2 results, board meeting on Oct 11

Nifty had failed to cross the hurdle short term moving average (20 exponential moving average placed at 19,670) in the recent past and is again hovering around the same area. A decisive close above 19,670 could help the index to extend a rebound toward the 19,800-20,000 zone, Ajit Mishra, SVP – Technical Research at Religare Broking said.

On the downside, he feels the 19,200-19,450 zone would continue to act as support, in case of a reversal.

F&O Cues, India VIX

The Options data also indicated that the Nifty may face strong resistance at 19,900-20,000 levels, with crucial support at 19,600-19,500 levels.

As per the weekly options data, the maximum Call open interest (OI) was at 20,000 strike, followed by 20,500 & 19,900 strikes, with meaningful Call writing at 20,500 strike, then 20,000 & 19,900 strikes.

On the Put side, the maximum open interest was seen at 19,500 strike, followed by 19,600 & 19,000 strikes, with writing at 19,600 strike, then 19,000 & 19,500 strikes.

Meanwhile, the volatility cooled down considerably in the week gone by, giving more comfort to the bulls. The India VIX, which measures the expected volatility for the next thirty days in the Nifty50, fell by 10 percent from 11.45, to 10.3 levels, the lowest since July.

The activity in primary market seems to be slowing down as only one IPO is set to be opened for subscription next week. Gujarat-based Arvind and Company Shipping Agency will open its Rs 14.74-crore public issue during October 12-16, with offer price of Rs 45 per share, in the SME segment, while Committed Cargo Care will close its IPO on October 10.

On the listing front, in the mainboard segment, Delhi-based wires manufacturing company Plaza Wires will make its debut on the bourses on October 13, while lubricants manufacturing company Arabian Petroleum and event management firm E Factor Experiences will list their shares on the NSE Emerge on October 9, as per IPO schedule.

Among others, City Crops Agro will debut on the BSE SME, and Goyal Salt & Kontor Space on the NSE Emerge on October 10, while Oneclick Logistics India, and Canarys Automations are set to list shares on the NSE Emerge on October 11.

Further, Vivaa Tradecom will make its debut on the BSE SME, and Vishnusurya Projects and Infra, Sharp Chucks and Machines, and Plada Infotech Services on the NSE Emerge on October 12, while the listing of Karnika Industries on the NSE Emerge will commence on the NSE Emerge, with effect from October 13.

Sunita Tools is supposed to list shares on the BSE SME on October 9 as per IPO schedule, but the exchange has not issued any circular yet.

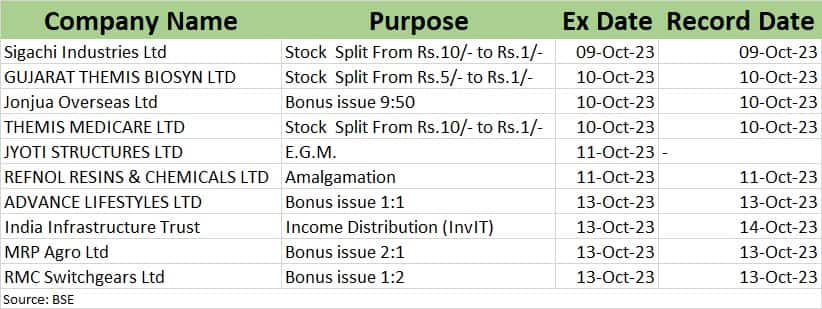

Corporate Action

Here are key corporate actions taking place next week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-498610166-77bb4fae883d41d98962f147c2c40fa2.jpg)