Dalal Street Week Ahead | Inflation, oil prices, FII outflow and other factors to watch out for in Samvat 2080

Dalal Street Week Ahead

Bulls kept Dalal Street charged up for the second straight week, driving the benchmark indices by another 1 percent as buying was seen in most sectors, barring technology. The first week of the Samvat 2080 is likely to remain positive amid consolidation, with focus on inflation numbers from the US and India, evolving dynamics of global markets, falling oil prices and speech by Federal Reserve officials.

The BSE Sensex climbed 541 points or 0.84 percent to 64,905, and the Nifty50 jumped 195 points or 1 percent to 19,425, in the week started on November 6, as falling crude prices and rising hopes for no rate hike by the US Fed in upcoming meetings had kept the market upbeat.

The broader markets also turned strong with the Nifty Midcap 100 and Smallcap 100 indices gaining around 3 percent each, backed by buying from domestic institutional investors and corporate earnings.

“As we get into Samvat 2080, we believe the market would continue to outperform on the back of strong earnings and healthy economic outlook,” Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services, said. He expects the market to start Samvat on a positive note and remain in a broader range with sectorial rotation.

Vinod Nair, head of research at Geojit Financial Services, stresses on the US and Indian inflation numbers for determining the market dynamics in the week ahead.

The market will remain open for an hour on November 12, for Muhurat trading, while the market will be shut on November 14 for Diwali Balipratipada.

Let’s take a look at the major factors that would map the market movement in the week beginning November 12.

US Inflation

The US inflation print is due on November 14, with experts hoping to see the CPI inflation below 3.5 percent in October from 3.7 percent in September on the back of lower cost of energy, and core inflation to be steady around 4.0-4.1 percent as against 4.1 percent in the this period.

Also read: HAL has broken the myth that investors can’t make money in PSU stocks: Madhu Kela

In his speech on Thursday, Fed chair Jerome Powell stated that the FOMC was committed to bringing down inflation to the 2 percent target level. “My colleagues and I expect that the process of getting inflation sustainably down to 2 percent has a long way to go,” Powell said, adding that the Fed is focused on whether rates need to go higher and how long they need to stay elevated, according to a report by CNBC TV-18.

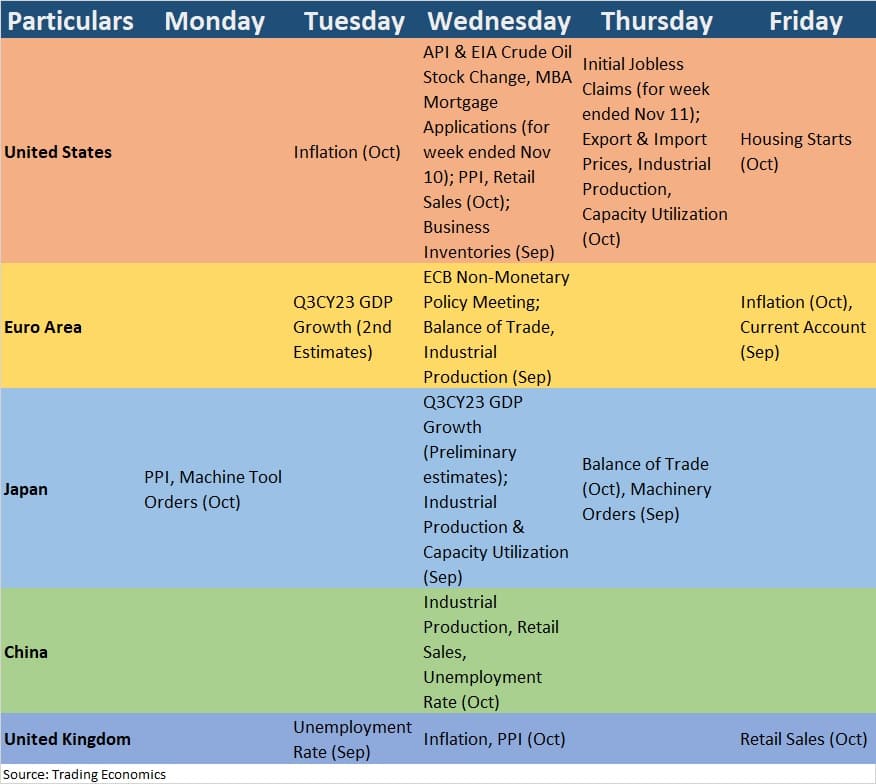

Global Economic Data

Apart from US inflation, global investors will also keep an eye on the speech by several Fed officials such as Cook, Jefferson, Barr, Mester, Goolsbee, Williams, Waller and Daly.

