Trade setup for Muhurat Trading: 15 things to know before opening bell

19,550-19,600 likely to be strong resistance area for Nifty

The market has seen stiff resistance in the 19,450-19,500 zone, which coincides with 50-day EMA (exponential moving average – 19,450), whereas, 21-day EMA of 19,370 points continued to act as a healthy support line for the Nifty50, followed by the 100-day EMA of 19,300 as a critical support.

Given the positive bias on the technical as well as fundamental ground, will the index continue to trade on the higher side?

Yes. With likely resistance at 19,550-19,600 though, there is a possibility of a rangebound and volatile session, experts said.

The BSE Sensex gained 72 points to reach 64,905, while the Nifty50 added 30 points to 19,425 and formed a bullish candlestick pattern on the daily charts, while on the weekly charts, there was a bullish candlestick pattern formation, negating its lower highs of the last two weeks.

“The Nifty showed volatility throughout the day, rebounding above the 21-day exponential moving average. However, the substantial open interest (OI) buildup at 19,500, particularly from Call writers, suggests a protective barrier that may impede further upward movement for the Nifty,” Rupak De, senior technical analyst at LKP Securities, said.

On the downside, he feels, Put writers are likely to safeguard the 19,400 levels. “We anticipate a market confined within a range on the Muhurat Trading Day,” he said.

The overall setup is stabilising with support-based buying but lack of momentum is making the upside capped, Chandan Taparia, senior vice-president and derivatives analyst at Motilal Oswal Financial Services, said. The Nifty50 has to hold above the 19,400 level to make an up-move towards 19,550 and 19,600, whereas supports are gradually shifting higher and are placed at 19,333 and then 19,250.

The broader markets outperformed the benchmark indices, with the Nifty Midcap 100 and Smallcap 100 indices rising half a percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may take support at 19,355, followed by 19,327 and 19,280. On the higher side, 19,449 can be the immediate resistance, followed by 19,477 and 19,524.

On November 10, the Bank Nifty continued to consolidate in the range of 43,200-43,900 levels throughout the week, rising 137 points to 43,820. The index has formed a bullish candlestick pattern with minor upper shadow on the daily charts. It continued to take support at the 21-day EMA (43,587) since the start of current week and faced strong resistance at 44,000.

“The daily and hourly momentum indicator has a positive crossover, which is a buy signal, and is in sync with the price action,” said Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas. He expects the positive momentum to continue till 44,200 – 44,400 levels from a short-term perspective.

As per the pivot point calculator, the index is expected to take support at 43,590, followed by 43,495 and 43,341. On the upside, the initial resistance is at 43,899 then at 43,994 and 44,148.