The weekly US jobs data and retail sales for October, Europe’s inflation for October, and second estimates for the Q2FY23 GDP growth, China’s retail sales for October, and the UK’s inflation and retail sales for October will also be watched out by the markets participants.

CPI Inflation

Back home, the CPI inflation for October, which is due on November 13, is also expected to ease further to below 5 percent with likely drop in food inflation. It has been falling for the second consecutive month in September at 5.02 percent.

Also read: Samvat 2080 | Fund managers believe IT stocks will eventually radiate light

“We estimate that CPI inflation continued on its moderating trajectory, slowing to 4.6 percent on-year in October. Easing food inflation in YoY terms likely drove the continued softening in the headline,” Rahul Bajoria, MD and Head of EM Asia (ex-China) Economics at Barclays, said.

The market participants will also focus on the WPI inflation for October scheduled on November 14 and balance of trade that is due the next day, while deposit and bank loan growth for the fortnight ended on November 3, and foreign exchange reserves for the week ended November 10 will be released on November 17.

Oil Prices

Brent crude oil futures fell sharply since mid-October to below $80 a barrel, which coincides with the 200-day EMA (exponential moving average), from around $92 a barrel on slowing demand and experts expect the prices to slide further. This played a crucial role in the equity rally seen over the last couple of weeks. This also reduced the fiscal deficit worries and provides the support to corporate earnings. On a week-on-week basis, Brent futures fell 4 percent to settle at $81.43 a barrel.

Also read: Porinju Veliyath’s lessons from the 2017-18 midcap meltdown

Market participants will keep a close watch on the flight of foreign institutional investors (FIIs) as they remained net sellers in November, keeping up the outflow for the fourth straight month, though the intensity of selling has reduced from the previous months.

The FIIs have net sold more than Rs 6,100 crore worth of shares in the cash segment, but domestic institutional investors have managed to compensate it by buying shares worth more than Rs 6,000 crore so far this month.

The US 10-year treasury yield dropped to 4.64 percent on November 10, from 4.93 percent on October 31, while the US dollar index slipped from 106.66, to 105.80 during the same period.

The movement in Indian rupee will also be watched as the currency hit a record low of 83.47 a dollar last Friday before closing the week at 83.29, weakening from 83.12 last week.

While all major corporates are done with their September quarter earnings last week, the results season will be concluded in the first part of next week with few midcaps and smallcaps. Most experts said the earnings season more or less has been in line with their expectations.

Grasim Industries is the only Nifty50 company left, announcing numbers on November 13. Manappuram Finance, and Narayana Hrudayalaya will also release numbers on the same day, while Aster DM Healthcare, Indiabulls Housing Finance, KNR Constructions, Natco Pharma, NMDC, Plaza Wires, Trident, Wockhardt and Yatra Online will announce results scorecard on November 14.

The first week of Samvat 2080 will be a quiet one for the primary market as there will be no IPO launch in the main board segment. Mumbai-based e-governance solutions company Protean eGov Technologies will debut on the bourses on November 13, while Gurugram-based auto component manufacturer ASK Automotive is likely to list its equity shares on November 15, sources told Moneycontrol.

On the SME front, agro-food manufacturing company Baba Food Processing India will debut on the NSE Emerge on November 16, while Maharashtra-based dryers manufacturing company Arrowhead Seperation Engineering will launch its Rs 13-crore initial public offering for subscription on the BSE SME, on November 16, with a price at Rs 233 per share.

Technical View

Technically, the Nifty50 is likely to get strong support at 19,300 in the near term and faced lot of resistance at 19,450-19,500 levels. Hence, if the index surpasses the hurdle of 19,500, then 19,600-19,700 can be the possibility in coming sessions, given the sentiment remains positive for last couple of weeks with higher lows for yet another week, experts said.

The index closed above 21-week EMA (19,300), and formed bullish candlestick pattern for second consecutive week.

“We can observe that the Nifty has held on to the support zone of 19,310 – 19,270 which coincided with the gap area and the 40-hour moving average. Buying interest emerged from that zone indicating that unless that is breached on the downside, we can expect the momentum to continue,” Jatin Gedia, technical research analyst, capital market strategy at Sharekhan by BNP Paribas said.

He further said the hourly momentum indicator has triggered a positive crossover from the equilibrium line indicating that the consolidation has matured, and it has started a new cycle on the upside. “A decisive close above 19,500 shall lead to a further extension till 19,690. Broad market outperformance is likely to continue.”