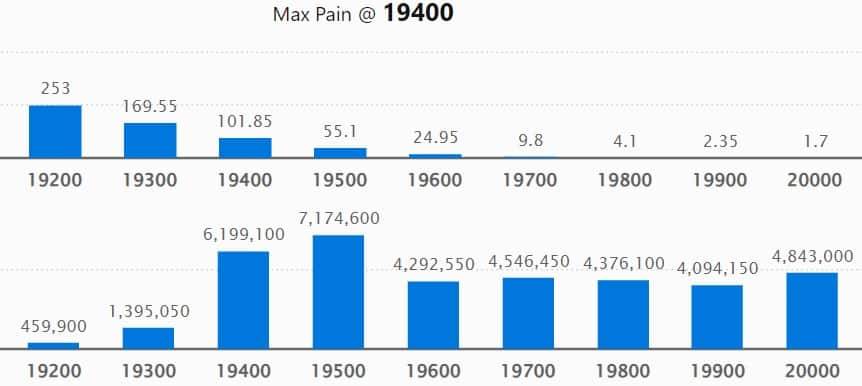

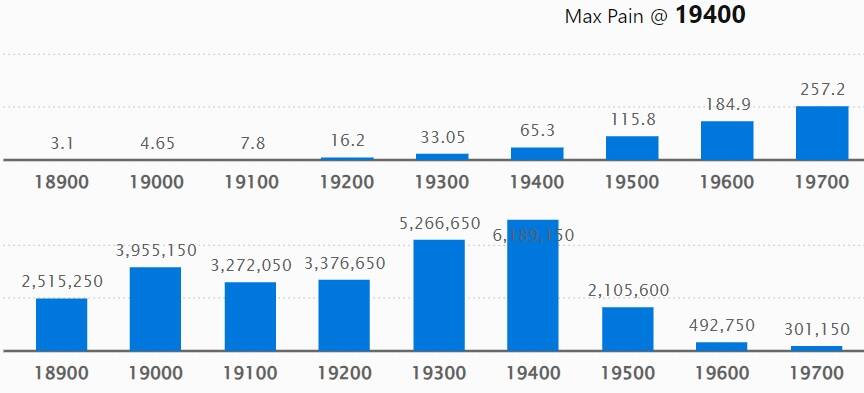

On the the weekly options data front, the maximum Call open interest was 19,500 has seen the maximum Call open interest (OI), with 71.74 lakh contracts, which can act as a key resistance levels for the Nifty. It was followed by the 19,400 strike, which had 61.99 lakh contracts, while the 20,000 strike had 48.43 lakh contracts.

Maximum Call writing was seen at the 19,400 strike, which added 21.77 lakh contracts, followed by 19,700 and 19,900 strikes, which added 15.85 lakh and 12.82 lakh contracts.

Maximum Call unwinding was at the 21,000 strike, which shed 5.84 lakh contracts, followed by 20,800 and 20,600 strikes, which shed 2.65 lakh and 37,500 contracts.

On the Put side, maximum open interest also remained at the 19,400 strike with 61.89 lakh contracts, which can act as key support levels for the Nifty. It was followed by 19,300 strike, comprising 52.66 lakh contracts and 18,000 strike with 43.59 lakh contracts.

Meaningful Put writing was at 19,300 strike, which added 29.17 lakh contracts, followed by 19,400 strike and 19,100 strike, which added 19.67 lakh and 14.77 lakh contracts.

Put unwinding was at 18,100 strike, which shed 14,150 contracts, followed by 19,900 strike which shed 200 contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Jubilant Foodworks, Marico, Mphasis, Godrej Consumer Products, and Siemens saw the highest delivery among the F&O stocks.

A long build-up was seen in 43 stocks, including Alkem Laboratories, Vedanta, Tata Consumer Products, Aurobindo Pharma, and NTPC. An increase in open interest (OI) and price indicates a build-up of long positions.

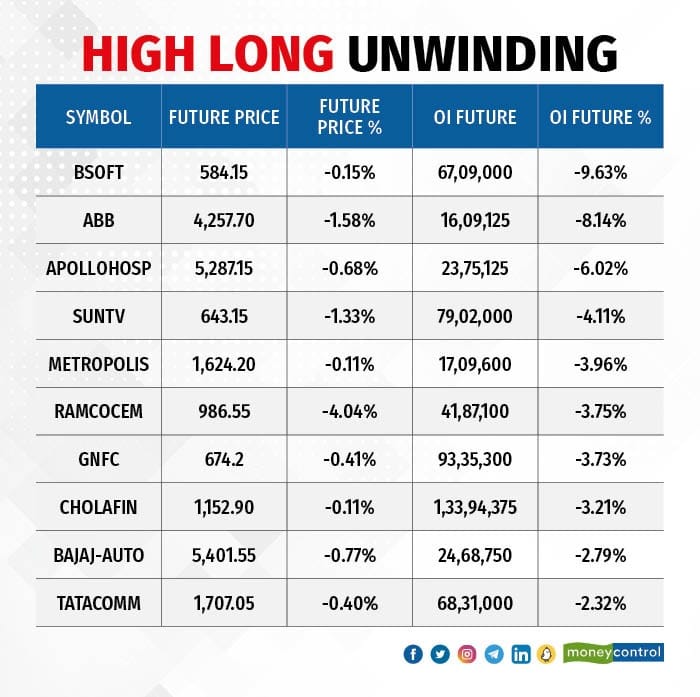

Based on the OI percentage, 44 stocks saw long unwinding, including Birlasoft, ABB India, Apollo Hospitals Enterprise, Sun TV Network, and Metropolis Healthcare. A decline in OI and price indicates long unwinding.

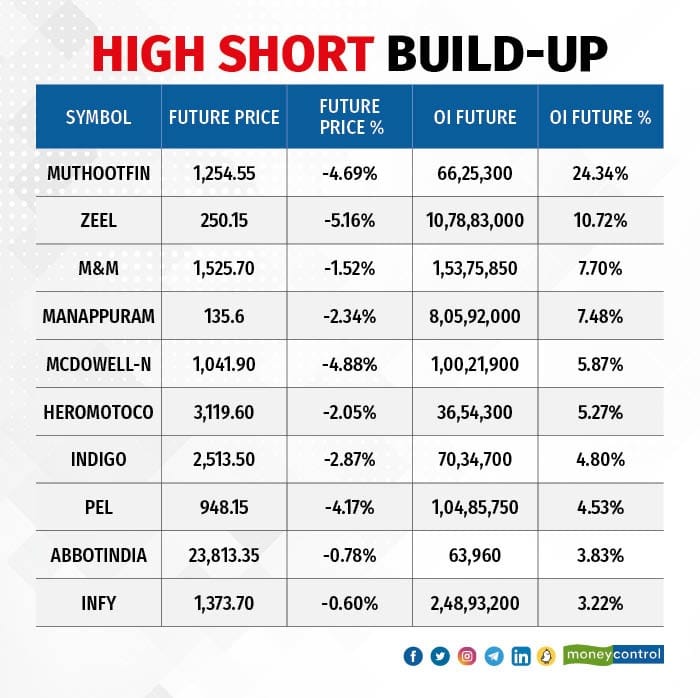

33 stocks see a short build-up

A short build-up was seen in 33 stocks, including Muthoot Finance, Zee Entertainment Enterprises, Mahindra & Mahindra, Manappuram Finance, and United Spirits. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 68 stocks were on the short-covering list. These include MCX India, PI Industries, Aditya Birla Fashion & Retail, Chambal Fertilisers and Chemicals, and Page Industries. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR) settled at 1.04 levels on Friday, up from 0.99 in previous session. The PCR above 1 suggests that the volume on the Put side is higher than Call side, which generally indicates the bearish sentiment.

For more bulk deals, click here

Stocks in the news

Oil & Natural Gas Corporation: The state-run oil and gas exploration company has recorded standalone profit at Rs 10,216 crore for quarter ended September FY24, falling 20.3 percent compared to year-ago period. Gross revenue declined 8.2 percent year-on-year to Rs 35,162 crore in Q2FY24.

Coal India: The country’s largest coal mining company has recorded a 12.7 percent on-year growth in consolidated profit at Rs 6,813.5 crore for quarter ended September FY24, with revenue from operations increasing by 9.8 percent to Rs 32,776.4 crore during the quarter.

Eicher Motors: The Royal Enfield maker has registered highest ever quarterly profit, revenue and EBITDA for the quarter ended September FY24. Net profit increased by 55 percent YoY to Rs 1,016 crore in Q2FY24, backed by healthy operating numbers. Revenue from operations grew by 17 percent YoY to Rs 4,115 crore.

Biocon: The biopharmaceuticals company has reported a massive 168 percent year-on-year surge in consolidated profit at Rs 126 crore for quarter ended September FY24, backed by strong topline and operating numbers. Revenue from operations grew by 49 percent YoY to Rs 3,462 crore.

Steel Authority of India: The state-owned steel production company has recorded consolidated profit at Rs 1,305.6 crore for July-September period of FY24, against loss of Rs 330 crore in year-ago period, backed by healthy operating numbers with fall in input cost. Consolidated revenue from operations increased by 13.2 percent YoY to Rs 29,712 crore in Q2FY24.

Sun TV Network: The mass media company has registered a 14 percent on-year growth in consolidated profit at Rs 464.5 crore for quarter ended September FY24, backed by strong topline and operating numbers. Revenue from operations grew by 27 percent YoY to Rs 1,048.5 crore during the quarter.

Funds Flow (Rs Crore)

Foreign institutional investors sold shares worth Rs 261.81 crore, while domestic institutional investors bought Rs 822.64 crore worth of stocks on November 10, provisional data from the National Stock Exchange showed.

Stock under F&O ban on NSE

The NSE has added Manappuram Finance and Zee Entertainment Enterprises to its F&O ban list for November 12, while retaining Chambal Fertilisers and Chemicals, Delta Corp, GNFC (Gujarat Narmada Valley Fertilizers and Chemicals), and MCX India in the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1383931917-16f7e81b08344140b4041462de226112.jpg)