F&O Cues

Options data also suggested 19,500 as the crucial resistance area, with support at 19,300 mark.

On the weekly Options data front, the maximum Call open interest was seen at 19,500 strike, followed by 19,400 and 20,000 strikes, with meaningful Call writing at 19,400 strike, then 19,700 and 19,900 strikes, while on the Put side, the maximum open interest was visible at 19,400 strike, followed by 19,300 strike, with writing at 19,300 and 19,400 strikes.

Volatility increased by 2 percent on a week-on-week basis, but still remained within the range of 9-13. The fear gauge, India VIX, rose to 11.1, from 10.88 levels.

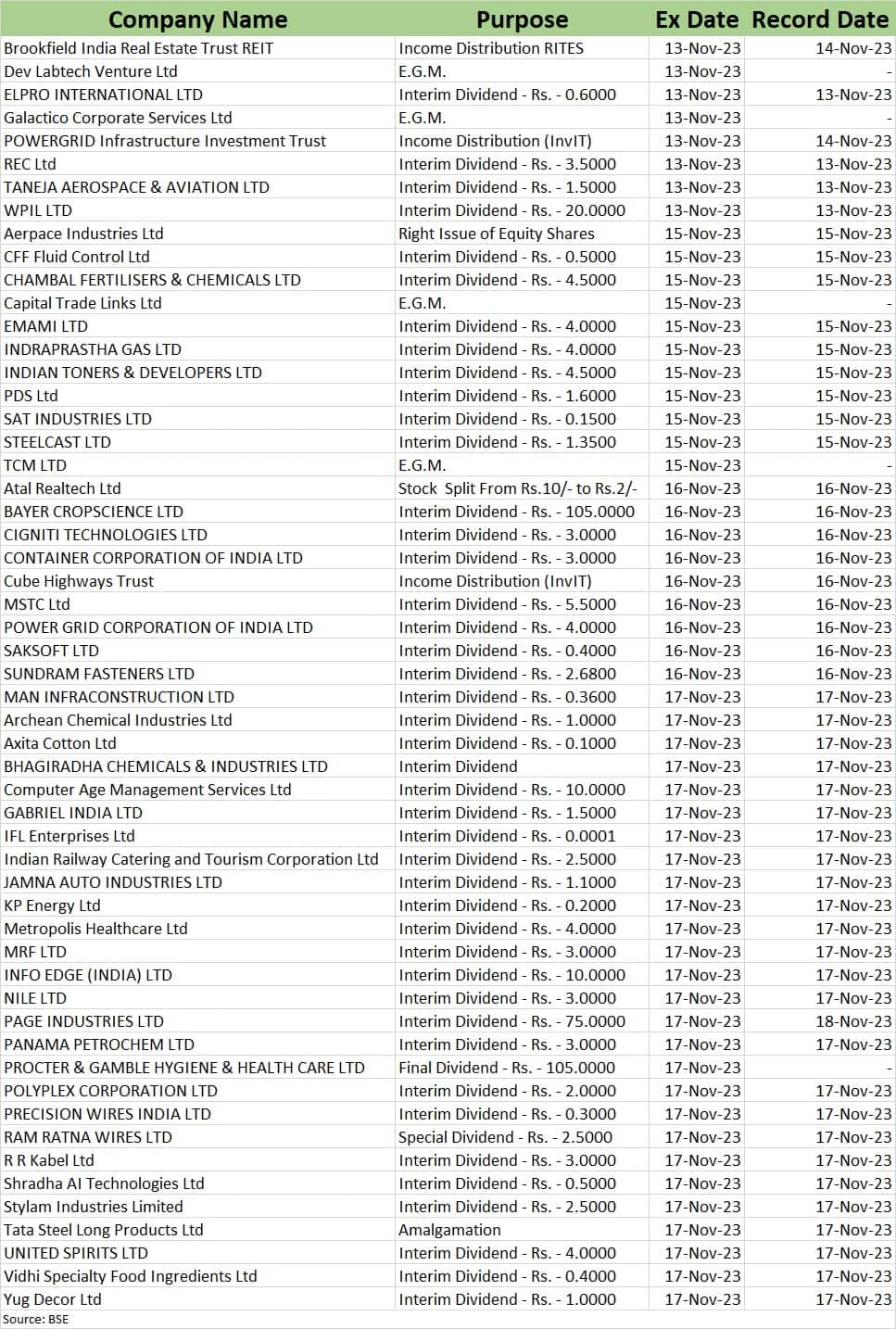

Corporate Action

Here are key corporate actions taking place next week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.